Parker Hannifin Corporation Fiscal 2024 First Quarter Earnings Presentation November 2, 2023 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. Often but not always, these statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Neither Parker nor any of its respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from past performance or current expectations. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of Meggitt PLC; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully business and operating initiatives, including the timing, price and execution of share repurchases and other capital initiatives; availability, cost increases of or other limitations on our access to raw materials, component products and/or commodities if associated costs cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; legal and regulatory developments and changes; compliance costs associated with environmental laws and regulations; potential supply chain and labor disruptions, including as a result of labor shortages; threats associated with international conflicts and efforts to combat terrorism and cyber security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; local and global political and competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates (including fluctuations associated with any potential credit rating decline) and credit availability; inability to obtain, or meet conditions imposed for, required governmental and regulatory approvals; changes in consumer habits and preferences; government actions, including the impact of changes in the tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof; and large scale disasters, such as floods, earthquakes, hurricanes, industrial accidents and pandemics. Readers should consider these forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and other periodic filings made with the SEC. This presentation contains references to non-GAAP financial information including organic sales for Parker and by segment, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, adjusted net income, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, Gross Debt to Adjusted EBITDA, Net Debt to Adjusted EBITDA and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. For Parker, adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, acquisition related expenses, and other one-time items. Free cash flow is defined as cash flow from operations less capital expenditures. Although organic sales, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, adjusted net income, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information 2

3 FY24 Q1 Highlights $4.8B Reported Sales 15% Increase +2.3% Organic1 24.9% Adjusted Segment Margin1 +220bps 26% Adjusted EPS Growth1 11.4% Free Cash Flow Margin1 Driven by a strong portfolio and our teams executing The Win StrategyTM Record sales, adjusted segment operating margins and adjusted earnings per share All segments above 24% adjusted segment margins1 Parker and Meggitt combination delivered an outstanding quarter for Aerospace Strong start to the year, increasing FY24 guidance FY24 Q1: A Standout Quarter 16% Reduction in Recordable Incidents 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY24 Q1 As Reported: Segment Operating Margin of 21.3%, EPS of $4.99.

Longer Cycle Shorter Cycle Industrial Aftermarket Longer Cycle + Secular Trends Shorter Cycle Industrial Aftermarket FY15 FY24 Guidance Longer Cycle + Secular Trends FY27 Illustration Longer Cycle + Secular Trends Shorter Cycle Industrial Aftermarket 4 Portfolio Transformation Expands Longer Cycle and Secular Revenue Mix

77% 81% 121% 123% FY16 FY19 FY23 FY24 Q1 Aerospace Systems Transformed Portfolio Drives Strong Backlog 5 1. Backlog % of NTM sales is a ratio of ending backlog of the period divided by next 12-month sales. FY24 Q1 illustration based on backlog as of 9/30/23 divided by FY24 sales guidance midpoint. Backlog Remains Resilient % of Next 12-Months Sales1 Robust Aerospace Demand Longer Term Visibility 27% 31% 55% 54% FY16 FY19 FY23 FY24 Q1 Parker 15% 18% 32% 31% FY16 FY19 FY23 FY24 Q1 Diversified Industrial % of Next 12-Months Sales1 % of Next 12-Months Sales1

Future Sales Growth Drivers FY27 Target 4-6% Organic Growth over the Cycle Our Business System Macro CapEx Investment Innovation Acquisitions Secular Growth Strategic Growth Drivers Address last decade under investment Supply chain development Mega Projects New Product Blueprinting Simple by DesignTM Product Vitality CLARCOR LORD Exotic Meggitt Aerospace Digital Electrification Clean Technologies Outcomes Growth & Financial Performance Machinery automation, expansion & secular trends Faster growth & support secular trends Accretive & longer cycle growth 2/3’s Portfolio enable Clean Technologies 6

