Parker Hannifin Corporation Fiscal 2023 Fourth Quarter & Full Year Earnings Presentation August 3, 2023 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. Often but not always, these statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Neither Parker nor any of its respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from past performance or current expectations. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of Meggitt PLC; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully business and operating initiatives, including the timing, price and execution of share repurchases and other capital initiatives; availability, cost increases of or other limitations on our access to raw materials, component products and/or commodities if associated costs cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; legal and regulatory developments and changes; compliance costs associated with environmental laws and regulations; potential supply chain and labor disruptions, including as a result of labor shortages; threats associated with international conflicts and efforts to combat terrorism and cyber security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; local and global political and competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates (including fluctuations associated with any potential credit rating decline) and credit availability; inability to obtain, or meet conditions imposed for, required governmental and regulatory approvals; changes in consumer habits and preferences; government actions, including the impact of changes in the tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof; and large scale disasters, such as floods, earthquakes, hurricanes, industrial accidents and pandemics. Readers should consider these forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2022 and other periodic filings made with the SEC. This presentation contains references to non-GAAP financial information including organic sales for Parker and by segment, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, adjusted net income, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, Gross Debt to Adjusted EBITDA, Net Debt to Adjusted EBITDA and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. For Parker, adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, acquisition related expenses, and other one-time items. Free cash flow is defined as cash flow from operations less capital expenditures. Although organic sales, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, adjusted net income, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Effective July 1, 2022, the company began classifying certain expenses, previously classified as cost of sales, as selling, general and administrative expenses (“SG&A”) or within other (income) expense, net. During the integration of recently acquired businesses, the company has seen diversity in practice of the classifications of certain expenses, and the reclassification was made to better align the presentation of expenses on the Consolidated Statement of Income with management’s internal reporting. The expenses reclassified from cost of sales to SG&A relate to certain administrative activities conducted in production facilities and research and development. Foreign currency transaction expense was also reclassified from cost of sales to other (income) expense, net on the Consolidated Statement of Income. These reclassifications had no impact on net income, earnings per share, cash flows, segment reporting or the financial position of the Company and were retrospectively applied to all periods presented in the financial tables of this presentation. Please visit www.PHstock.com for more information 2

FY23 Q4: Outstanding Performance 3 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY23 Q4 As Reported: Segment Operating Margin of 22.1%. 2. Backlog coverage is the FY23 Q4 ending backlog as the % of FY24 sales guidance midpoint. Top quartile safety performance; 20% reduction in recordable incidents Record sales of $5.1B, +22% vs. prior year, +6% organic growth1 Record adjusted segment margin of 24.0%, +110 bps vs. prior Backlog coverage2 remains resilient at ~55%; backlog +1% sequentially A Strong Finish to a Great Year

FY23 – A Transformational Year 4 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY23 As Reported: Segment Operating Margin of 19.1%, EPS of $16.04. FY23 Highlights $19B Sales 11% Organic Sales Growth1 +60bps Adjusted Segment Margin1 15% Adjusted EPS Growth1 $3B Operating Cash Flow Top quartile safety & engagement ~30% exposure to Aerospace & Defense Meggitt exceeding expectations Great cash generation and debt paydown

Longer Cycle Shorter Cycle Industrial Aftermarket Longer Cycle + Secular Trends Shorter Cycle Industrial Aftermarket FY15 FY23 Update Expanding Longer Cycle and Secular Trend Exposure Revenue Mix Reflects Transforming Portfolio Longer Cycle + Secular Trends FY27 Illustration Longer Cycle + Secular Trends Shorter Cycle Industrial Aftermarket 5

Future Sales Growth Drivers FY27 Target 4-6% Organic Growth over the Cycle Our Business System Macro CapEx Investment Innovation Acquisitions Secular Growth Strategic Growth Drivers Address last decade under investment Supply chain development Mega Projects New Product Blueprinting Simple by DesignTM Product Vitality CLARCOR LORD Exotic Meggitt Aerospace Digital Electrification Clean Technologies Outcomes Growth & Financial Performance Machinery automation, expansion & secular trends Faster growth & support secular trends Accretive & longer cycle growth 2/3’s Portfolio enable Clean Technologies 6

7 Enabling Engineering Breakthroughs that Lead to a Better Tomorrow Climate Action Parker Teams & Communities Clean Technologies On Track - Carbon Neutral by 2040 20% Carbon Reduction in FY231 1st Quartile CDP Climate Change 20% Safety Incident Reduction in FY23 10,000+ volunteer hours in FY23 ~$67M donated to our communities over past 10 years Continued Technology Advancement 2/3 of Portfolio Enables Clean Tech Parker’s BOM Increases ~1.5 to 2X on Electric Applications 1. Data represents a rolling 12-month through FY23 Q3.

