| ¨ Preliminary Proxy Statement

x Definitive Proxy Statement

|

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

¨

|

Definitive Additional Materials

|

x

|

No fee required.

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

(1)

|

Title of each class of securities to which transaction applies:

|

(2)

|

Aggregate number of securities to which transaction applies:

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

(5)

|

Total fee paid:

|

¨

|

Fee paid previously with preliminary materials.

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

(1)

|

Amount Previously Paid:

|

(2)

|

Form, Schedule or Registration Statement No.:

|

(3)

|

Filing Party:

|

(4)

|

Date Filed:

|

![]()

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard - Mayfield Heights, Ohio 44124-4141

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OCTOBER 24, 2001

The annual meeting of shareholders of Parker-Hannifin Corporation will be held at the Corporation's headquarters at 6035 Parkland Boulevard, Mayfield Heights, Ohio 44124, on Wednesday, October 24, 2001, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

1. Electing four Directors in the class whose three-year term of office will expire in 2004:

2. Appointing PricewaterhouseCoopers LLP as independent certified public accountants for the fiscal year ending June 30, 2002; and

3. Transacting such other business as may properly come before the meeting.

Shareholders of record at the close of business on August 31, 2001 are entitled to vote at the meeting. If you do not expect to attend the Annual Meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the proxy card.

| By Order of the Board of Directors | |

|

|

|

| Thomas A. Piraino, Jr.

Secretary |

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard - Mayfield Heights, Ohio 44124-4141

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of the Corporation of proxies to be voted at the annual meeting of shareholders scheduled to be held on October 24, 2001, and at all adjournments thereof. Only shareholders of record at the close of business on August 31, 2001 will be entitled to vote. On that date, 117,321,173 Common Shares were outstanding and entitled to vote at the meeting, each share being entitled to one vote. This Proxy Statement and the form of proxy are being mailed to shareholders on September 24, 2001.

Shareholders of the Corporation have cumulative voting rights in the election of Directors if any shareholder gives notice in writing to the President or a Vice President or the Secretary of the Corporation not less than 48 hours before the time fixed for holding the meeting that cumulative voting at such election is desired and an announcement of the giving of such notice is made upon the convening of the meeting by the Chairman or the Secretary or by or on behalf of the shareholder giving such notice. In such event, each shareholder has the right to cumulate votes and give one nominee the number of votes equal to the number of Directors to be elected multiplied by the number of votes to which the shareholder is entitled, or to distribute votes on the same principle among two or more nominees, as the shareholder sees fit. In the event that voting at the election is cumulative, the persons named in the proxy will vote Common Shares represented by valid Board of Directors’ proxies on a cumulative basis for the election of the nominees named below, allocating the votes of such Common Shares in accordance with their judgment.

ELECTION OF DIRECTORS

The Directors of the class elected at each annual election hold office for terms of three years. The Board of Directors of the Corporation presently consists of 13 members divided into three classes. The classes whose terms expire in 2001 and 2003 each consist of four members and the class whose term expires in 2002 consists of five members. As permitted under the Corporation's Code of Regulations, William E. Kassling was elected to the Board of Directors in July 2001 to a term expiring in 2002.

Shareholder approval is sought to elect John G. Breen, Hector R. Ortino, Dennis W. Sullivan and Donald E. Washkewicz, Directors whose terms of office expire in 2001, to the class whose term will expire in 2004. A plurality of the Common Shares voted in person or by proxy is required to elect a Director.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of such other person as a Director as the Board of Directors may recommend. However, the Board of Directors has no reason to believe that this contingency will occur.

1

NOMINEES FOR ELECTION AS DIRECTORS FOR TERM EXPIRING IN 2004

JOHN G. BREEN, 67, has served as a Director of the Corporation since 1980. He is Chairman of the Compensation and Management Development Committee and a member of the Nominating and Retirement Planning Committees. Now retired, Mr. Breen was the Chairman of the Board of The Sherwin Williams Company (paints and coatings) until April 2000 and Chief Executive Officer until October 1999. Mr. Breen is also a Director of National City Corporation, Mead Corporation, Goodyear Tire and Rubber Company, The Sherwin Williams Company and The Stanley Works.

HECTOR R. ORTINO, 59, has served as a Director of the Corporation since 1997. He is Chairman of the Audit Committee and a member of the Nominating Committee. Mr. Ortino has been the President of Ferro Corporation (specialty materials) since February 1996 and has been Chief Executive Officer and Chairman of the Board of Ferro Corporation since April 1999. He was previously Chief Operating Officer of Ferro Corporation from February 1996 to April 1999.

DENNIS W. SULLIVAN, 62, has served as a Director of the Corporation since 1983. Mr. Sullivan is Executive Vice President of the Corporation. Mr. Sullivan is also a Director of Ferro Corporation and KeyCorp.

DONALD E. WASHKEWICZ, 51, was elected to the Board of Directors in February 2000. Mr. Washkewicz has been the Chief Executive Officer of the Corporation since July 2001 and the President of the Corporation since February 2000. He was previously the Chief Operating Officer of the Corporation from February 2000 to July 2001; a Vice President of the Corporation and President of the Hydraulics Group of the Corporation from October 1997 to February 2000; and Vice President-Operations of the Fluid Connectors Group of the Corporation from October 1994 to October 1997.

PRESENT DIRECTORS WHOSE TERMS EXPIRE IN 2003

DUANE E. COLLINS, 65, has served as a Director of the Corporation since 1992. Mr. Collins has been Chairman of the Board of Directors since October 1999. He was previously the Chief Executive Officer of the Corporation from July 1993 to July 2001 and the President of the Corporation from July 1993 to February 2000. Mr. Collins is also a Director of National City Corporation, The Sherwin Williams Company and Mead Corporation.

KLAUS-PETER MULLER, 57, has served as a Director of the Corporation since 1998. He is a member of the Nominating and Retirement Planning Committees. Mr. Müller has been Chairman of the Board of Managing Directors of Commerzbank AG (international banking) in Frankfurt, Germany since May 2001 and a member of the Board of Managing Directors of Commerzbank since 1990.

GIULIO MAZZALUPI, 60, has served as a Director of the Corporation since 1999. He is a member of the Nominating and Retirement Planning Committees. Mr. Mazzalupi has been the President, Chief Executive Officer and a Director of Atlas Copco AB (industrial manufacturing) in Sweden since April 1997. He was previously Senior Executive Vice President of Atlas Copco AB and Business Area Executive of Compressor Technique (a business unit of Atlas Copco AB) from April 1990 to April 1997.

ALLAN L. RAYFIELD, 66, has served as a Director of the Corporation since 1984. He is Chairman of the Nominating Committee and a member of the Audit and Compensation and Management Development Committees. Now retired, Mr. Rayfield previously served as President, Chief Executive Officer and Director of M/A-COM, Inc. (microwave manufacturing) . Mr. Rayfield is also a Director of Acme Metal Inc. and Arch Wireless, Inc.

PRESENT DIRECTORS WHOSE TERMS EXPIRE IN 2002

PAUL C. ELY, JR., 69, has served as a Director of the Corporation since 1984. He is Chairman of the Retirement Planning Committee and a member of the Audit and Nominating Committees. Now retired, Mr. Ely owns and operates Santa Cruz Yachts (yacht manufacturing). He was a General Partner of Alpha Partners (venture capital seed financing) from July 1989 to May 1998. Mr. Ely is also a Director of Sabre Holdings Corporation, Tektronix, Inc. and Travelocity.com Inc.

WILLIAM E. KASSLING, 57, was elected to the Board of Directors in July 2001. He is a member of the Audit and Nominating Committees. He has been Chairman of the Board of Wabtec Corporation (technology-based equipment for the rail industry) since 1990. He was previously the Chief Executive Officer of Wabtec from March 1990 to February 2001 and the President of Wabtec from March 1990 to February 1998. Mr. Kassling is also a Director of Aearo Corporation and Scientific Atlanta, Inc.