A POWERFUL COMBINATION

8

31% 14%34% 21% 9 Favorable Aerospace Secular Trend Drives Future Growth 19 20 21 22 23E 24E 25E 26E 19 20 21 22 23E 24E19 20 21 22 23E 24E 25E 26E Commercial Aircraft Deliveries1 Air Traffic Available Seat Km (ASK)2 DoD Budget ($B)3 45% Aftermarket Military OE Defense budget growth Commercial OE Narrowbodies production rate increase Commercial Aftermarket Commercial air traffic recovery Military Aftermarket DoD repair depot partnerships and retrofits / upgrades ~12% CY23-26 CAGR ~10% CY23-26 CAGR ~6% Gov’t FY21-24 CAGR 1. Commercial aircraft deliveries is Parker internal forecast based on 3rd party data. 2. ASK is Parker internal forecast. 3. DoD Budget is from U.S. government budget. FY 23 S al es M ix M ac ro G ro w th D riv er s

Summary of Fiscal 2024 1st Quarter Highlights

FY24 Q1 Financial Summary 1. Sales figures As Reported. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY23 Q1 As Reported: Segment Operating Margin of 19.8%, EBITDA Margin of 18.3%, Net Income of $388M, EPS of $2.98. 11 $ Millions, except per share amounts FY24 Q1 FY24 Q1 FY23 Q1 YoY Change As Reported Adjusted¹ Adjusted¹ Adjusted Sales $4,847 $4,847 $4,233 +15% Segment Operating Margin 21.3% 24.9% 22.7% +220 bps EBITDA Margin 24.7% 24.8% 23.3% +150 bps Net Income $651 $776 $616 +26% EPS $4.99 $5.96 $4.74 +26%

FY24 Q1 Adjusted Earnings per Share Bridge 1. FY23 Q1 As Reported EPS of $2.98. FY24 Q1 As Reported EPS of $4.99. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 12 $5.16 $6.13 $4.74 $5.96 $4.74 $5.96