Parker’s Promising Future 1. Adjusted numbers include certain non-GAAP financial measures. 22.9% FY23 FY27F Adjusted Segment Operating Margin1 Growth from secular trends Building on transformation with Meggitt Acceleration from Win Strategy 3.0 Top quartile performance Organic growth 4-6% over the cycle $21.55 $30.00 FY23 FY27F +210 bps~40% Growth Adjusted EPS1 8 25%

Summary of Fiscal 2023 4th Quarter Highlights

FY23 Q4 Financial Summary 1. Sales figures As Reported. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY22 Q4 As Reported: Segment Operating Margin of 20.9%, EBITDA Margin of 7.9%, Net Income of $129M, EPS of $0.99. $ Millions, except per share amounts FY23 Q4 FY23 Q4 FY22 Q4 YoY Change As Reported Adjusted¹ Adjusted¹ Adjusted Sales $5,096 $5,096 $4,188 +22% Segment Operating Margin 22.1% 24.0% 22.9% +110 bps EBITDA Margin 24.9% 24.4% 23.1% +130 bps Net Income $709 $791 $671 +18% EPS $5.44 $6.08 $5.16 +18% 10

FY23 Q4 Adjusted Earnings per Share Bridge 1. FY22 Q4 As Reported EPS of $0.99. FY23 Q4 As Reported EPS of $5.44. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 11 $5.16 $6.13 $5.16 $6.08

FY23 Q4 Segment Performance Sales As Reported $ Organic %1 Segment Operating Margin As Reported Segment Operating Margin Adjusted1 Order Rates2 Commentary $2,301M +4.9% Organic 21.3% 23.5% +60 bps YoY (8%) • Backlog coverage supported growth • Productivity & supply chain improvement • Excellent operating execution $1,512M +3.9% Organic 20.5% 23.3% +90 bps YoY (1%) • Organic growth1: EMEA +0.8%, AP +8.6% • Margin expansion driven by cost control • Distribution mix continues to expand $1,283M +16.0% Organic 25.5% 25.8% +160 bps YoY +28% • 20%+ commercial organic growth; military OEM returns to growth • Strong aftermarket mix • Excellent performance of legacy & Meggitt $5,096M +6.4% Organic 22.1% 24.0% +110 bps YoY +3% • Record adjusted segment margin of 24%1 • Aerospace strength drives positive orders • Strong finish to an outstanding year 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Diversified Industrial orders are on a 3-month average computation and Aerospace Systems are rolling 12-month average computations. Beginning FY23 Q3, orders include acquisitions and exclude divestitures and currency. Diversified Industrial International Diversified Industrial North America Parker Aerospace Systems 12

