UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PARKER-HANNIFIN CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRELIMINARY COPY

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard – Cleveland, Ohio 44124-4141

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OCTOBER 24, 2007

TO OUR SHAREHOLDERS:

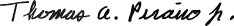

You are cordially invited to attend the annual meeting of the shareholders of Parker-Hannifin Corporation. The meeting will be held at our headquarters located at 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, on Wednesday, October 24, 2007, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect three Directors in the class whose three-year term of office will expire in 2010; |

| 2. | To consider and vote upon a management proposal to declassify our Board of Directors; |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2008; and |

| 4. | To transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on August 31, 2007 are entitled to vote at the meeting. Your vote is important, so if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the enclosed proxy card.

Thank you for your support of Parker-Hannifin Corporation.

By Order of the Board of Directors

Thomas A. Piraino, Jr.

Secretary

September 24, 2007

PRELIMINARY COPY

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard - Cleveland, Ohio 44124-4141

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting of Shareholders scheduled to be held on October 24, 2007, and at all adjournments thereof. Only shareholders of record at the close of business on August 31, 2007 will be entitled to vote at the meeting. On August 31, 2007, Common Shares were outstanding and entitled to vote at the meeting. Each share is entitled to one vote. Definitive copies of this Proxy Statement and the form of proxy are intended to be released and sent to shareholders on or about September 24, 2007.

Our shareholders have cumulative voting rights in the election of Directors if any shareholder gives notice in writing to our President, a Vice President or the Secretary not less than 48 hours before the time fixed for holding the meeting that cumulative voting at such election is desired. The fact that such notice has been given must be announced upon the convening of the meeting by the Chairman, the Secretary or by or on behalf of the shareholder giving such notice. In such event, each shareholder has the right to cumulate votes and give one nominee the number of votes equal to the number of Directors to be elected multiplied by the number of votes to which the shareholder is entitled, or to distribute votes on the same principle among two or more nominees, as the shareholder sees fit. If voting at the election is cumulative, the persons named in the proxy will vote Common Shares represented by valid Board of Directors’ proxies on a cumulative basis for the election of the nominees named below, allocating the votes of such Common Shares in accordance with their judgment.

ELECTION OF DIRECTORS

The Directors of the class elected at each Annual Meeting of Shareholders hold office for terms of three years. The Board of Directors presently consists of 10 members divided into three classes. The class whose term expires in 2007 presently consists of three members, the class whose term expires in 2008 presently consists of three members and the class whose term expires in 2009 presently consists of four members. As permitted under our Code of Regulations, Linda S. Harty was elected to the Board of Directors in January 2007 to a term expiring in October 2007. Nickolas W. Vande Steeg, a Director since 2004 and a member of the class whose term expires in October 2007, elected to retire as of December 31, 2006. None of our Directors are related to each other.

Shareholder approval is sought to elect Linda S. Harty, Candy M. Obourn and Donald E. Washkewicz, Directors whose terms of office expire in 2007, to the class whose three-year term of office will expire in 2010. The number of Directors in the class whose term expires in 2010 has been fixed by the Directors at three. A plurality of the Common Shares voted in person or by proxy is required to elect a Director.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of another person for Director as the Board of Directors may recommend. However, the Board of Directors has no reason to believe that this contingency will occur.

1

NOMINEES FOR ELECTION AS DIRECTORS FOR TERMS EXPIRING IN 2010

|

LINDA S. HARTY, 46, was elected to the Board of Directors in January 2007. She is a member of the Audit Committee and the Finance Committee. Ms. Harty has been an Executive Vice President – Finance and Chief Financial Officer – Healthcare Supply Chain Services of Cardinal Health, Inc. (healthcare products and services) since March 2007. She was previously Executive Vice President of Cardinal Health from August 2006 to March 2007; Treasurer of Cardinal Health from January 2005 to March 2007; Senior Vice President of Cardinal Health from January 2005 to August 2006; Senior Vice President and Chief Financial Officer of RTM Restaurant Group (restaurant franchisee group) from July 2003 to January 2005; and Senior Vice President and Treasurer of BellSouth Corporation (communication services) from August 2000 to June 2003. | |