PETER W. LIKINS, 65, has served as a Director of the Corporation since 1989. He is a member of the Audit, Compensation and Management Development and Nominating Committees. Dr. Likins is President of the University of Arizona. He was previously the President of Lehigh University from July 1982 to October 1997. Dr. Likins is also a Director of Consolidated Edison, Inc.

2

WOLFGANG R. SCHMITT, 57, has served as a Director of the Corporation since 1992. He is a member of the Audit, Compensation and Management Development and Nominating Committees. Mr. Schmitt is the Chief Executive Officer of Trends 2 Innovation (strategic growth consultants). He was previously the Chairman of the Board of ValueAmerica, Inc. (on-line electronics and technology superstore) from November 1999 to May 2000 and Vice Chairman of the Board of Newell Rubbermaid Inc. (consumer products) as a result of the merger between Newell Co. and Rubbermaid Incorporated from April 1999 to August 1999. Prior to the merger, he had been the Chairman of the Board of Rubbermaid Incorporated (manufacturer of rubber and plastic products) since 1993 and the Chief Executive Officer since 1992. Mr. Schmitt is also a Director of Kimberly-Clark Corporation.

DEBRA L. STARNES, 48, has served as a Director of the Corporation since 1997. She is a member of the Compensation and Management Development, Nominating and Retirement Planning Committees. Now a Consultant, Ms. Starnes was the Senior Vice President, Organizational and Process Change, of Lyondell Chemical Company (petrochemical production) from April 2000 to July 2001; Senior Vice President, Intermediate Chemicals, of Lyondell from July 1998 to April 2000; Senior Vice President, Polymers-Equistar Chemical (a joint venture majority owned by Lyondell) from December 1997 to July 1998; and Senior Vice President, Polymers, of Lyondell from May 1995 to December 1997.

No Director of the Corporation is related to any other Director. During the fiscal year ended June 30, 2001, there were six meetings of the Corporation’s Board of Directors. Each Director attended at least 75% of the meetings held by the Board of Directors and the Committees of the Board on which he or she served.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Corporation’s executive officers, directors and beneficial owners of more than 10% of the Corporation's Common Shares to file initial stock ownership reports and reports of changes in ownership with the Securities and Exchange Commission and the New York Stock Exchange. SEC regulations require that the Corporation be furnished with copies of these reports. Based solely on a review of these reports and written representations from the executive officers and directors, the Corporation believes that there was compliance with all such filing requirements for the fiscal year ended June 30, 2001, except Lynn M. Cortright, Vice President, filed one late Form 4 to report two transactions, Dana A. Dennis, Controller, filed one late Form 4 to report one transaction and Timothy K. Pistell, Treasurer, filed one late Form 4 to report one transaction.

The Audit Committee, which met twice during the fiscal year ended June 30, 2001, is responsible for reviewing with the Corporation’s financial management and its independent certified public accountants the proposed auditing program (including both the independent and the internal audits) for each fiscal year, the results of the audits and the adequacy of the Corporation’s internal control structure. This Committee recommends to the Board of Directors the appointment of the independent certified public accountants for the fiscal year.

The Retirement Planning Committee, which met twice during the fiscal year ended June 30, 2001, is responsible for reviewing with the Corporation’s management the funding and investment policies for defined benefit plans and defined contribution plans sponsored by the Corporation.

The Compensation and Management Development Committee, which met twice during the fiscal year ended June 30, 2001, is responsible for annually reviewing and fixing the salaries and other compensation of the officers of the Corporation, deciding upon the grant of stock options to the officers and other employees of the Corporation and reviewing corporate policies and programs for succession management and the development of management personnel.

The Nominating Committee, which met twice during the fiscal year ended June 30, 2001, is responsible for evaluating and recommending to the Board qualified nominees for election as Directors of the Corporation and considering other matters pertaining to the size and composition of the Board. The Nominating Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as Directors of the Corporation, provided that such recommendations are accompanied by information sufficient to enable the Committee to evaluate the qualifications of the nominee. Nominations should be sent to the attention of the Secretary of the Corporation.

Compensation of Directors. The Corporation compensates Directors, other than officers who are Directors, for their services. The annual retainer for such Directors is $30,000. The fee for attending each Board and Committee meeting is $1,500 for all such Directors other than Committee Chairmen, whose fee is $2,000 for chairing committee meetings. Beginning in July 2001, Duane E. Collins, Chairman of the Board of Directors, upon retirement as an active employee, now receives an annual retainer of $175,000, plus meeting fees, club memberships and the use of a leased automobile. Directors may elect to defer all or a portion of their fees under the Corporation’s Deferred Compensation Plan for Directors or to elect to receive all or a portion of their fees in Common Shares of the Corporation pursuant to the Corporation’s Non-Employee Directors’ Stock Plan.

Each Director who was not a current or retired employee of the Corporation (“Non-Employee Director”) was granted 1,100 stock options under the Non-Employee Directors Stock Option Plan in August 2000 at an option price equal to the then current fair market value of the Corporation’s Common Shares. Such options have a ten-year term and vest 50% following one year of continued service as a Director and the remaining 50% following the second year of continued service as a Director. In August 2001, each Non-Employee Director was granted an additional 700 stock options upon identical terms.

3

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is composed of six directors who are independent, as defined in the listing standards of the New York Stock Exchange. The responsibilities of the Audit Committee are set forth in the Audit Committee Charter approved by the Board of Directors, a copy of which is attached to this Proxy Statement as Appendix A.

In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited consolidated financial statements of the Corporation for the fiscal year ended June 30, 2001, with the Corporation’s management and PricewaterhouseCoopers LLP (“PwC”), the Corporation’s independent certified public accountants.

The Audit Committee has discussed with PwC the matters required to be discussed by Statement on Auditing Standards No. 61, Communications with Audit Committees. In addition, the Audit Committee has received and reviewed the written disclosures and the letter from PwC required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with PwC their objectivity and independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements for the fiscal year ended June 30, 2001, be included in the Corporation’s Annual Report on Form 10-K for the year ended June 30, 2001 to be filed with the Securities and Exchange Commission.

|

|

|

| Hector R. Ortino, Chairman

|

Dr. Peter W. Likins

|

|

|

|

|

| Paul C. Ely, Jr.

|

Allan L. Rayfield

|

|

|

|

|

| William E. Kassling

|

Wolfgang R. Schmitt

|

4

COMPENSATION AND MANAGEMENT DEVELOPMENT

COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation and Management Development Committee of the Board of Directors (the “Committee”) has furnished the following report on executive compensation.

The Committee, which consists entirely of five outside non-employee Directors, has overall responsibility to:

Following review and approval by the Committee, all issues pertaining to executive compensation are submitted to the full Board of Directors in conjunction with its approval and review of the Corporation’s strategies and operating plans, thereby assuring that the Corporation’s system of executive compensation is reasonable and appropriate, meets its stated purpose and effectively serves the interests of the shareholders and the Corporation.

The Corporation’s executive compensation programs are designed to attract and retain key executives critical to the long-term success of the Corporation by remaining competitive with other multinational diversified manufacturing companies of similar size. Comparative compensation information is used by the Committee to establish competitive salary grade ranges at the market median for base pay, annual bonus and long-term compensation. The group of companies used for compensation comparison purposes is not the same as the S&P Manufacturing (Diversified Industrials) Index, which is the peer group of companies included in the performance graph on page 12. Comparative compensation information is obtained by the Committee from independent surveys of numerous diversified manufacturers, which the Committee believes is important in order to establish competitive compensation ranges at the appropriate levels. On the other hand, the S&P Manufacturing (Diversified Industrials) Index utilized in the performance graph contains data only with respect to a limited number of companies that are in businesses similar to the Corporation, which data is theoretically reflective of the stock performance of all diversified manufacturers as a whole.