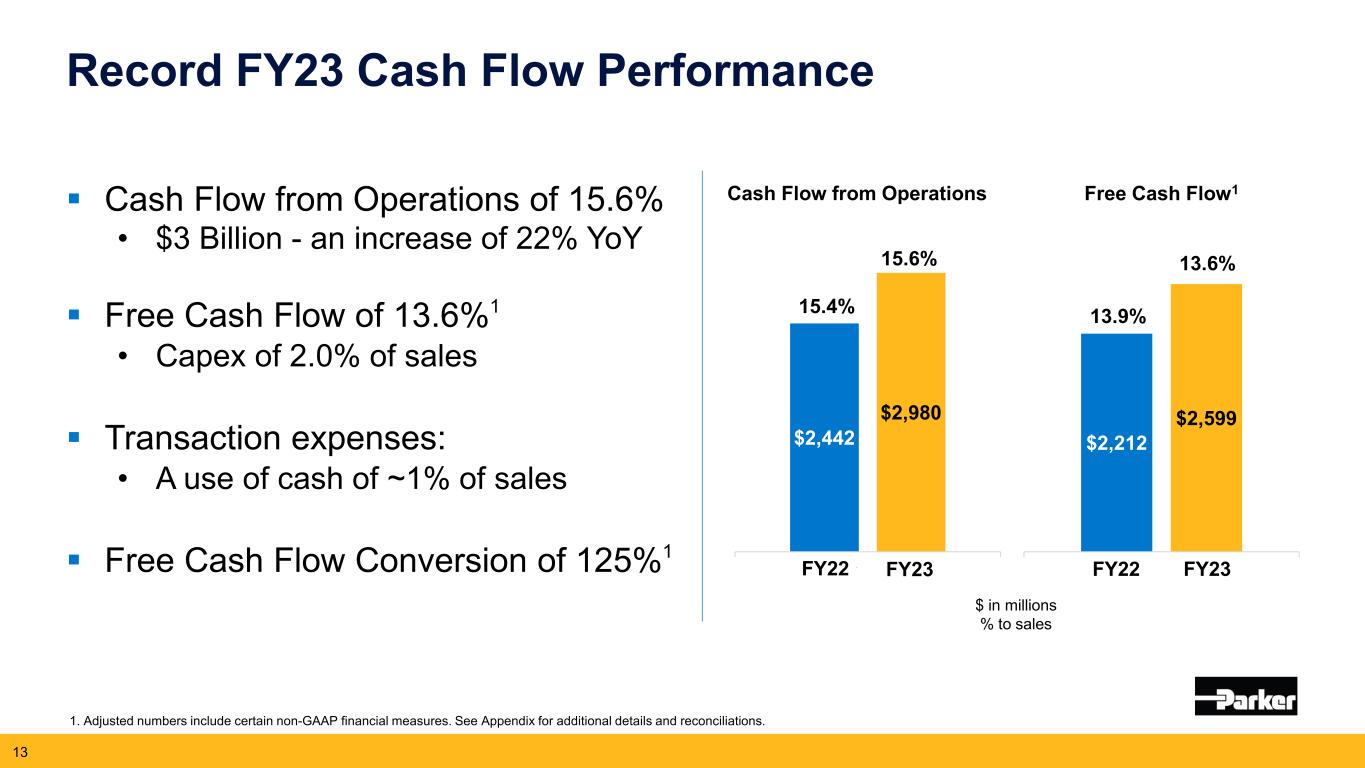

Record FY23 Cash Flow Performance Cash Flow from Operations of 15.6% • $3 Billion - an increase of 22% YoY Free Cash Flow of 13.6%1 • Capex of 2.0% of sales Transaction expenses: • A use of cash of ~1% of sales Free Cash Flow Conversion of 125%1 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 13 Free Cash Flow1 $2,212 $2,599 d FY22 FY23 13.9% 13.6% Cash Flow from Operations $2,442 $2,980 Adj. EPS 15.4% 15.6% FY22 FY23 $ in millions % to sales

Debt & Leverage Reduction Ahead of Schedule 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 14 ~$850M debt reduction during Q4 • $1.4B since Meggitt acquisition close • Paid down ~35% of total deal consideration since announcement Achieved ~1x leverage reduction • Since Meggitt acquisition close Expect ~$2B debt paydown in FY24 Target 2.0x leverage during FY25 3.8x 3.6x 3.2x 2.8x FY23 Q1 FY23 Q2 FY23 Q3 FY23 Q4 Gross Debt / Adj. EBITDA1 3.6x 3.4x 3.1x 2.7x FY23 Q1 FY23 Q2 FY23 Q3 FY23 Q4 Net Debt / Adj. EBITDA1

FY24 Guidance EPS Midpoint: $18.55 As Reported, $22.40 Adjusted 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 15 Guidance Metric FY24 Full Year Key Assumptions Reported Sales 3% - 6% Backlog coverage continues to support growth ~$460M net sales from acquisitions and divestitures Reported sales split: 1H: 49%, 2H: 51% Organic Sales Growth1 ~1.5% Expect HSD organic growth from Aerospace Organic growth: 1H: ~2.5%, 2H: ~0.5% Adj. Operating Margin1 23.0% - 23.4% 30bps margin expansion ~30% incremental margin Adj. EPS1 $21.90 - $22.90 Tax rate: ~23.5% EPS split: 1H: 46%, 2H: 54% Free Cash Flow1 $2.6B - $3.0B CapEx: ~2% of sales FCF Conversion >100%

FY24 Adjusted Earnings per Share Bridge 1. FY23 As Reported EPS of $16.04. FY24 As Reported midpoint guidance EPS of $18.55. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Interest income is included in other expense on the income statement 16 $21.55 $22.40 2

Key Messages and Outlook Successful Meggitt integration, synergies ahead of schedule ~30% exposure to Aerospace & Defense markets Longer cycle & more resilient revenue mix: ~85% by FY27 A Promising Future Top quartile safety and engaged people Continue performance acceleration from The Win Strategy™ 3.0 Proven track record - our people and performance through cycles Top Quartile Performance Well positioned to capitalize on the growth from secular trends Committed to FY27 Targets Continue to be great generators and deployers of cash 17 Portfolio Transformation