|

CANDY M. OBOURN, 57, has served as a Director since 2002. She is a member of the Corporate Governance and Nominating Committee and the Human Resources and Compensation Committee. Ms. Obourn has been Chief Executive Officer and President of Active Healthcare (women’s health care products) since February 2006. She was previously General Manager, Film Capture, Digital & Film Imaging Systems of Eastman Kodak Company (photography and digital imaging) from November 2004 to February 2006; Senior Vice President of Eastman Kodak from January 2000 to February 2006; and Chief Operating Officer, Health Imaging Division of Eastman Kodak from January 2002 to November 2004. | |

|

DONALD E. WASHKEWICZ, 57, has served as a Director since 2000. Mr. Washkewicz has been our Chairman of the Board of Directors since October 2004; our Chief Executive Officer since July 2001; and our President since January 2007. He was previously our President from February 2000 to October 2004. | |

2

PRESENT DIRECTORS WHOSE TERMS EXPIRE IN 2008

|

WILLIAM E. KASSLING, 63, has served as a Director since 2001. He is Chairman of the Corporate Governance and Nominating Committee and a member of the Audit Committee. Mr. Kassling has been Chairman of the Board of Wabtec Corporation (technology-based equipment for the rail industry) since 1990. He was previously Chief Executive Officer of Wabtec from May 2004 to February 2006 and President of Wabtec from May 2004 to February 2006. | |

|

JOSEPH M. SCAMINACE, 54, was elected to the Board of Directors in October 2004. He is a member of the Corporate Governance and Nominating Committee and the Human Resources and Compensation Committee. Mr. Scaminace has been a Director, the Chief Executive Officer and President of OM Group, Inc. (metal-based specialty chemicals) since June 2005. He was previously the President and Chief Operating Officer of The Sherwin Williams Company (paints and coatings) from October 1999 to May 2005. Mr. Scaminace is also a Director of The Boler Company. | |

|

WOLFGANG R. SCHMITT, 63, has served as a Director since 1992. He is Chairman of the Human Resources and Compensation Committee and a member of the Audit Committee. Mr. Schmitt has been the Chief Executive Officer of Trends 2 Innovation (strategic growth consultants) since May 2000. | |

3

PRESENT DIRECTORS WHOSE TERMS EXPIRE IN 2009

|

ROBERT J. KOHLHEPP, 63, has served as a Director since July 2002. He is Chairman of the Audit Committee and a member of the Finance Committee. Mr. Kohlhepp has been Vice Chairman of Cintas Corporation (uniform rental) since July 2003 and has been a Director of Cintas since 1979. He was the Chief Executive Officer of Cintas from August 1995 to July 2003. Mr. Kohlhepp is also a director of Eagle Hospitality Properties Trust, Inc. | |

|

GIULIO MAZZALUPI, 66, has served as a Director since 1999. He is a member of the Audit Committee and the Finance Committee. Now retired, Mr. Mazzalupi was the President, Chief Executive Officer and a Director of Atlas Copco AB (industrial manufacturing) in Sweden until July 2002. | |

|

KLAUS-PETER MÜLLER, 63, has served as a Director since 1998. He is Chairman of the Finance Committee and a member of the Corporate Governance and Nominating Committee. Mr. Müller has been Chairman of the Board of Managing Directors of Commerzbank AG (international banking) in Frankfurt, Germany since May 2001 and a member of the Board of Managing Directors of Commerzbank since 1990. In March 2005, Mr. Müller was named President of the Association of German Banks, Berlin, Germany. | |

|

MARKOS I. TAMBAKERAS, 57, has served as a Director since April 2005. He is a member of the Human Resources and Compensation Committee and the Finance Committee. Now retired, Mr. Tambakeras was the Chairman of the Board of Kennametal Inc. (global tooling solutions supplier) from July 2002 to December 2006. He was previously President and Chief Executive Officer of Kennametal from July 1999 to December 2005. He is also a Director of ITT Industries, Inc. | |

The Board of Directors unanimously recommends a vote FOR each of the nominees to the Board of Directors.