The Corporation’s executive compensation programs also are intended to reward executives commensurate with performance and attainment of pre-determined financial objectives. Accordingly, compensation of executive officers is directly and materially linked to both operating and stock price performance, thus aligning the financial interests of the Corporation’s executives with those of its shareholders.

Compensation for the Corporation’s executives consists of three primary elements:

| 1.

|

A base salary within a competitively established range. The specific base salary within the range is determined by

experience, individual contributions and performance as measured against pre-established goals and objectives. Goals and objectives for each executive vary in accordance with each executive’s responsibilities and are established by each

executive’s supervisor.

|

|

| 2.

|

An annual cash incentive bonus that is comprised of two components:

|

|

| a.

|

An amount that is determined by the Corporation’s pre-tax return on average assets as compared to the Corporation’s annual plan established at the beginning of the fiscal year (the “Target

Incentive Bonus”); and

|

|

| b.

|

An amount that is determined based on the return on division net assets for the divisions in each executive’s individual operating unit (or the average return for all divisions for corporate staff

executive officers) (the “RONA Bonus”).

|

|

The target amounts of the annual cash incentive bonuses are established in such a manner that base salary plus the target bonuses will be within the competitively determined total annual compensation range mentioned above. Target annual cash incentive bonuses represent approximately 30-45% of total targeted annual compensation for the executive officers with operational profit and loss responsibility (including the Chief Executive Officer) and 25-40% of total targeted annual compensation for the other executive officers.

The Chief Executive Officer, with the approval of the Committee, also has the authority to establish additional annual incentive programs for operating executives. In fiscal year 2001, under a Volume Incentive Plan, operating group presidents had the opportunity to earn an additional bonus of 1% of base salary for each 1% of sales by which their group exceeded their previous year’s sales by between 10% and 15%, and an additional bonus of 2% of base salary for each 1% of sales by which their group exceeded their previous year’s sales by more than 15%; subject, however, to an overall maximum of 15% of the participant’s base salary. Acquisitions may only account for up to 5% of the increase in sales. Also, sales growth above 15% resulted in additional payments under the Plan only if the group exceeded corporate goals with respect to its return on sales and its assets/sales ratio. An identical Volume Incentive Plan has been adopted for fiscal year 2002.

5

| 3.

|

Long-term incentive compensation that is comprised of two components:

|

|

| a.

|

A long-term incentive plan (“LTIP”) award that is based upon the Corporation’s actual average return on equity for a three fiscal year period, payable in either restricted stock or as an

account entry under the Corporation’s Executive Deferral Plan (“EDP”) in an amount equal to the value of such restricted stock. The amount of the LTIP award in shares is calculated by dividing a target LTIP dollar value (adjusted for

risk of forfeiture) by the market price of the Corporation’s Common Shares at the beginning of the three-year performance period. The target LTIP value is established by the Committee at the market median of comparative LTIP compensation.

|

|

| b.

|

A stock option grant determined by utilizing the Black-Scholes valuation model to convert a target stock option dollar value (adjusted for risk of non-vesting) into the number of stock options to be

granted. The target stock option value is established by the Committee at the market median of comparative stock option compensation. Stock options are granted with an exercise price equal to the fair market value of the Corporation’s Common

Shares on the day of grant, and grants historically had a ten-year term with one year vesting. Beginning in August 1999, grants have a ten-year term and vest 50% following one year of continued service and the remaining 50% following the second year

of continued service from the date granted. The Corporation's Stock Option Deferral Plan permits executives to defer the recognition of gain upon the exercise of stock options under the Plan.

|

|

Incentive compensation for the Corporation’s executives is significantly “at risk,” based upon the financial performance of the Corporation. Indeed, more than one-half of each executive’s targeted total compensation (including base salary, annual bonus, LTIP payouts and stock options) may fluctuate significantly from year to year because it is directly tied to business and individual performance.

Long-term incentive programs are designed to link the interests of the executives with those of the shareholders. LTIP awards focus on long-term return on equity and provide an incentive to increase the stock price during the three year performance period. Restricted stock awards build stock ownership and encourage a long-term focus on shareholder value, since the stock is restricted from being sold, transferred or assigned for a specified period. Stock option grants provide an incentive that aligns the executive’s interests with those of the shareholders, since stock options will provide value to the executive only when the price of the Corporation’s stock increases above the option grant price.

In August 1996, the Board of Directors, at the recommendation of the Committee, adopted stock ownership guidelines that are designed to encourage the accumulation and retention of the Corporation’s Common Shares by its Directors, executive officers and other key executives. These guidelines, stated as a multiple of executives’ base salaries and of Directors’ annual retainer, are as follows: Chief Executive Officer and President: three times; Vice Presidents: two times; other executive officers and group presidents: one time; and non-officer Directors: four times. The recommended time period for reaching the above guidelines is five years. The Chief Executive Officer reviews compliance with this policy with the Committee on an annual basis.

The Corporation’s executive compensation philosophy is specifically evident in the compensation paid during the most recent fiscal year to Duane E. Collins, who is currently the Corporation’s Chairman of the Board of Directors and was the Corporation’s Chief Executive Officer until June 30, 2001. Mr. Collins’ increase in base salary from fiscal 2000 to fiscal 2001 of 6% is reflective of his “outstanding” performance rating for fiscal 2000. In addition, based on the Corporation’s fiscal 2001 operating plan, Mr. Collins was entitled to receive 100% of his Target Incentive Bonus of $350,000 if the Corporation’s actual pretax return on average assets, adjusted primarily for acquisitions and currency transactions, was 13.2%. A minimum payout of 15% of the Target Incentive Bonus was established at a 2.8% pretax return on average assets and a maximum payout of 150% of the Target Incentive Bonus was established at a 16.0% pretax return on average assets. During the fiscal year ended June 30, 2001, the Corporation’s adjusted pretax return on average assets was 11.97% and each executive officer, including Mr. Collins, received an amount equal to 91.2% of his Target Incentive Bonus, which is included in the “Bonus” column of the Summary Compensation Table on page 8.

Mr. Collins’ RONA Bonus was targeted at $498,522 based upon an approximate 30.73% average return on division net assets. The average return on division net assets was 29.6%, resulting in a RONA Bonus payment to Mr. Collins of $464,293, which is included in the “Bonus” column of the Summary Compensation Table on page 8. The other executive officers also received RONA Bonuses based upon the return on division net assets by their respective operating units (or the average return for all divisions for corporate staff executive officers).

Based on the Corporation’s average return on equity of 16.45% for the three fiscal years ended June 30, 2001, Mr. Collins and the other executive officers received a payment under the 1999-00-01 LTIP in the form of either restricted shares and/or contributions to their EDP accounts in an amount equal to the value of the restricted shares earned, as reported in the “LTIP Payouts” column of the Summary Compensation Table on page 8. Such payment represents 140.65% of the target payment that would have been achieved had the Corporation merely achieved its return on equity goal of 14% during such period.

6

During fiscal year 2001, Mr. Collins and the other executive officers also received a long-term incentive award as described in the LTIP Table on page 10 and a stock option grant as reported in the Option Grants Table on page 9.