Annual Meeting of Shareholders October 25, 2023 FY24 Q1 Earnings Release November 2, 2023 FY24 Q2 Earnings Release February 1, 2024 FY24 Q3 Earnings Release May 2, 2024 FY24 Q4 Earnings Release August 8, 2024 Upcoming Event Calendar

Appendix FY24 Guidance Details Reconciliation of Organic Growth Adjusted Amounts Reconciliation – Consolidated Adjusted Amounts Reconciliation – Segment Operating Income Reconciliation of EBITDA to Adjusted EBITDA Reconciliation of Gross and Net Debt to Adjusted EBITDA Reconciliation of Free Cash Flow Conversion Supplemental Sales Information – Global Technology Platforms Reconciliation of Forecasted Segment Operating Margin Reconciliation of Forecasted EPS 19

FY24 Guidance Details Sales Growth vs. Prior Year As Reported Organic1 Diversified Industrial North America 0.5% - 3.5% ~1% Diversified Industrial International -3.0% - 0% ~(2.5%) Aerospace Systems 15.5% - 18.5% ~8% Parker 3% - 6% ~1.5% Segment Operating Margins As Reported Adjusted1 Diversified Industrial North America 20.7% - 21.1% 23.0% - 23.4% Diversified Industrial International 20.3% - 20.7% 22.8% - 23.2% Aerospace Systems 17.1% - 17.5% 23.2% - 23.6% Parker 19.7% - 20.1% 23.0% - 23.4% Earnings Per Share As Reported Adjusted1 Midpoint $18.55 $22.40 Range $18.05 - $19.05 $21.90 - $22.90 1. Adjusted numbers include certain non-GAAP financial measures. Detail of Pre-Tax Adjustments to: Segment Margins Below Segment Acquired Intangible Asset Amortization ~$550M — Business Realignment Charges ~$70M — Integration Costs to Achieve ~$35M — 20 Additional Items As Reported and Adjusted1 Corporate G&A ~$242M Interest Expense ~$525M Other Expense ~$25M Reported Tax Rate ~23.5% Diluted Shares Outstanding ~130M

Reconciliation of Organic Growth 21

Reconciliation of Organic Growth 22

Adjusted Amounts Reconciliation Consolidated Statement of Income 23 *Prior period amounts have been recast to reflect the income statement reclassification. (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2023 Acquired Business Meggitt Acquisition Amortization Meggitt As Reported Intangible Asset Realignment Costs to Related of Inventory Early Debt Adjusted June 30, 2023 % of Sales Amortization Charges Achieve Expenses Step-Up to FV Retirement June 30, 2023 % of Sales Net sales 5,095,943$ 100.0 % -$ -$ -$ -$ -$ -$ 5,095,943$ 100.0 % Cost of sales 3,262,860 64.0 % 27,990 5,247 5,197 - (57,992) - 3,282,418 64.4 % Selling, general and admin. expenses 834,940 16.4 % 98,306 3,979 13,589 2,754 - - 716,312 14.1 % Interest expense 157,176 3.1 % - - - - - 9,999 147,177 2.9 % Other (income) expense, net (62,228) (1.2)% - - - - - - (62,228) (1.2)% Income before income taxes 903,195 17.7 % (126,296) (9,226) (18,786) (2,754) 57,992 (9,999) 1,012,264 19.9 % Income taxes 194,117 3.8 % 30,816 2,251 4,584 672 (14,150) 2,440 220,730 4.3 % Net income 709,078 13.9 % (95,480) (6,975) (14,202) (2,082) 43,842 (7,559) 791,534 15.5 % Less: Noncontrolling interests 122 0.0 % - - - - - - 122 0.0 % Net income - common shareholders 708,956$ 13.9 % (95,480)$ (6,975)$ (14,202)$ (2,082)$ 43,842$ (7,559)$ 791,412$ 15.5 % Diluted earnings per share 5.44$ (0.73)$ (0.06)$ (0.11)$ (0.02)$ 0.34$ (0.06)$ 6.08$ (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2022 Acquired Business Lord Acquisition Loss on Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Costs to Adjusted June 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Achieve June 30, 2022 % of Sales Net sales 4,187,832$ 100.0 % -$ -$ -$ -$ -$ -$ 4,187,832$ 100.0 % Cost of sales* 2,768,925 66.1 % 15,584 2,696 39 - - - 2,750,606 65.7 % Selling, general and admin. expenses* 650,956 15.5 % 61,489 2,310 608 10,655 - 1,177 574,717 13.7 % Interest expense 71,270 1.7 % - - - - - - 71,270 1.7 % Other (income) expense, net* 578,513 13.8 % - (60) - 1,007 619,061 - (41,495) (1.0)% Income before income taxes 118,168 2.8 % (77,073) (4,946) (647) (11,662) (619,061) (1,177) 832,734 19.9 % Income taxes (10,738) (0.3)% 17,341 1,113 146 2,624 150,432 265 161,183 3.8 % Net income 128,906 3.1 % (59,732) (3,833) (501) (9,038) (468,629) (912) 671,551 16.0 % Less: Noncontrolling interests 75 0.0 % - - - - - - 75 0.0 % Net income - common shareholders 128,831$ 3.1 % (59,732)$ (3,833)$ (501)$ (9,038)$ (468,629)$ (912)$ 671,476$ 16.0 % Diluted earnings per share 0.99$ (0.46)$ (0.03)$ -$ (0.07)$ (3.60)$ (0.01)$ 5.16$