Director Independence. In making a determination as to the independence of our Directors for purposes of considering membership on our Board of Directors and Committees, we have followed the rules of the New York Stock Exchange and have broadly considered our Independence Standards for Directors and the materiality of each Director’s relationship with us. Based upon the foregoing criteria, the Board of Directors has determined that the following persons who served as Directors during any part of fiscal year 2007 are independent: Linda S. Harty, William E. Kassling, Robert J. Kohlhepp, Peter W. Likins, Giulio Mazzalupi, Klaus-Peter Müller, Candy M. Obourn, Joseph M. Scaminace, Wolfgang R. Schmitt and Markos I. Tambakeras.

Board Meetings. During the fiscal year ended June 30, 2007, there were seven meetings of our Board of Directors. Each Director attended at least 75% of the meetings held by the Board of Directors and the Committees of the Board of Directors on which he or she served.

Attendance at Annual Meeting. We hold a regularly scheduled meeting of our Board of Directors in conjunction with our Annual Meeting of Shareholders. Directors are expected to attend the Annual Meeting of Shareholders absent an appropriate reason. All of the members of the Board of Directors attended our 2007 Annual Meeting of Shareholders, except for Linda Harty who was not a Director at the time.

4

Audit Committee Financial Experts. We have a standing audit committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934. Our Board of Directors has determined that Robert J. Kohlhepp, the Chairman of the Audit Committee, and Linda S. Harty, a member of the Audit Committee, are audit committee financial experts as defined in the federal securities laws. Mr. Kohlhepp and Ms. Harty are independent as defined for audit committee members in the listing standards of the New York Stock Exchange.

The Audit Committee, which met nine times during the fiscal year ended June 30, 2007, is responsible for, among other things, appointing, determining the compensation of and overseeing the work of the independent registered public accounting firm and ensuring its independence, approving all non-audit engagements with the independent registered public accounting firm and reviewing with our financial management and our independent registered public accounting firm annual and quarterly financial statements, the proposed internal audit plan for each calendar year, the proposed independent audit plan for each fiscal year, the results of the audits and the adequacy of our internal control structure.

The Human Resources and Compensation Committee. We have a standing compensation committee. The Human Resources and Compensation Committee, which met five times during the fiscal year ended June 30, 2007, is responsible for, among other things, annually reviewing and approving the salaries and other compensation (including stock incentives) of our executive officers, reviewing and determining the compensation of our non-employee Directors, engaging and determining the fees of compensation consultants, overseeing regulatory compliance with respect to compensation matters, reviewing management succession of key executives, and reviewing corporate policies and programs for the development of management personnel.

The Finance Committee, which met twice during the fiscal year ended June 30, 2007, is responsible for, among other things, reviewing our capital structure and tax and risk management strategies and reviewing and approving our debt and equity offerings, share repurchase programs and the funding and investment policies for defined benefit plans, defined contribution plans and non-qualified plans sponsored by us.

The Corporate Governance and Nominating Committee. We have a standing nominating committee. The Corporate Governance and Nominating Committee, which met twice during the fiscal year ended June 30, 2007, is responsible for, among other things, evaluating and recommending to the Board of Directors qualified nominees for election as Directors and qualified Directors for committee membership, establishing evaluation procedures and completing an annual evaluation of the performance of the Board of Directors, developing and recommending corporate governance principles to the Board of Directors and considering other matters pertaining to the size and composition of the Board of Directors. The Corporate Governance and Nominating Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as our Directors, provided that such recommendations comply with the procedures set forth under the caption “Procedures for Submission and Consideration of Director Candidates” in this Proxy Statement.

The Board of Directors adopted a written charter for each of the committees of the Board of Directors. These charters, as well as our Code of Ethics, Guidelines on Corporate Governance Issues and Independence Standards for Directors, are posted and available under the Corporate Governance page on our investor relations internet website at www.phstock.com. Shareholders may request copies of these corporate governance documents, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000.