The Omnibus Budget Reconciliation Act of 1993 includes potential limitations on the deductibility of compensation in excess of $1 million paid to the Corporation’s Chief Executive Officer and four other highest paid executive officers. The Committee has taken the necessary actions to ensure the deductibility of compensation paid by the Corporation to such individuals.

|

|

|

| John G. Breen, Chairman

|

Dr. Peter W. Likins

|

|

|

|

|

| Allan L. Rayfield

|

Wolfgang R. Schmitt

|

|

| |

||

| Debra L. Starnes

|

||

7

EXECUTIVE COMPENSATION

The following table summarizes compensation paid by the Corporation for each of the last three fiscal years to its Chief Executive Officer and each of the other four most highly compensated executive officers:

Summary Compensation Table

| Annual Compensation

|

Long-Term Compensation

|

||||||||||||||

| Awards

|

Payouts

|

||||||||||||||

| Fiscal

Year |

Securities

Underlying Options (#) |

|

|

||||||||||||

| Name and Principal Position | Salary ($)

|

Bonus ($)

|

Other Annual

Compensation ($) (a) |

LTIP

Payouts ($) (b) |

All Other

Compensation ($) |

||||||||||

| |

|

|

|

|

|

|

|

|

|||||||

| Duane E. Collins, | 2001

|

1,097,100

|

783,493

|

14,580

|

105,410

|

1,258,304

|

451,381

|

(c)

|

|||||||

| Chief Executive Officer and | 2000

|

1,035,000

|

854,186

|

16,763

|

126,809

|

925,812

|

493,127

|

||||||||

| Chairman of the Board | 1999

|

984,996

|

702,714

|

20,663

|

84,070

|

1,907,821

|

437,108

|

||||||||

| Donald E. Washkewicz | 2001

|

614,250

|

377,363

|

184,769

|

71,260

|

254,895

|

61,411

|

(e)

|

|||||||

| President and Chief | 2000

|

320,105

|

162,955

|

21,235

|

62,310

|

153,680

|

31,063

|

||||||||

| Operating Officer (d) | 1999

|

239,100

|

106,867

|

1,780

|

13,880

|

204,914

|

6,824

|

||||||||

| Dennis W. Sullivan, | 2001

|

689,076

|

391,993

|

10,390

|

53,530

|

467,392

|

86,322

|

(e)

|

|||||||

| Executive Vice President | 2000

|

656,256

|

415,715

|

14,534

|

29,590

|

443,400

|

93,454

|

||||||||

| 1999

|

624,996

|

351,599

|

15,900

|

31,220

|

842,807

|

115,938

|

|||||||||

| Michael J. Hiemstra, | 2001

|

428,604

|

288,710

|

5,386

|

27,340

|

336,082

|

129,639

|

(f)

|

|||||||

| Vice President - | 2000

|

412,923

|

261,578

|

4,674

|

16,390

|

258,930

|

140,399

|

||||||||

| Finance and Administration | 1999

|

425,004

|

216,661

|

5,040

|

18,300

|

481,976

|

55,559

|

||||||||

| and Chief Financial Officer | |||||||||||||||

| Lawrence M. Zeno, | 2001

|

441,000

|

267,653

|

6,317

|

32,450

|

420,835

|

64,627

|

(e)

|

|||||||

| Vice President | 2000

|

420,000

|

286,054

|

4,069

|

21,560

|

359,145

|

70,952

|

||||||||

| 1999

|

399,996

|

240,179

|

9,132

|

32,174

|

481,976

|

63,808

|

|||||||||

| (a)

|

Unless otherwise indicated, no executive officers named in the Summary Compensation Table received personal benefits or perquisites in excess of the lesser of $50,000 or 10% of his total compensation

reported in the Salary and Bonus columns. Reported in this column is annual compensation consisting of (i) amounts reimbursed by the Corporation for the payment of income taxes on certain executive perquisites and (ii) $121,172 in executive

perquisites received by Mr. Washkewicz in fiscal year 2001, including payments of $119,239 for country club dues.

|

| (b)

|

For fiscal years 2001 and 1999, the amounts represent contributions to the executives’ Executive Deferral Plan (“EDP”) accounts based upon performance achieved under the 1999-00-01 and

1997-98-99 Long Term Incentive Plans (“LTIP”), respectively. For fiscal 2000, the amounts represent: (i) contributions to the EDP accounts of Messrs. Collins, Washkewicz and Zeno based upon performance achieved under the 1998-99-00 LTIP;

(ii) the dollar value of restricted shares issued to Mr. Sullivan under the 1998-99-00 LTIP based on the Corporation’s stock price on the date of issuance of the shares; and (iii) a contribution to Mr. Hiemstra’s EDP account of $100,000

and the dollar value of his remaining payout in restricted shares under the 1998-99-00 LTIP. The EDP contributions and restricted shares are subject to a three-year vesting period, with accelerated vesting in the event of the death, disability or

normal retirement of the Plan participant. Dividends are paid by the Corporation on the restricted shares. The number and value of the aggregate restricted stock holdings for each of the above-named executive officers with restricted stock as of

June 30, 2001 was as follows: Mr. Collins, 8,628 shares with a value of $366,172, Mr. Sullivan, 29,990 shares with a value of $1,272,776, and Mr. Hiemstra, 4,640 shares with a value of $196,922.

|

| (c)

|

Represents: (i) $15,850 of matching contributions by the Corporation to the Parker Retirement Savings Plan (“Savings Plan”) and the Parker-Hannifin Corporation Savings Restoration Plan

(“Restoration Plan”); (ii) $161,936 of compensatory split-dollar life insurance benefits under the Corporation’s Executive Life Insurance Plan (“Executive Life Insurance Plan”); and (iii) $273,595 of additional compensatory

split-dollar life insurance benefits under a policy purchased by the Corporation pursuant to an Executive Estate Protection Agreement entered into between Mr. Collins and the Corporation.

|

| (d) | Mr. Washkewicz was named President and Chief Operating Officer on February 3, 2000. |

| (e)

|

Represents: (i) $15,283, $14,433 and $14,444 of matching contributions by the Corporation to the Savings Plan and the Restoration Plan for Messrs. Washkewicz, Sullivan and Zeno, respectively; and (ii)

$46,128, $71,889, and $50,183 of compensatory split-dollar life insurance benefits for Messrs. Washkewicz, Sullivan and Zeno, respectively, under the Executive Life Insurance Plan.

|

| (f)

|

Represents: (i) $15,283 of matching contributions by the Corporation to the Savings Plan and the Restoration Plan; (ii) $44,765 of compensatory split-dollar life insurance benefits under the Executive Life

Insurance Plan; and (iii) $69,591 of additional compensatory split-dollar life insurance benefits under a policy purchased by the the Corporation pursuant to an Executive Estate Protection Agreement entered into between Mr. Hiemstra and the

Corporation in exchange for the surrender by Mr. Hiemstra of $50,000 per year in base salary until October 2006.

|

8

The following table summarizes stock option grants by the Corporation during the fiscal year ended June 30, 2001 to each of the executive officers identified in the Summary Compensation Table on page 8:

| Option Grants in Fiscal 2001

|

|||||||||||||||

| Individual Grants

|

|||||||||||||||

| Name

|

Number of

Securities Underlying Options Granted (#) (a) |

% of Total

Options Granted to Employees in Fiscal 2001 |

Exercise

Or Base Price ($/Sh)

|

Expiration

Date |

Potential realizable value at

assumed annual rates of stock price appreciation for option term (b) |

||||||||||

| |

|||||||||||||||

| 5% ($)

|

10% ($)

|

13.52% ($) (c)

|

|||||||||||||

| |

|

|

|

|

|

|

|

||||||||

| Duane E. Collins | 105,410

|

7.2%

|

$

|

35.938

|

8/8/10

|

2,382,371

|

6,037,463

|

9,675,268

|

|||||||

| Donald E. Washkewicz | 71,260

|

4.9%

|

$

|

35.938

|

8/8/10

|

1,610,547

|

4,081,488

|

6,540,742

|

|||||||

| Dennis W. Sullivan | 53,530

|

3.7%

|

$

|

35.938

|

8/8/10

|

1,209,832

|

3,065,984

|

4,913,358

|

|||||||

| Michael J. Hiemstra | 27,340

|

1.9%

|

$

|

35.938

|

8/8/10

|

617,911

|

1,565,926

|

2,509,457

|

|||||||

| Lawrence M. Zeno | 32,450

|

2.2%

|

$

|

35.938

|

8/8/10

|

733,402

|

1,858,606

|

2,978,488

|

|||||||

| (a)

|

Options are 50% exercisable on the date following completion of one year of continuous employment after the date of grant and the remaining 50% is exercisable on the date following completion of two years

of continuous employment after the date of grant with accelerated vesting in the event of a Change in Control (as defined on page 11). Restorative or "reload" option rights are attached to each option and up to two reload options will be granted

upon exercise, subject to certain provisions, if the exercise price is paid using shares of the Corporation's common stock owned by the optionee.