Adjusted Amounts Reconciliation Consolidated Statement of Income 24 *Prior period amounts have been recast to reflect the income statement reclassification. (Dollars in thousands, except per share data) (Unaudited) Year-to-Date FY 2023 Acquired Business Meggitt Acquisition Loss on Amortization Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Net Gain on of Inventory Early Debt Adjusted June 30, 2023 % of Sales Amortization Charges Achieve Expenses Forward Contracts Divestitures Step-Up to FV Retirement June 30, 2023 % of Sales Net sales 19,065,194$ 100.0 % -$ -$ -$ -$ -$ -$ -$ -$ 19,065,194$ 100.0 % Cost of sales 12,635,892 66.3 % 99,619 15,993 12,552 - - - 109,981 - 12,397,747 65.0 % Selling, general and admin. expenses 3,354,103 17.6 % 401,094 10,713 82,887 114,604 - - - - 2,744,805 14.4 % Interest expense 573,894 3.0 % - - - - - - 9,999 563,895 3.0 % Other (income) expense, net (178,359) (0.9)% - - - 51,690 389,992 (362,003) - - (258,038) (1.4)% Income before income taxes 2,679,664 14.1 % (500,713) (26,706) (95,439) (166,294) (389,992) 362,003 (109,981) (9,999) 3,616,785 19.0 % Income taxes 596,128 3.1 % 120,844 6,453 23,043 39,447 94,713 (90,931) 26,370 2,440 818,507 4.3 % Net income 2,083,536 10.9 % (379,869) (20,253) (72,396) (126,847) (295,279) 271,072 (83,611) (7,559) 2,798,278 14.7 % Less: Noncontrolling interests 600 0.0 % - - - - - - - - 600 0.0 % Net income - common shareholders 2,082,936$ 10.9 % (379,869)$ (20,253)$ (72,396)$ (126,847)$ (295,279)$ 271,072$ (83,611)$ (7,559)$ 2,797,678$ 14.7 % Diluted earnings per share 16.04$ (2.92)$ (0.16)$ (0.56)$ (0.98)$ (2.27)$ 2.08$ (0.64)$ (0.06)$ 21.55$ (Dollars in thousands, except per share data) (Unaudited) Year-to-Date FY 2022 Acquired Business Lord Acquisition Loss on Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Russia Cost to Adjusted June 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Liquidation Achieve June 30, 2022 % of Sales Net sales 15,861,608$ 100.0 % -$ -$ -$ -$ -$ -$ -$ -$ 15,861,608$ 100.0 % Cost of sales* 10,550,309 66.5 % 61,888 5,007 181 - - 9,493 - - 10,473,740 66.0 % Selling, general and admin. expenses* 2,504,061 15.8 % 252,562 9,747 3,408 44,190 - 2,847 1,177 - 2,190,130 13.8 % Interest expense 255,252 1.6 % - - - - - - - - 255,252 1.6 % Other (income) expense, net* 937,760 5.9 % - 3 - 51,537 1,015,426 7,717 - - (136,923) (0.9)% Income before income taxes 1,614,226 10.2 % (314,450) (14,757) (3,589) (95,727) (1,015,426) (20,057) (1,177) - 3,079,409 19.4 % Income taxes 298,040 1.9 % 71,223 3,340 813 21,627 240,901 2,089 265 - 638,298 4.0 % Net income 1,316,186 8.3 % (243,227) (11,417) (2,776) (74,100) (774,525) (17,968) (912) - 2,441,111 15.4 % Less: Noncontrolling interests 581 0.0 % - - - - - - - - 581 0.0 % Net income - common shareholders 1,315,605$ 8.3 % (243,227)$ (11,417)$ (2,776)$ (74,100)$ (774,525)$ (17,968)$ (912)$ -$ 2,440,530$ 15.4 % Diluted earnings per share 10.09$ (1.87)$ (0.09)$ (0.02)$ (0.57)$ (5.94)$ (0.13)$ (0.01)$ -$ 18.72$