Executive Sessions. In accordance with the listing standards of the New York Stock Exchange, the non-management Directors are scheduled to meet regularly in executive sessions without management, and if required, the independent Directors will meet at least once annually. Additional meetings of the non-management Directors may be scheduled from time to time when the non-management Directors decide such meetings are desirable. The Chairman of the Corporate Governance and Nominating Committee will preside at such meetings. The Corporate Governance and Nominating Committee Charter provides that the Chairman of the Corporate Governance and Nominating Committee has a term limit of three years. The non-management Directors met four times during the fiscal year ended June 30, 2007.

Review and Approval of Transactions with Related Persons. The Corporate Governance and Nominating Committee charter provides that the Corporate Governance and Nominating Committee is responsible for considering questions of possible conflicts of interest of Board members and management and for making recommendations to prevent, minimize or eliminate such conflicts of interest. Our Code of Ethics provides that our

5

directors, officers, employees, and their spouses and other close family members, must avoid interests or activities that create any actual or potential conflict of interest. These restrictions cover, among other things, interests or activities that result in receipt of improper personal benefits by any person as a result of his or her position as our director, officer, employee, or as a spouse or other close family member of any of our directors, officers or employees. The Code of Ethics also requires our directors, officers and employees to promptly disclose any potential conflicts of interest to our General Counsel. We also require that each of our executive officers and directors complete a detailed annual questionnaire which requires, among other things, disclosure of any transactions with a related person meeting the minimum threshold for disclosure under the relevant Securities and Exchange Commission (“SEC”) rules. All responses to the annual questionnaires are reviewed and analyzed by our legal counsel and, if necessary or appropriate, presented to the Corporate Governance and Nominating Committee for analysis, consideration and, if appropriate, approval.

Certain Relationships and Related Transactions. Russell G. Chester, Vice President-Enterprise Compliance, is the spouse of Pamela J. Huggins, our Vice President and Treasurer. Mr. Chester’s salary and bonus for the fiscal year ended June 30, 2007 was $311,108. We have taken the necessary steps to ensure the avoidance of any conflicting interests resulting from this relationship.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, Directors and beneficial owners of more than 10% of our Common Shares to file initial stock ownership reports and reports of changes in ownership with the SEC and the New York Stock Exchange. SEC regulations require that we are furnished with copies of these reports. Based solely on a review of these reports and written representations from the executive officers and Directors, we believe that there was compliance with all such filing requirements for the fiscal year ended June 30, 2007, except that John K. Oelslager, a Vice President and President of the Filtration Group, inadvertently filed one late Form 4 to report the movement of shares to his wife’s trust in 2005 and Joseph M. Scaminace, a Director, inadvertently filed one late Form 4 to report a purchase of shares.

6

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is composed of five Directors, each of whom is independent in compliance with the independence standards applicable to audit committee members in the listing standards of the New York Stock Exchange. The responsibilities of the Audit Committee are set forth in the written Audit Committee Charter, a copy of which is available on the Corporate Governance page of Parker-Hannifin’s investor relations website at www.phstock.com.

In fulfilling its responsibilities, the Audit Committee has reviewed and discussed Parker-Hannifin’s audited consolidated financial statements for the fiscal year ended June 30, 2007 with management and with PricewaterhouseCoopers LLP (“PwC”), Parker-Hannifin’s independent registered public accounting firm for the fiscal year ended June 30, 2007.

The Audit Committee has discussed with PwC the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. In addition, the Audit Committee has received and reviewed the written disclosures and the letter from PwC required by Independence Standards Board Standard No. 1, (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, and has discussed with PwC their objectivity and independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that Parker-Hannifin’s audited consolidated financial statements for the fiscal year ended June 30, 2007 be included in its Annual Report on Form 10-K for the fiscal year ended June 30, 2007 filed with the Securities and Exchange Commission.