|

| (b)

|

The potential realizable value illustrates the value that might be realized upon the exercise of the options immediately prior to the expiration of their term, assuming the specified compounded rates of

appreciation over the entire term of the option. Shareholders of the Corporation, as a group, would realize approximately $2.57 billion and $6.52 billion at assumed annual rates of appreciation of 5% and 10%, respectively, over the ten-year life of

the options. There can be no assurance that the amounts reflected in this table will be achieved.

|

| (c)

|

Represents the Corporation's actual rate of stock price appreciation over the 10-year period ending June 30, 2001.

|

The following table summarizes exercises of stock options during the fiscal year ended June 30, 2001 by each of the executive officers identified in the Summary Compensation Table on page 8 and the fiscal year-end value of unexercised options for such executive officers:

| Aggregated Option Exercises in Fiscal 2001 and Fiscal Year-End Option Values

|

||||||||||

| Name | Shares

Acquired on Exercise (#) |

Value

Realized ($) |

Number of

Securities Underlying Unexercised Options at FY-End (#) Exercisable / Unexercisable |

Value of Unexercised

In-the-Money Options at FY-End ($) Exercisable / Unexercisable |

||||||

| |

|

|

|

|

||||||

| Duane E. Collins | 180,000

|

8,251,484

|

331,419

|

/

|

139,610 | 2,838,118

|

/

|

685,429 | ||

| Donald E. Washkewicz | -

|

-

|

66,035

|

/

|

102,415 | 592,199

|

/

|

463,368 | ||

| Dennis W. Sullivan | -

|

-

|

194,615

|

/

|

68,325 | 2,806,169

|

/

|

348,079 | ||

| Michael J. Hiemstra | 45,000

|

2,205,450

|

57,230

|

/

|

35,535 | 522,404

|

/

|

177,778 | ||

| Lawrence M. Zeno | -

|

-

|

37,664

|

/

|

43,230 | 0

|

/

|

211,006 | ||

9

The following table summarizes awards by the Corporation during the fiscal year ended June 30, 2001 to each of the executive officers identified in the Summary Compensation Table on page 8 under the Corporation's Long Term Incentive Plan ("LTIP"):

| Long Term Incentive Plan - Awards in Fiscal 2001

|

||||||||

| Number of

Shares (#) |

Performance or

Other Period Until Maturation or Payout |

Estimated Future Payouts under

Non-Stock Price-Based Plans |

||||||

| Name | Threshold (#)

|

Target (#)

|

Maximum (#)

|

|||||

| Duane E. Collins | 33,000

|

3 Years

|

8,250

|

33,000

|

66,000

|

|||

| Donald E. Washkewicz | 22,310

|

3 Years

|

5,578

|

22,310

|

44,620

|

|||

| Dennis W. Sullivan | 16,760

|

3 Years

|

4,190

|

16,760

|

33,520

|

|||

| Michael J. Hiemstra | 10,510

|

3 Years

|

2,628

|

10,510

|

21,020

|

|||

| Lawrence M. Zeno | 12,470

|

3 Years

|

3,118

|

12,470

|

24,940

|

|||

Target awards under the Corporation's LTIP during the last fiscal year were made in the form of restricted shares of the Corporation's Common Shares and entitle each executive officer to receive a pro rata share of his award based upon the Corporation's actual average return on equity (threshold of 8%; target of 14%; maximum of 20%) for the three fiscal years ending June 30, 2003. Awards are payable in August 2003. Executive officers will receive cash in lieu of restricted shares under the LTIP if they are retired at the time of payment or if they elect, prior to May 31, 2002, to defer the amount earned under the LTIP pursuant to the Corporation's Executive Deferral Plan.

| Pension Plan Table

|

||||||

| The following table summarizes the estimated annual benefits payable upon retirement to the executive officers identified in the Summary Compensation Table on page 8: | ||||||

| Years of Service

|

||||||

| |

||||||

| |

Remuneration

|

15 or more

|

||||

| |

|

|

||||

| $ 400,000

|

$ 220,000

|

|||||

| 600,000

|

330,000

|

|||||

| 800,000

|

440,000

|

|||||

| 1,000,000

|

550,000

|

|||||

| 1,200,000

|

660,000

|

|||||

| 1,400,000

|

770,000

|

|||||

| 1,600,000

|

880,000

|

|||||

| 1,800,000

|

990,000

|

|||||

| 2,000,000

|

1,100,000

|

|||||

| 2,200,000

|

1,210,000

|

|||||

| 2,400,000

|

1,320,000

|

|||||

The foregoing table sets forth the straight-life annuity payable under the Corporation's Supplemental Executive Retirement Benefits Program (the "Program") at the normal retirement age of 65. Mr. Collins retired on June 30, 2001 after 40 years of service. Mr. Zeno retired on August 31, 2001 after 35 years of service. The years of service under the Program for each of the other executive officers identified in the Summary Compensation Table on page 8, at their respective retirement dates, will be as follows: Mr. Washkewicz, 43 years; Mr. Sullivan, 44 years; and Mr. Hiemstra, 25 years. The Program provides an annual benefit based upon the average of the participant's three highest years of cash compensation (Salary, RONA Bonus and Target Incentive Bonus) with the Corporation. Benefits payable under the Program are based on calendar year compensation. The average of the three highest calendar years of cash compensation used for Mr. Collins in determining his benefit under the Program as of the date of his retirement was $1,795,620. If the benefits were to be payable to each of the remaining named participants based on retirement as of June 30, 2001, the average of the three highest calendar years of cash compensation included in determining benefits under the Program for each of the named participants would be as follows: Mr. Washkewicz, $455,464; Mr. Sullivan, $1,028,666; Mr. Hiemstra, $656,085; and Mr. Zeno, $663,310. Benefits are subject to reduction for payments received under the Corporation's Retirement Plan plus 50% of primary social security benefits.

10

“Change in Control” Severance Agreements with Officers. The Corporation has entered into separate agreements (collectively the “Agreements”) with Messrs. Washkewicz, Sullivan and Hiemstra that are designed to retain the executives and provide for continuity of management in the event of any actual or threatened change in the control of the Corporation. Each Agreement only becomes operative upon a “Change in Control” of the Corporation, as that term is defined in the Agreements, and the subsequent termination of the employment of the executive pursuant to the terms of the Agreement. A Change in Control of the Corporation shall be deemed to have occurred if and when: (i) subject to certain exceptions, any “person” (as such term is used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act) is or becomes a beneficial owner, directly or indirectly, of securities of the Corporation representing 20% or more of the combined voting power of the Corporation’s then outstanding securities eligible to vote for the election of the Board; (ii) during any period of twenty-four consecutive months, individuals who at the beginning of such twenty-four month period were Directors of the Corporation (the “Incumbent Board”) cease to constitute at least a majority of the Board of Directors of the Corporation, unless the election, or nomination for election, of any person becoming a Director subsequent to the beginning of such twenty-four month period was approved by a vote of at least two-thirds of the Incumbent Board; (iii) the Corporation enters into a merger, consolidation or other reorganization, or sells all its assets, unless (a) immediately following the business combination: (1) more than 50% of the total voting power eligible to elect directors of the resulting corporation is represented by shares that were Common Shares immediately prior to the business combination, (2) subject to certain exceptions, no person becomes the beneficial owner, directly or indirectly, of 20% or more of the voting power of the corporation resulting from the business combination, and (3) at least a majority of the members of the board of directors of the resulting corporation were members of the Incumbent Board at the time of the Board of Directors of the Corporation’s approval of the execution of the initial agreement providing for such business combination, or (b) the business combination is effected by means of the acquisition of Common Shares from the Corporation, and the Board of Directors of the Corporation approves a resolution providing expressly that such business combination does not constitute a “Change in Control”; or (iv) the shareholders of the Corporation approve a plan of complete liquidation or dissolution of the Corporation.