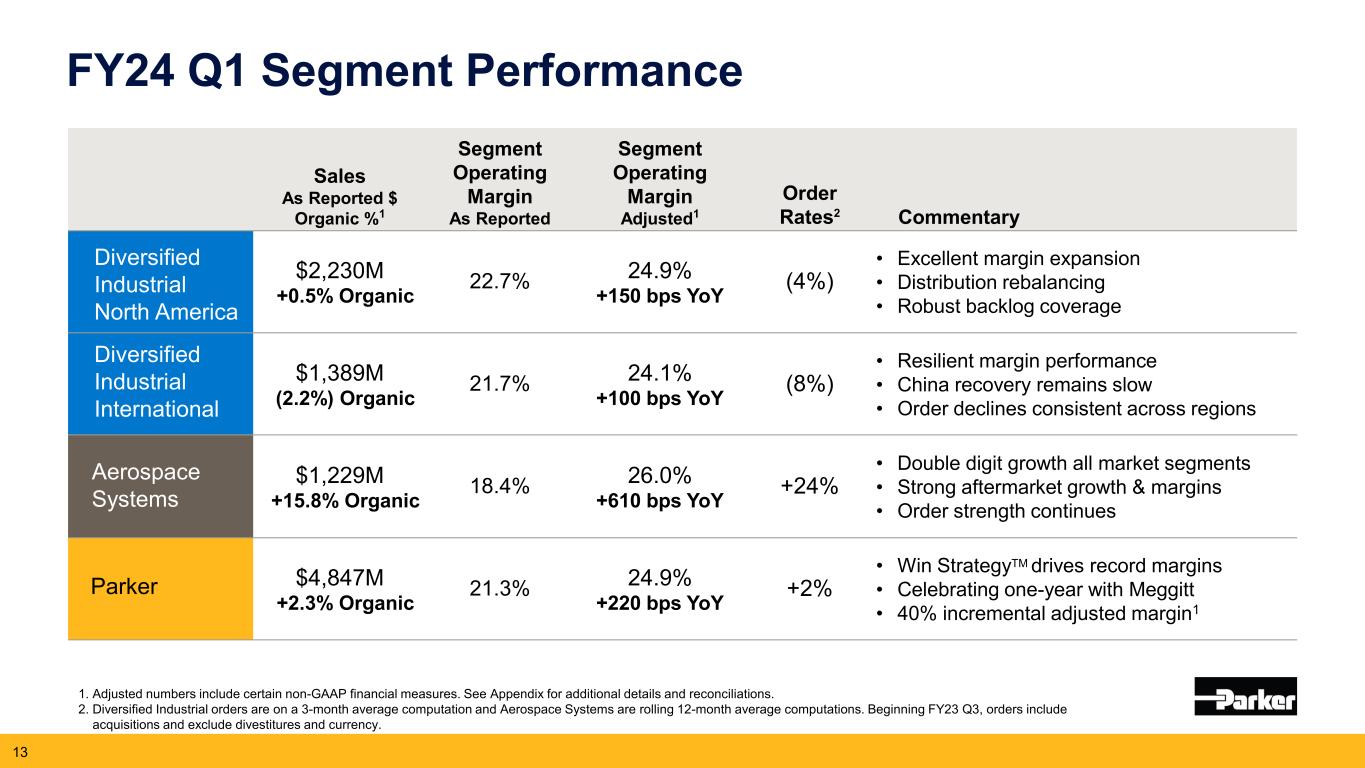

FY24 Q1 Segment Performance Sales As Reported $ Organic %1 Segment Operating Margin As Reported Segment Operating Margin Adjusted1 Order Rates2 Commentary $2,230M +0.5% Organic 22.7% 24.9% +150 bps YoY (4%) • Excellent margin expansion • Distribution rebalancing • Robust backlog coverage $1,389M (2.2%) Organic 21.7% 24.1% +100 bps YoY (8%) • Resilient margin performance • China recovery remains slow • Order declines consistent across regions $1,229M +15.8% Organic 18.4% 26.0% +610 bps YoY +24% • Double digit growth all market segments • Strong aftermarket growth & margins • Order strength continues $4,847M +2.3% Organic 21.3% 24.9% +220 bps YoY +2% • Win StrategyTM drives record margins • Celebrating one-year with Meggitt • 40% incremental adjusted margin1 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Diversified Industrial orders are on a 3-month average computation and Aerospace Systems are rolling 12-month average computations. Beginning FY23 Q3, orders include acquisitions and exclude divestitures and currency. Diversified Industrial International Diversified Industrial North America Parker Aerospace Systems 13

FY24 Q1 Cash Flow Performance Cash Flow from Operations of 13.4% Free Cash Flow of 11.4%1 • CapEx of 2.0% of sales Free Cash Flow Conversion of 85%1 Committed to FY24 Guidance: • Free Cash Flow1 of $2.6B - $3.0B • FCF Conversion1 >100% 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 14 Free Cash Flow1 $374M $552M d FY23 FY24 8.8% 11.4% Cash Flow from Operations $457M $650M Adj. EPS 10.8% 13.4% FY23 FY24 % to sales

3.6x 2.5x Adj. EPS Debt & Leverage Reduction Ahead of Schedule 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 15 Since Meggitt acquisition close: • ~$1.8B debt reduction • 1.2x leverage reduction ~$370M debt reduction during Q1 Expect ~$2B debt paydown in FY24 Target 2.0x leverage during FY25 Net Debt / Adj. EBITDA1Gross Debt / Adj. EBITDA1 3.8x 2.6x Adj. EPSQ1 FY23 Q1 FY24 Q1 FY23 Q1 FY24

FY24 Guidance Increased EPS Midpoint: $19.13 As Reported, $23.00 Adjusted 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 16 Guidance Metric FY24 Full Year Key Assumptions Reported Sales 2.5% - 5.5% Strong backlog coverage ~$140m currency headwind vs. prior guidance Split: 1H: 49% | 2H: 51% Organic Sales Growth1 ~1.5% Reaffirming full-year organic growth midpoint Raising Aerospace organic to 10% vs. 8% in prior guidance Adj. Operating Margin1 23.4% - 23.8% Raising midpoint to 23.6% vs. 23.2% in prior guidance ~40% incrementals Adj. EPS1 $22.60 - $23.40 ~($0.20) currency headwind vs. prior guidance Tax rate: ~23% Split: 1H: 48% | 2H: 52% Free Cash Flow1 $2.6B - $3.0B CapEx: ~2% of sales FCF Conversion >100%