Adjusted Amounts Reconciliation Segment Operating Income 1. Segment operating income as a percent of sales is calculated on segment sales. 2. Adjusted amounts as a percent of sales are calculated on as reported sales. 25 (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2023 Acquired Business Meggitt Acquisition Amortization Meggitt As Reported Intangible Asset Realignment Costs to Related of Inventory Early Debt Adjusted June 30, 2023 % of Sales Amortization Charges Achieve Expenses Step-Up to FV Retirement June 30, 2023 % of Sales2 Diversified Industrial: North America1 490,823$ 21.3% 47,138$ 1,792$ 877$ -$ -$ -$ 540,630$ 23.5% International1 309,373 20.5% 34,935 7,385 358 - - - 352,051 23.3% Total Diversified Industrial1 800,196 21.0% 82,073 9,177 1,235 - - - 892,681 23.4% Aerospace Systems1 327,595 25.5% 44,223 49 17,551 - (57,992) - 331,426 25.8% Total segment operating income 1,127,791 22.1% (126,296) (9,226) (18,786) - 57,992 - 1,224,107 24.0% Corporate administration 83,336 1.6% - - - - - - 83,336 1.6% Income before interest and other 1,044,455 20.5% (126,296) (9,226) (18,786) - 57,992 - 1,140,771 22.4% Interest expense 157,176 3.1% - - - - - 9,999 147,177 2.9% Other (income) expense (15,916) -0.3% - - - 2,754 - - (18,670) -0.4% Income before income taxes 903,195$ 17.7% (126,296)$ (9,226)$ (18,786)$ (2,754)$ 57,992$ (9,999)$ 1,012,264$ 19.9% (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2022 Acquired Business Lord Acquisition Loss on Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Cost to Adjusted June 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Achieve June 30, 2022 % of Sales2 Diversified Industrial: North America1 430,142$ 20.6% 46,630$ 670$ 214$ -$ -$ -$ 477,656$ 22.9% International1 296,838 20.8% 17,701 4,282 433 - - - 319,254 22.4% Total Diversified Industrial1 726,980 20.7% 64,331 4,952 647 - - - 796,910 22.7% Aerospace Systems1 149,368 22.1% 12,742 54 - - - 1,177 163,341 24.2% Total segment operating income 876,348 20.9% (77,073) (5,006) (647) - - (1,177) 960,251 22.9% Corporate administration 70,635 1.7% - - - - - - 70,635 1.7% Income before interest and other 805,713 19.2% (77,073) (5,006) (647) - - (1,177) 889,616 21.2% Interest expense 71,270 1.7% - - - - - - 71,270 1.7% Other (income) expense 616,275 14.7% - (60) - 11,662 619,061 - (14,388) -0.3% Income before income taxes 118,168$ 2.8% (77,073)$ (4,946)$ (647)$ (11,662)$ (619,061)$ (1,177)$ 832,734$ 19.9%