Each Agreement provides that, if the employment of the executive is terminated during the three years following a Change in Control of the Corporation, either by the Corporation without “Cause” (as defined in the Agreements) or by the executive for “Good Reason” (as defined in the Agreements and described below), the executive shall be entitled to receive (a) pro rata salary and bonus for the year of termination of employment; (b) severance pay equal to three times the executive’s annual salary and bonus; (c) continuation of welfare benefits (e.g., medical, life insurance, disability coverage) for a period of three years; (d) to the extent not previously received, all amounts previously deferred under the Corporation’s non-qualified income deferral plans together with a “make whole” amount designed to compensate the executive for the lost opportunity to continue to defer receipt of such income (and the earnings thereon) pursuant to elections made under such deferral plans; and (e) a “gross-up” payment to offset the effect, if any, of the excise tax imposed by Section 4999 of the Internal Revenue Code. “Good Reason” for termination of employment by the executive includes, without limitation, diminution in duties, reduction in compensation or benefits or relocation. In addition, termination of employment by the executive for any or no reason during the 180-day period beginning on the 91st day after the Change in Control shall constitute Good Reason.

A Change in Control of the Corporation also has an effect under other executive compensation plans of the Corporation, as follows: (1) any outstanding unvested stock option held by an executive vests immediately upon a Change in Control; (2) any outstanding unvested shares of restricted stock issued or unvested Executive Deferral Plan (“EDP”) amounts credited to an executive pursuant to the Corporation’s Long Term Incentive Plans (“LTIP”) vest immediately in the event of a Change in Control; (3) any outstanding LTIP award to an executive will be paid in full in cash upon a Change in Control, at the target amount or on the basis of corporate financial performance to the date of the Change in Control, whichever is greater; (4) upon a Change in Control, all amounts previously deferred by the executive under the EDP, together with the “make whole” amount (described in subsection (d) of the preceding paragraph), will be paid to the executive; (5) upon a Change in Control, all shares the receipt of which were previously deferred by the executive under the Stock Option Deferral Plan will be issued to the executive; and (6) upon a Change in Control, each participant under the Corporation’s Supplemental Executive Retirement Benefits Program (the “Program”) will receive three additional years of age and service credit under the Program and will receive a lump-sum payment equal to the present value of the participant’s vested benefit under the Program.

11

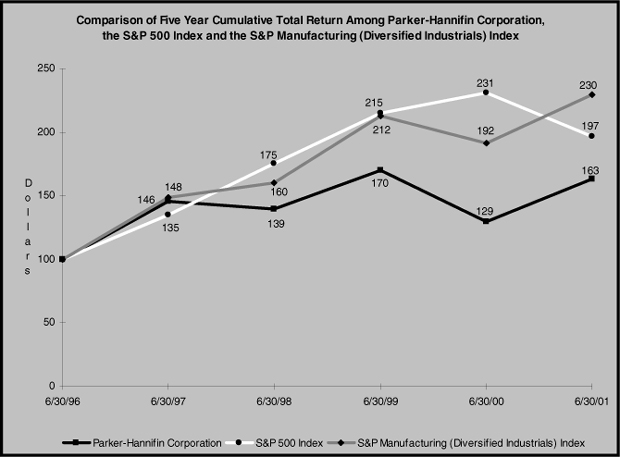

Common Share Price Performance Graph

The following graph sets forth a comparison of the cumulative shareholder return on the Corporation's Common Shares with the S&P 500 Index and the S&P Manufacturing (Diversified Industrials) Index during the period June 30, 1996 through June 30, 2001, assuming the investment of $100 on June 30, 1996, and the reinvestment of dividends.

APPOINTMENT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Audit Committee and the Board of Directors recommend the appointment of PricewaterhouseCoopers LLP (“PwC”) as independent certified public accountants to examine the financial statements of the Corporation as of and for the fiscal year ending June 30, 2002. PwC has conducted the annual audit of the Corporation’s accounts since its organization in 1938. A representative of PwC is expected to be present at the meeting with an opportunity to make a statement if he desires to do so and to respond to appropriate questions. Ratification of the appointment of PwC as independent certified public accountants requires the affirmative vote of the holders of at least a majority of the votes present or represented and entitled to vote on the proposal at the Annual Meeting.

Audit Fees

The aggregate fees billed by PwC for auditing the Corporation’s annual consolidated financial statements for the fiscal year ended June 30, 2001 and reviewing the Corporation’s interim financial statements included in the Corporation’s Form 10-Q’s filed with the Securities and Exchange Commission during fiscal 2001 were $2.39 million.

Financial Information Systems Design and Implementation Fees

PwC did not provide any services to the Corporation relating to financial information systems design and implementation during the fiscal year ended June 30, 2001.

All Other Fees

The aggregate fees billed by PwC for all other professional services provided to the Corporation (other than the services described above under “Audit Fees”) for the fiscal year ended June 30, 2001 were $3.02 million. These fees were primarily for tax and acquisition related services.

12

The Audit Committee has considered whether the services rendered by the independent certified public accountants with respect to the foregoing fees are compatible with maintaining their independence.

The Board of Directors unanimously recommends a vote FOR the proposal to appoint PricewaterhouseCoopers LLP as the Corporation’s independent certified public accountants for the fiscal year ending June 30, 2002.

PRINCIPAL SHAREHOLDERS OF THE CORPORATION

The following table sets forth, as of August 31, 2001, the name and address of each person believed to be a beneficial owner of more than 5% of the Common Shares of the Corporation, the number of shares and the percentage so owned, as well as the beneficial ownership of Common Shares of the Corporation by the Directors, the executive officers of the Corporation named in the Summary Compensation Table on page 8, and all Directors and executive officers as a group:

| Amount and Nature

of Beneficial Ownership(a) |

Percentage

of Class(b) |

||||

| Name of

Beneficial Owner |

|||||

| |

|

|

|||

| FMR Corp.

82 Devonshire Street Boston, MA 02109 |

11,966,234

|

(c) | 10.3%

|

||

| J. G. Breen | 18,350

|

(d) | |||

| P. C. Ely | 10,828

|

(e) | |||

| W. E. Kassling | 4,500

|

(f) | |||

| P. W. Likins | 11,714

|

(g) | |||

| G. Mazzalupi | 2,400

|

(h) | |||

| K. P. Müller | 5,389

|

(h) | |||

| H. R. Ortino | 7,354

|

(i) | |||

| A. L. Rayfield | 8,943

|

(e) | |||

| W. R. Schmitt | 10,605

|

(e) | |||

| D. L. Starnes | 6,609

|

(j) | |||

| D. E. Collins | 548,670

|

(k) | |||

| D. E. Washkewicz | 138,636

|

(l) | |||

| D. W. Sullivan | 337,166

|

(m) | |||

| M. J. Hiemstra | 126,378

|

(n) | |||

| L. M. Zeno | 95,581

|

(o) | |||

| All Directors and executive

officers as a group (29 persons) |

2,011,601

|

(p) | 1.7%

|

||

| (a)

|

Unless otherwise indicated, the beneficial owner has sole voting and investment power.

|

| (b)

|

No Director or executive officer beneficially owned more than 1% of the Corporation’s Common Stock as of August 31, 2001.

|

| (c)

|

Pursuant to a statement filed by FMR Corp. with the Securities and Exchange Commission in accordance with Rule 13d-1 of the Securities and Exchange Act of 1934, FMR Corp. has reported on behalf of itself,