Lee Banks Transformational Leadership & Countless Significant Contributions to Parker’s Success ▪ Retiring as Vice Chairman and President effective December 31, 2023 ▪ Joined Parker in 1991; Officer since 2006 & Director since 2015 ▪ During his tenure, sales grew at a 7% CAGR to nearly $20B1 ▪ EPS have grown from $0.36 in FY91 to $21.55 adjusted in FY23 ▪ TSR of 292% since 2015 vs. S&P 500 Industrials sector of 80% 17 1. CAGR from FY91 to FY24 Guidance. Note: Total shareholder return data from Capital IQ as of February 1, 2015 through September 30, 2023

Key Messages and Outlook Successful first full year with Meggitt ~30% exposure to Aerospace & Defense markets Longer cycle & more resilient revenue mix: ~85% by FY27 A Promising Future Focus on safety and engagement Continue performance acceleration from The Win Strategy™ 3.0 Proven track record - our people and performance through cycles Consistent Performance Well positioned to capitalize on the growth from secular trends Continue to be great generators and deployers of cash Committed to FY27 Targets 18 Portfolio Transformation

FY24 Q2 Earnings Release February 1, 2024 FY24 Q3 Earnings Release May 2, 2024 FY24 Q4 Earnings Release August 8, 2024 Upcoming Event Calendar

Appendix FY24 Guidance Details Reconciliation of Organic Growth Adjusted Amounts Reconciliation – Consolidated Adjusted Amounts Reconciliation – Segment Operating Income Reconciliation of EBITDA to Adjusted EBITDA Reconciliation of Gross and Net Debt to Adjusted EBITDA Reconciliation of Free Cash Flow Conversion Supplemental Sales Information – Global Technology Platforms Reconciliation of Forecasted Segment Operating Margin Reconciliation of Forecasted EPS 20

FY24 Guidance Details Sales Growth vs. Prior Year As Reported Organic1 Diversified Industrial North America 0.0% - 3.0% ~0.5% Diversified Industrial International (5.0%) - (2.0%) ~(3.0%) Aerospace Systems 16.5% - 19.5% ~10% Parker 2.5% - 5.5% ~1.5% Segment Operating Margins As Reported Adjusted1 Diversified Industrial North America 20.9% - 21.3% 23.1% - 23.5% Diversified Industrial International 20.4% - 20.8% 22.9% - 23.3% Aerospace Systems 18.2% - 18.6% 24.4% - 24.8% Parker 20.0% - 20.4% 23.4% - 23.8% Earnings Per Share As Reported Adjusted1 Midpoint $19.13 $23.00 Range $18.73 - $19.53 $22.60 - $23.40 1. Adjusted numbers include certain non-GAAP financial measures. Detail of Pre-Tax Adjustments to: Segment Margins Below Segment Acquired Intangible Asset Amortization ~$565M — Business Realignment Charges ~$70M — Integration Costs to Achieve ~$35M — Net Gain on Divestiture — ($13M) 21 Additional Items As Reported and Adjusted1 Corporate G&A ~$240M Interest Expense ~$515M Other Expense ~$16M ~$29M Reported Tax Rate ~23% Diluted Shares Outstanding ~130M