Adjusted Amounts Reconciliation Segment Operating Income 1. Segment operating income as a percent of sales is calculated on segment sales. 2. Adjusted amounts as a percent of sales are calculated on as reported sales. 26 (Dollars in thousands) (Unaudited) Year-to-Date FY 2023 Acquired Business Meggitt Acquisition Loss on Amortization Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Net Gain on of Inventory Early Debt Adjusted June 30, 2023 % of Sales Amortization Charges Achieve Expenses Forward Contracts Divestitures Step-Up to FV Retirement June 30, 2023 % of Sales2 Diversified Industrial: North America1 1,853,079$ 20.8% 181,954$ 4,024$ 4,636$ -$ -$ -$ -$ -$ 2,043,693$ 22.9% International1 1,218,331 21.0% 85,825 19,617 3,875 - - - - - 1,327,648 22.9% Total Diversified Industrial1 3,071,410 20.9% 267,779 23,641 8,511 - - - - - 3,371,341 22.9% Aerospace Systems1 562,444 12.9% 232,934 3,065 86,928 - - - 109,981 - 995,352 22.8% Total segment operating income 3,633,854 19.1% (500,713) (26,706) (95,439) - - - (109,981) - 4,366,693 22.9% Corporate administration 229,677 1.2% - - - - - - - - 229,677 1.2% Income before interest and other 3,404,177 17.9% (500,713) (26,706) (95,439) - - - (109,981) - 4,137,016 21.7% Interest expense 573,894 3.0% - - - - - - - 9,999 563,895 3.0% Other (income) expense 150,619 0.8% - - - 166,294 389,992 (362,003) - - (43,664) -0.2% Income before income taxes 2,679,664$ 14.1% (500,713)$ (26,706)$ (95,439)$ (166,294)$ (389,992)$ 362,003$ (109,981)$ (9,999)$ 3,616,785$ 19.0% (Dollars in thousands) (Unaudited) Year-to-Date FY 2022 Acquired Business Lord Acquisition Loss on Meggitt As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Russia Cost to Adjusted June 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Liquidation Achieve June 30, 2022 % of Sales2 Diversified Industrial: North America1 1,515,259$ 19.7% 188,325$ 2,638$ 1,171$ -$ -$ -$ -$ -$ 1,707,393$ 22.2% International1 1,178,044 20.9% 75,105 11,149 2,418 - - 6,257 - - 1,272,973 22.6% Total Diversified Industrial1 2,693,303 20.2% 263,430 13,787 3,589 - - 6,257 - - 2,980,366 22.3% Aerospace Systems1 501,431 19.9% 51,020 967 - - - 6,570 1,177 - 561,165 22.3% Total segment operating income 3,194,734 20.1% (314,450) (14,754) (3,589) - - (12,827) (1,177) - 3,541,531 22.3% Corporate administration 219,699 1.4% - - - - - - - - 219,699 1.4% Income before interest and other 2,975,035 18.8% (314,450) (14,754) (3,589) - - (12,827) (1,177) - 3,321,832 20.9% Interest expense 255,252 1.6% - - - - - - - - 255,252 1.6% Other (income) expense 1,105,557 7.0% - 3 - 95,727 1,015,426 7,230 - - (12,829) -0.1% Income before income taxes 1,614,226$ 10.2% (314,450)$ (14,757)$ (3,589)$ (95,727)$ (1,015,426)$ (20,057)$ (1,177)$ -$ 3,079,409$ 19.4%

Reconciliation of EBITDA to Adjusted EBITDA 27 (Dollars in thousands) Three Months Ended (Unaudited) June 30, 2023 % of Sales 2022 % of Sales Net sales $ 5,095,943 100.0% $ 4,187,832 100.0% Net income $ 709,078 13.9% $ 128,906 3.1% Income taxes 194,117 3.8% (10,738) -0.3% Depreciation 82,767 1.6% 62,369 1.5% Amortization 126,296 2.5% 77,073 1.8% Interest expense 157,176 3.1% 71,270 1.7% EBITDA 1,269,434 24.9% 328,880 7.9% Adjustments: Business realignment charges 9,226 0.2% 4,946 0.1% Meggitt costs to achieve 18,786 0.4% 1,177 0.0% Lord costs to achieve - 0.0% 647 0.0% Acquisition-related expenses 2,754 0.1% 11,662 0.3% Loss on deal-contingent forward contracts - 0.0% 619,061 14.8% Amortization of inventory step-up to FV (57,992) -1.1% - 0.0% EBITDA - Adjusted $ 1,242,208 24.4% $ 966,373 23.1% EBITDA margin 24.9 % 7.9 % EBITDA margin - Adjusted 24.4 % 23.1 % (Dollars in thousands) Twelve Months Ended (Unaudited) June 30, 2023 % of Sales 2022 % of Sales Net sales $ 19,065,194 100.0% $ 15,861,608 100.0% Net income $ 2,083,536 10.9% $ 1,316,186 8.3% Income taxes 596,128 3.1% 298,040 1.9% Depreciation 317,416 1.7% 257,314 1.6% Amortization 500,713 2.6% 314,450 2.0% Interest expense 573,894 3.0% 255,252 1.6% EBITDA 4,071,687 21.4% 2,441,242 15.4% Adjustments: Business realignment charges 26,706 0.1% 14,757 0.1% Meggitt costs to achieve 95,439 0.5% 1,177 0.0% Lord costs to achieve - 0.0% 3,589 0.0% Acquisition-related expenses 166,294 0.9% 95,727 0.6% Loss on deal-contingent forward contracts 389,992 2.0% 1,015,426 6.4% Net gain on divestitures (362,003) -1.9% - 0.0% Amortization of inventory step-up to FV 109,981 0.6% - 0.0% Russia Liquidation - 0.0% 20,057 0.1% EBITDA - Adjusted $ 4,498,096 23.6% $ 3,591,975 22.6% EBITDA margin 21.4 % 15.4 % EBITDA margin - Adjusted 23.6 % 22.6 %