Edward C. Johnson 3d (Chairman of FMR Corp.), Abigail P. Johnson (Director of FMR Corp.), Fidelity Management & Research Company, Fidelity Management Trust Company and Fidelity International Limited that, as of December 31, 2000, it had sole

voting power over 1,425,817 Common Shares and sole investment power over 11,966,234 Common Shares.

|

| (d)

|

This amount includes 11,000 Common Shares owned jointly by Mr. Breen and his spouse and 3,150 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the

Corporation’s Non-Employee Directors Stock Option Plan.

|

| (e)

|

These amounts include 4,650 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s Non-Employee Directors Stock Option Plan.

|

| (f)

|

These shares are owned jointly by Mr. Kassling and his spouse.

|

| (g)

|

This amount includes 1,424 Common Shares owned jointly by Dr. Likins and his spouse and 4,650 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the

Corporation’s Non-Employee Directors Stock Option Plan.

|

13

| (h)

|

These amounts include 1,400 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s Non-Employee Directors Stock Option Plan.

|

| (i)

|

This amount includes 3,900 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s Non-Employee Directors Stock Option Plan.

|

| (j)

|

This amount includes 300 Common Shares owned jointly by Ms. Starnes and her spouse and 3,150 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s

Non-Employee Directors Stock Option Plan.

|

| (k)

|

This amount includes 41,850 Common Shares owned solely by Mr. Collins’ spouse, 22,751 Common Shares as to which Mr. Collins holds voting power pursuant to the Corporation’s Retirement Savings Plan

as of June 30, 2001, and 418,324 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s 1993 Stock Incentive Program.

|

| (l)

|

This amount includes 3,939 Common Shares owned jointly by Mr. Washkewicz and his mother, 21,713 Common Shares as to which Mr. Washkewicz holds voting power pursuant to the Corporation’s Retirement

Savings Plan as of June 30, 2001, and 107,820 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s 1993 Stock Incentive Program.

|

| (m)

|

This amount includes 137 Common Shares as to which Mr. Sullivan holds voting power pursuant to the Corporation’s Retirement Savings Plan as of June 30, 2001 and 236,175 Common Shares subject to options

exercisable on or prior to October 30, 2001 granted under the Corporation’s 1993 Stock Incentive Program.

|

| (n)

|

This amount includes 2,250 Common Shares owned jointly by Mr. Hiemstra and his spouse, 11,967 Common Shares owned solely by Mr. Hiemstra’s spouse, 4,369 Common Shares as to which Mr. Hiemstra holds

voting power pursuant to the Corporation’s Retirement Savings Plan as of June 30, 2001, and 79,095 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s 1993 Stock Incentive

Program.

|

| (o)

|

This amount includes 1,686 Common Shares owned jointly by Mr. Zeno and his spouse, 21,974 Common Shares owned solely by Mr. Zeno’s spouse, 2,526 Common Shares as to which Mr. Zeno holds voting power

pursuant to the Corporation’s Retirement Savings Plan as of June 30, 2001 and 64,669 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s 1993 Stock Incentive Program.

|

| (p)

|

This amount includes 143,424 Common Shares for which voting and investment power is shared, 112,885 Common Shares as to which all Directors and executive officers as a group hold voting power pursuant to

the Corporation’s Retirement Savings Plan as of June 30, 2001, and 1,423,733 Common Shares subject to options exercisable on or prior to October 30, 2001 granted under the Corporation’s stock option plans held by all Directors and

executive officers as a group.

|

SHAREHOLDERS’ PROPOSALS

The Corporation must receive by May 27, 2002 any proposal of a shareholder intended to be presented at the 2002 Annual Meeting of Shareholders of the Corporation (the “2002 Meeting”) and to be included in the Corporation’s proxy, notice of meeting and proxy statement related to the 2002 Meeting pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934 (the “Exchange Act”). Such proposals should be submitted by certified mail, return receipt requested. Proposals of shareholders submitted outside the processes of Rule 14a-8 under the Exchange Act (“Non-Rule 14a-8 Proposals”) in connection with the 2002 Meeting must be received by the Corporation by August 10, 2002 or such proposals will be considered untimely under Rule 14a-4(c) of the Exchange Act. The Corporation’s proxy related to the 2002 Meeting will give discretionary authority to the proxy holders to vote with respect to all Non-Rule 14a-8 Proposals received by the Corporation after August 10, 2002. The Corporation’s proxy related to the 2001 Annual Meeting of Shareholders gives discretionary authority to the proxy holders to vote with respect to all Non-Rule 14a-8 Proposals received by the Corporation after August 11, 2001.

GENERAL

The Board of Directors knows of no other matters which will be presented at the meeting. However, if any other matters properly come before the meeting or any adjournment, the person or persons voting the proxies will vote in accordance with their best judgment on such matters.

14

The Corporation will bear the expense of preparing, printing and mailing this Proxy Statement. In addition to solicitation by mail, officers and other employees of the Corporation may solicit the return of proxies. The Corporation will request banks, brokers and other custodians, nominees and fiduciaries to send proxy material to beneficial owners of Common Shares. The Corporation will, upon request, reimburse them for their expenses in so doing. The Corporation has retained Georgeson Shareholder Communications Inc., 88 Pine Street, Wall Street Plaza, 30th Floor, New York, New York, to assist in the solicitation of proxies at an anticipated cost of $14,000, plus disbursements.

You are urged to vote your proxy promptly by internet, telephone or mail by following the instructions on the enclosed proxy card in order to make certain your shares will be voted at the meeting. Common Shares represented by properly executed proxies will be voted in accordance with any specification made thereon and, if no specification is made, will be voted in favor of the election of the four nominees for Directors in the class whose three-year term of office will expire in 2004; and in favor of the appointment of PricewaterhouseCoopers LLP as independent certified public accountants for the fiscal year ending June 30, 2002. Abstentions and broker non-votes are counted in determining the votes present at a meeting. Consequently, an abstention or a broker non-vote has the same effect as a vote against a proposal which requires the affirmative vote of a certain number of Common Shares, as each abstention or broker non-vote would be one less vote in favor of a proposal. You may revoke your proxy at any time prior to the close of voting at the Annual Meeting by internet or telephone or by giving notice to the Corporation in writing or in open meeting, without affecting any vote previously taken. However, your mere presence at the meeting will not operate to revoke your proxy.

The Annual Report of the Corporation, including financial statements for the fiscal year ended June 30, 2001, is being mailed to shareholders with this Proxy Statement.

| By Order of the Board of Directors | |

|

|

|

| Thomas A. Piraino, Jr.

Secretary |

|

| September 24, 2001 |

15

APPENDIX A

AUDIT COMMITTEE CHARTER

Function of the Audit Committee

The Audit Committee will assist the Board of Directors (a) in its oversight of the Corporation’s financial reporting principles and policies and internal audit controls and procedures; (b) in its oversight of the Corporation’s financial statements and audits thereof; and (c) in selecting, evaluating and, where deemed appropriate, replacing the outside auditors (or nominating the outside auditors to be proposed for shareholder approval in any proxy statement). The Audit Committee will also assist in other matters as may from time to time be specifically delegated to the Audit Committee by the Board.

While the Audit Committee has the powers and responsibilities set forth in this Charter, it is not the responsibility of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate or are in compliance with generally accepted accounting principles, which is the responsibility of management and the outside auditors. Likewise, it is not the responsibility of the Audit Committee to conduct investigations, to resolve disputes, if any, between management and the outside auditors or to assure compliance with laws or the Corporation’s corporate compliance program or code of ethics.

Membership

The Audit Committee shall consist of at least three (3) members, each of whom shall have no relationship to the Corporation that may interfere with the exercise of their independence from management and the Corporation and shall otherwise satisfy the applicable requirements under the rules of the New York Stock Exchange, Inc. Alternate members of the Audit Committee who shall also meet the aforementioned requirements, may, from time to time, be designated by the Board of Directors to take the place of any absent member or members of the Audit Committee.