Reconciliation of Organic Growth 22 (Dollars in thousands) (Unaudited) Quarter-to-Date As Reported Adjusted As Reported Net Sales September 30, 2023 Acquisitions September 30, 2023 September 30, 2022 Diversified Industrial: North America 2,229,906$ (10,944)$ 543$ (77,384)$ 2,142,121$ 2,131,760$ International Europe 784,198 (38,100) - (33,935) 712,163 698,826 Asia Pacific 524,954 12,057 - (3,986) 533,025 581,623 Latin America 79,470 1,180 - - 80,650 74,564 International 1,388,622 (24,863) - (37,921) 1,325,838 1,355,013 Total Diversified Industrial 3,618,528 (35,807) 543 (115,305) 3,467,959 3,486,773 Aerospace Systems 1,228,960 (3,496) 24,404 (385,702) 864,166 746,002 Total Parker Hannifin 4,847,488$ (39,303)$ 24,947$ (501,007)$ 4,332,125$ 4,232,775$ As reported Currency Divestitures Acquisitions Organic Diversified Industrial: North America 4.6 % 0.5 % (0.0)% 3.6 % 0.5 % International Europe 12.2 % 5.4 % 0.0 % 4.9 % 1.9 % Asia Pacific (9.7)% (2.0)% 0.0 % 0.7 % (8.4)% Latin America 6.6 % (1.6)% 0.0 % 0.0 % 8.2 % International 2.5 % 1.9 % 0.0 % 2.8 % (2.2)% Total Diversified Industrial 3.8 % 1.0 % (0.0)% 3.3 % (0.5)% Aerospace Systems 64.7 % 0.5 % (3.3)% 51.7 % 15.8 % Total Parker Hannifin 14.5 % 1.0 % (0.6)% 11.8 % 2.3 % Currency Divestitures

(Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2024 Acquired Business Meggitt As Reported Intangible Asset Realignment Costs to Gain on Adjusted September 30, 2023 % of Sales Amortization Charges Achieve Divestiture September 30, 2023 % of Sales Net sales 4,847,488$ 100.0 % -$ -$ -$ -$ -$ -$ -$ 4,847,488$ 100.0 % Cost of sales 3,097,349 63.9 % 27,199 6,984 1,274 - - - - 3,061,892 63.2 % Selling, general and admin. expenses 873,691 18.0 % 128,321 6,108 5,132 - - - - 734,130 15.1 % Interest expense 134,468 2.8 % - - - - - - - 134,468 2.8 % Other (income) expense, net (78,455) (1.6)% - - - (13,260) - - - (65,195) (1.3)% Income before income taxes 820,435 16.9 % (155,520) (13,092) (6,406) 13,260 - - - 982,193 20.3 % Income taxes 169,363 3.5 % 37,169 3,129 1,531 (5,681) - - - 205,511 4.2 % Net income 651,072 13.4 % (118,351) (9,963) (4,875) 7,579 - - - 776,682 16.0 % Less: Noncontrolling interests 245 0.0 % - - - - - - - 245 0.0 % Net income - common shareholders 650,827$ 13.4 % (118,351)$ (9,963)$ (4,875)$ 7,579$ -$ -$ -$ 776,437$ 16.0 % Diluted earnings per share 4.99$ (0.91)$ (0.08)$ (0.04)$ 0.06$ -$ -$ -$ 5.96$ Adjusted Amounts Reconciliation Consolidated Statement of Income 23 (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2023 Acquired Business Meggitt Acquisition Loss on Gain on Amortization As Reported Intangible Asset Realignment Costs to Related Deal-Contingent Aircraft Wheel & Brake of Inventory Adjusted September 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Divestiture Step-Up to FV September 30, 2022 % of Sales Net sales 4,232,775$ 100.0 % -$ -$ -$ -$ -$ -$ -$ 4,232,775$ 100.0 % Cost of sales 2,795,456 66.0 % 18,632 2,499 627 - - - 18,358 2,755,340 65.1 % Selling, general and admin. Expenses 835,804 19.7 % 68,382 1,362 11,364 108,568 - - - 646,128 15.3 % Interest expense 117,794 2.8 % - - - - - - - 117,794 2.8 % Other (income) expense, net (19,624) (0.5)% - - - 51,690 389,992 (372,930) - (88,376) (2.1)% Income before income taxes 503,345 11.9 % (87,014) (3,861) (11,991) (160,258) (389,992) 372,930 (18,358) 801,889 18.9 % Income taxes 115,308 2.7 % 20,622 915 2,842 37,982 94,713 (90,570) 4,351 186,163 4.4 % Net income 388,037 9.2 % (66,392) (2,946) (9,149) (122,276) (295,279) 282,360 (14,007) 615,726 14.5 % Less: Noncontrolling interests 183 0.0 % - - - - - - - 183 0.0 % Net income - common shareholders 387,854$ 9.2 % (66,392)$ (2,946)$ (9,149)$ (122,276)$ (295,279)$ 282,360$ (14,007)$ 615,543$ 14.5 % Diluted earnings per share 2.98$ (0.52)$ (0.02)$ (0.07)$ (0.94)$ (2.27)$ 2.17$ (0.11)$ 4.74$