Reconciliation of Gross and Net Debt / Adjusted EBITDA 28 (Unaudited) (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 Notes payable and long-term debt payable within one year 1,725,077$ 1,994,333$ 1,992,919$ 3,763,175$ Long-term debt 12,238,900 12,025,860 11,412,304 8,796,284 Add: Deferred debt issuance costs 87,934 83,758 79,018 74,713 Total gross debt 14,051,911$ 14,103,951$ 13,484,241$ 12,634,172$ Cash and cash equivalents 502,307$ 756,055$ 534,831$ 475,182$ Marketable securities and other investments 19,504 21,611 23,466 8,390 Total cash 521,811$ 777,666$ 558,297$ 483,572$ Net debt (Gross debt less total cash) 13,530,100$ 13,326,285$ 12,925,944$ 12,150,600$ TTM Net Sales 16,331,574$ 17,181,805$ 18,157,083$ 19,065,194$ Net income 1,252,760$ 1,260,492$ 1,503,364$ 2,083,536$ Income tax 293,066 311,753 391,273 596,128 Depreciation 258,530 280,656 297,018 317,416 Amortization 321,693 385,208 451,490 500,713 Interest Expense 313,696 399,267 487,988 573,894 TTM EBITDA 2,439,745$ 2,637,376$ 3,131,133$ 4,071,687$ Adjustments: Business realignment charges 15,604 17,337 22,426 26,706 Costs to achieve 15,555 48,166 78,477 95,439 Acquisition-related costs 203,786 186,627 175,202 166,294 Loss on deal-contingent forward contracts 1,405,418 1,256,036 1,009,053 389,992 Gain on Aircraft Wheel & Brake divestiture (372,930) (372,930) (372,930) (372,930) Amortization of inventory step-up to FV 18,358 130,331 167,973 109,981 Net loss on divestitures 0 0 10,927 10,927 Russia liquidation 20,057 20,057 0 0 TTM Adjusted EBITDA 3,745,593$ 3,923,000$ 4,222,261$ 4,498,096$ Gross Debt/TTM Adjusted EBITDA 3.8 3.6 3.2 2.8 Net Debt/TTM Adjusted EBITDA 3.6 3.4 3.1 2.7

Reconciliation of Free Cash Flow Conversion 29 (Unaudited) (Dollars in thousands) 2023 2022 Net Income 2,083,536$ 1,316,186$ Cash Flow from Operations 2,979,930$ 2,441,730$ Capital Expenditures (380,747) (230,044) Free Cash Flow 2,599,183$ 2,211,686$ Free Cash Flow Conversion (Free Cash Flow / Net Income) 125% 168% Twelve Months Ended June 30,

Supplemental Sales Information Global Technology Platforms 30 (Unaudited) (Dollars in thousands) 2023 2022 2023 2022 Net sales Diversified Industrial: Motion Systems $ 992,659 $ 921,265 $ 3,830,062 $ 3,489,431 Flow and Process Control 1,263,428 1,229,853 4,939,356 4,616,270 Filtration and Engineered Materials 1,557,344 1,360,502 5,936,275 5,236,345 Aerospace Systems 1,282,512 676,212 4,359,501 2,519,562 Total $ 5,095,943 $ 4,187,832 $ 19,065,194 $ 15,861,608 Three Months Ended June 30, Twelve Months Ended June 30,

*Totals may not foot due to rounding Reconciliation of Forecasted Segment Operating Margin 31 (Unaudited) (Amounts in percentages) Fiscal Year 2024 Forecasted segment operating margin 19.7% to 20.1% Adjustments: Business realignment charges 0.4% Costs to achieve 0.2% Acquisition-related intangible asset amortization expense 2.8% Adjusted forecasted segment operating margin 23.0% to 23.4%

Reconciliation of EPS 1. This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 32 (Unaudited) (Amounts in dollars) Fiscal Year 2024 Forecasted earnings per diluted share $18.05 to $19.05 Adjustments: Business realignment charges 0.54 Costs to achieve 0.27 Acquisition-related intangible asset amortization expense 4.23 Tax effect of adjustments1 (1.19) Adjusted forecasted earnings per diluted share $21.90 to $22.90