Responsibilities and Authorities

The Audit Committee’s powers and authorities on behalf of the Board of Directors shall include the following:

| a) | Recommend the selection, each year, of the outside auditors for the Corporation. The outside auditors are ultimately accountable to the Board of Directors. The Board of Directors, with the assistance of the Audit Committee, has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the outside auditors (or to nominate the outside auditors to be proposed for shareholder approval in the proxy statement). |

| b) | Review with financial management and the outside and internal auditors the proposed auditing programs, their coordination of same, and costs for the ensuing year, including those for nonaudit services by outside auditors, and suggest changes in emphasis or scope as necessary. |

| c) | Ensure the outside auditors prepare and deliver to the Audit Committee annually a formal written statement delineating all relationships between the outside auditors and the Corporation, addressing at least the matters set forth in Independence Standards Board Standard No. 1. Any disclosed relationships that may impact the objectivity and independence of the outside auditors must be discussed with the outside auditors. Recommend that the Board of Directors take appropriate action in response to the outside auditors’ report to satisfy itself of the auditors’ independence. |

| The outside auditors shall submit to the Corporation annually a formal written statement of the fees billed for each of the following categories of services rendered by the outside auditors: (1) the audit of the Corporation’s annual financial statements for the most recent fiscal year and the reviews of the financial statements included in the Corporation’s Quarterly Reports on Form 10-Q for that fiscal year; (2) information technology consulting services for the most recent fiscal year, in the aggregate and for each service; and (3) all other services rendered by the outside auditors for the most recent fiscal year, in the aggregate and by each service. | |

| d) | Where necessary, consider whether the outside auditors' provision of (1) information technology consulting services relating to financial information systems design and implementation and (2) other non-audit services to the Corporation is compatible with maintaining the independence of the outside auditors. |

| e) | Review with financial management and the outside and internal auditors the results of the year’s audits. The review should cover key issues that the auditors considered during their work, leading to their expression of an opinion on the financial statements of the Corporation. The review should also cover the development of the Financial Section of the Annual Report to Shareholders, along with an explanation of significant variances from the prior year, accounting issues and estimates, changes in regulatory or accounting standards that have an impact on the financial statements and whether management sought a second opinion on a significant accounting issue. |

A-1

| f) | Obtain from the outside auditors assurance that the audit was conducted in a manner consistent with Section 10A of the Securities Exchange Act of 1934, as amended, which sets forth certain procedures to be followed in any audit of financial statements required under the Securities Exchange Act of 1934. |

| g) | Review with the outside and internal auditors their recommendations for improvements to accounting, internal control, adherence to Corporation policies, maintaining independence of audit activity, and assure that appropriate action is taken in response to these recommendations. |

| h) | Review with the independent public accountants their opinion on the quality of the Corporation’s accounting principles as well as the quality of financial and accounting personnel and the internal audit staff, any difficulties encountered in performing the audit and any disagreements with management. |

| i) | Receive reports, as needed, from the Corporation’s Government Contracts Review Board with regard to contract compliance issues, internal or governmental audit findings, and adherence to the Defense Industry Initiatives (DII). |

| j) | Undertake, or cause to be undertaken, any additional reviews that it deems necessary to answer adequately any questions related to the above matters, and in such regard may retain appropriate professional consultation as desired. |

| k) | Report, at least annually, to the full Board on the above matters. |

| l) | Prepare any report or other disclosures, including recommendations of the Audit Committee, required by the rules of the Securities and Exchange Commission to be included in the Corporation’s annual proxy statement. |

| m) | Review this Charter at least annually and recommend any changes to the full Board of Directors. |

Meetings

Meetings of the Audit Committee may be called by the Chairman of the Committee or by any two members thereof. Meetings of the Audit Committee may be held at any place within or without the State of Ohio and may be held by means of communications equipment if all members participating can hear each other. Participation of the members of the Audit Committee held through communications equipment shall constitute presence at such meeting. Meetings may be held with outside auditors, with internal auditors and with such other employees of the Corporation in attendance as the Audit Committee shall desire. Notice of the time and place of each meeting of the Audit Committee shall be given to each member by personal delivery, or by mail, telegram, cablegram or telephone, at least two days before the meeting, which notice need not specify the purposes of the meeting. Notices of adjournment of the meeting of the Audit Committee need not be given if the time and place to which they are given are fixed and announced at such meeting.

Quorum

A majority of the members of the Audit Committee shall constitute a quorum for any meeting. Any action of a majority of the members of the Audit Committee present at any meeting at which a quorum is present shall be the action of the Audit Committee. The Audit Committee may act without a meeting by writing or writings signed by all of its members.

Minutes

The minutes of each meeting of the Audit Committee shall be sent to the Directors prior to the next succeeding meeting of the Board of Directors.

A-2

Proxy card must be signed and dated on the reverse side.

ê Please fold and detach card at perforation before mailing ê

This proxy is solicited on behalf of the Board of Directors for the Annual Meeting of Shareholders on October 24, 2001.

The undersigned hereby appoints DUANE E. COLLINS, DONALD E. WASHKEWICZ and THOMAS A. PIRAINO, JR., and any of them, as proxies to represent and to vote all shares of stock of Parker-Hannifin Corporation which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Corporation to be held on October 24, 2001, and at any adjournment(s) thereof, on the proposals more fully described in the Proxy Statement for the Meeting in the manner specified herein and on any other business that may properly come before the Meeting.

1. Election of Directors in the class whose three-year term of office will expire in 2004.

[_] FOR all nominees listed below [_] WITHHOLD

AUTHORITY

(except as otherwise marked below) to vote for all nominees listed below

John G. Breen, Hector R. Ortino, Dennis W. Sullivan and Donald E. Washkewicz

(Instructions: to withhold authority to vote for any individual nominee, strike a line through that nominee’s name.)

2. Appointment of PricewaterhouseCoopers LLP as independent certified public accountants for FY02.

| [_] | FOR | [_] | AGAINST | [_] | ABSTAIN | |||||||

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ITEMS 1 AND 2.

Vote by Telephone

Have this proxy card available when you call the Toll-Free number 1-800-250-9081 using a Touch-Tone phone. You will be prompted to enter your control number and then you can follow the simple prompts that will be presented to you to record your vote.

Vote by Internet

Have this proxy card available when you access the website http://www.votefast.com. You will be prompted to enter your control number and then you can follow the simple prompts that will be presented to you to record your vote.

Vote by Mail

Please mark, sign and date this proxy card and return it in the postage paid envelope provided or return it to: Stock Transfer Dept. (PH), National City Bank, P.O. Box 92301, Cleveland, OH 44197-1200.

If voting by telephone or internet, please do not send this proxy card by mail.

| Vote by Telephone

Call Toll-Free using a Touch-tone phone 1-800-250-9081 |

Vote by Internet

Access the Website and cast your vote http://www.votefast.com |

Vote by Mail

Return this proxy card in the postage-paid envelope provided |

Vote 24 hours a day, 7 days a week!

Your telephone or internet vote must be received by 11:59 p.m. Eastern Daylight Time on

October 23, 2001 to be counted in the final tabulation.

Your Control Number is:

Proxy card must be signed and dated below.

ê Please fold and detach card at perforation before mailing ê

| PARKER-HANNIFIN CORPORATION | PROXY

|

| |

|

YOU ARE ENCOURAGED TO SPECIFY YOUR CHOICE BY MARKING THE APPROPRIATE BOXES (SEE REVERSE SIDE) BUT YOU NEED NOT MARK ANY BOXES IF YOU WISH TO VOTE IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS. THE PROXIES CANNOT VOTE YOUR SHARES UNLESS YOU SIGN AND RETURN THIS CARD.

Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing on behalf of a corporation or as a fiduciary, attorney, executor, administrator, trustee or guardian, please give full title as such.

________________________________________

Signature

________________________________________

Signature

Date:

_______________________________, 2001