Adjusted Amounts Reconciliation Segment Operating Income 1. Segment operating income as a percent of sales is calculated on segment sales. 2. Adjusted amounts as a percent of sales are calculated on as reported sales. 24 (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2024 Acquired Business Meggitt As Reported Intangible Asset Realignment Costs to Net Gain on Adjusted September 30, 2023 % of Sales Amortization Charges Achieve Divestiture September 30, 2023 % of Sales2 Diversified Industrial: North America1 506,053$ 22.7% 44,683$ 2,584$ 945$ -$ -$ -$ 554,265$ 24.9% International1 300,701 21.7% 23,268 10,055 194 - - - 334,218 24.1% Total Diversified Industrial1 806,754 22.3% 67,951 12,639 1,139 - - - 888,483 24.6% Aerospace Systems1 226,260 18.4% 87,569 453 5,267 - - - 319,549 26.0% Total segment operating income 1,033,014 21.3% (155,520) (13,092) (6,406) - - - 1,208,032 24.9% Corporate administration 55,656 1.1% - - - - - - 55,656 1.1% Income before interest and other 977,358 20.2% (155,520) (13,092) (6,406) - - - 1,152,376 23.8% Interest expense 134,468 2.8% - - - - - - 134,468 2.8% Other (income) expense 22,455 0.5% - - - (13,260) - - 35,715 0.7% Income before income taxes 820,435$ 16.9% (155,520)$ (13,092)$ (6,406)$ 13,260$ -$ -$ 982,193$ 20.3% (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2023 Acquired Business Meggitt Acquisition Loss on Gain on Amortization As Reported Intangible Asset Realignment Cost to Related Deal-Contingent Aircraft Wheel & Brake of Inventory Adjusted September 30, 2022 % of Sales Amortization Charges Achieve Expenses Forward Contracts Divestiture Step-Up to FV September 30, 2022 % of Sales2 Diversified Industrial: North America1 452,986$ 21.2% 46,274$ 133$ 47$ -$ -$ -$ -$ 499,440$ 23.4% International1 293,940 21.7% 16,805 1,879 139 - - - - 312,763 23.1% Total Diversified Industrial1 746,926 21.4% 63,079 2,012 186 - - - - 812,203 23.3% Aerospace Systems1 92,151 12.4% 23,935 1,849 11,805 - - - 18,358 148,098 19.9% Total segment operating income 839,077 19.8% (87,014) (3,861) (11,991) - - - (18,358) 960,301 22.7% Corporate administration 51,660 1.2% - - - - - - - 51,660 1.2% Income before interest and other 787,417 18.6% (87,014) (3,861) (11,991) - - - (18,358) 908,641 21.5% Interest expense 117,794 2.8% - - - - - - - 117,794 2.8% Other (income) expense 166,278 3.9% - - - 160,258 389,992 (372,930) - (11,042) -0.3% Income before income taxes 503,345$ 11.9% (87,014)$ (3,861)$ (11,991)$ (160,258)$ (389,992)$ 372,930$ (18,358)$ 801,889$ 18.9%

Reconciliation of EBITDA to Adjusted EBITDA 25 (Dollars in thousands) Three Months Ended (Unaudited) September 30, 2023 % of Sales 2022 % of Sales Net sales $ 4,847,488 100.0% $ 4,232,775 100.0% Net income $ 651,072 13.4% $ 388,037 9.2% Income taxes 169,363 3.5% 115,308 2.7% Depreciation 84,867 1.8% 66,967 1.6% Amortization 155,520 3.2% 87,014 2.1% Interest expense 134,468 2.8% 117,794 2.8% EBITDA 1,195,290 24.7% 775,120 18.3% Adjustments: Business realignment charges 13,092 0.3% 3,861 0.1% Meggitt costs to achieve 6,406 0.1% 11,991 0.3% Acquisition-related expenses - 0.0% 160,258 3.8% Loss on deal-contingent forward contracts - 0.0% 389,992 9.2% Amortization of inventory step-up to FV - 0.0% 18,358 0.4% Gain on divestitures (13,260) -0.3% (372,930) -8.8% EBITDA - Adjusted $ 1,201,528 24.8% $ 986,650 23.3% EBITDA margin 24.7 % 18.3 % EBITDA margin - Adjusted 24.8 % 23.3 %

Reconciliation of Gross and Net Debt / Adjusted EBITDA 26 (Unaudited) (Dollars in thousands) September 30, 2022 September 30, 2023 Notes payable and long-term debt payable within one year 1,725,077$ 3,594,425$ Long-term debt 12,238,900 8,596,063 Add: Deferred debt issuance costs 87,934 70,406 Total gross debt 14,051,911$ 12,260,894$ Cash and cash equivalents 502,307$ 448,926$ Marketable securities and other investments 19,504 7,930 Total cash 521,811$ 456,856$ Net debt (Gross debt less total cash) 13,530,100$ 11,804,038$ TTM Net Sales 16,331,574$ 19,679,907$ Net income 1,252,760$ 2,346,571$ Income tax 293,066 650,183 Depreciation 258,530 335,316 Amortization 321,693 569,219 Interest Expense 313,696 590,568 TTM EBITDA 2,439,745$ 4,491,857$ Adjustments: Business realignment charges 15,604 35,937 Costs to achieve 15,555 89,854 Acquisition-related costs 203,786 6,036 Loss on deal-contingent forward contracts 1,405,418 0 Gain on divestitures (372,930) (13,260) Amortization of inventory step-up to FV 18,358 91,623 Net loss on divestitures 0 10,927 Russia liquidation 20,057 0 TTM Adjusted EBITDA 3,745,593$ 4,712,974$ Gross Debt/TTM Adjusted EBITDA 3.8 2.6 Net Debt/TTM Adjusted EBITDA 3.6 2.5

(Unaudited) (Dollars in thousands) 2023 2022 Net Income 651,072$ 388,037$ Cash Flow from Operations 649,959$ 457,358$ Capital Expenditures (97,746) (83,555) Free Cash Flow 552,213$ 373,803$ Free Cash Flow Conversion (Free Cash Flow / Net Income) 85% 96% Three Months Ended September 30, Reconciliation of Free Cash Flow Conversion 27

Supplemental Sales Information Global Technology Platforms 28 (Unaudited) (Dollars in thousands) 2023 2022 Net sales Diversified Industrial: Motion Systems $ 942,314 $ 906,014 Flow and Process Control 1,181,461 1,204,464 Filtration and Engineered Materials 1,494,753 1,376,295 Aerospace Systems 1,228,960 746,002 Total $ 4,847,488 $ 4,232,775 Three Months Ended September 30,

Reconciliation of Forecasted Segment Operating Margin 29 (Unaudited) (Amounts in percentages) Fiscal Year 2024 Forecasted segment operating margin 20.0% to 20.4% Adjustments: Business realignment charges 0.3% Costs to achieve 0.2% Acquisition-related intangible asset amortization expense 2.9% Adjusted forecasted segment operating margin 23.4% to 23.8%

Reconciliation of EPS 1. This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 30 (Unaudited) (Amounts in dollars) Fiscal Year 2024 Forecasted earnings per diluted share $18.73 to $19.53 Adjustments: Business realignment charges 0.53 Costs to achieve 0.27 Acquisition-related intangible asset amortization expense 4.36 Net gain on divestitures (0.10) Tax effect of adjustments1 (1.19) Adjusted forecasted earnings per diluted share $22.60 to $23.40