Audit Committee:

Robert J. Kohlhepp, Chairman

Linda S. Harty

William E. Kassling

Giulio Mazzalupi

Wolfgang R. Schmitt

7

COMPENSATION DISCUSSION AND ANALYSIS

[To be included in the Definitive Proxy Statement]

8

COMPENSATION COMMITTEE REPORT

[To be included in the Definitive Proxy Statement]

9

COMPENSATION TABLES

[To be included in the Definitive Proxy Statement]

10

MANAGEMENT PROPOSAL TO DECLASSIFY THE BOARD OF DIRECTORS

The Board of Directors recommends a vote FOR the proposal to amend Article II of our Code of Regulations to provide for the annual election of Directors. Currently, the Board of Directors is divided into three classes, with Directors elected to staggered three-year terms. Approximately one-third of the Directors stand for election each year. If the proposed amendments to the Code of Regulations are approved, Directors will be elected to one-year terms of office starting at the 2008 Annual Meeting of Shareholders. To ensure a smooth transition to the new board structure, Directors currently serving terms that expire at the 2009 and 2010 Annual Meetings of Shareholders will serve the remainder of their respective terms, and thereafter their successors will be elected to one-year terms. From and after the 2010 Annual Meeting of Shareholders, all Directors would stand for election annually.

The Corporate Governance and Nominating Committee and the Board of Directors, with the assistance of outside advisors, carefully considered the advantages and disadvantages of maintaining the classified board structure in light of our current circumstances. The Committee and the Board considered that the overlapping three-year terms of Directors are designed to provide stability, enhance long-term planning and ensure that, at any given time, there are Directors serving on the Board who are familiar with us and our business and strategic goals. Staggered terms also give new Directors an opportunity to gain knowledge about our business and strategies from experienced Directors and may assist us in attracting Director candidates interested in making a long-term commitment to us and our shareholders. A classified board structure arguably also enhances the independence of the non-management members of the Board and may increase the Board’s leverage to negotiate the terms of a proposed takeover or restructuring in a way that maximizes value for our shareholders.

The Corporate Governance and Nominating Committee and the Board of Directors also considered the views of our shareholders regarding the classified Board structure, including the support of the holders of a majority of our outstanding Common Shares for the shareholder proposals to declassify the Board presented at the 2005 and 2006 Annual Meetings of Shareholders. The Committee and Board also considered that some shareholders believe that a classified board structure reduces director accountability to shareholders and diminishes shareholder influence over a company’s policies. Finally, the Committee and Board considered that many U.S. public companies have eliminated their classified board structures in recent years in favor of annual director elections.

After weighing all of these considerations, the Corporate Governance and Nominating Committee recommended to the Board of Directors the elimination of our classified Board. The Board of Directors has approved the proposed amendments to our Code of Regulations, a copy of which are attached to this proxy statement as Appendix A, and recommends that the shareholders adopt the amendments by voting in favor of this proposal.

Under the Code of Regulations, this proposal must be approved by the holders of shares entitling them to exercise a majority of Parker-Hannifin’s voting power on the proposal. Accordingly, this proposal will be approved, and the proposed amendments to the Code of Regulations adopted, upon the affirmative vote of the holders of a majority of our outstanding Common Shares.

The Board of Directors unanimously recommends a vote FOR the management proposal to declassify the Board of Directors by amending our Code of Regulations.

11

RATIFICATION OF THE

APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors recommends ratification of its appointment of Deloitte & Touche LLP (“D&T”) as the independent registered public accounting firm to audit our financial statements as of and for the fiscal year ending June 30, 2008. PricewaterhouseCoopers LLP (“PwC”) served as the independent registered public accounting firm to audit our financial statements as of and for the fiscal year ended June 30, 2007.

On April 17, 2007, the Audit Committee approved the appointment of D&T as our independent registered public accounting firm for the fiscal year ending June 30, 2008. D&T formally accepted its engagement on June 28, 2007. During the fiscal years ended June 30, 2006 and June 30, 2005 and the interim period from July 1, 2006 through June 28, 2007, neither we nor anyone on our behalf consulted with D&T regarding: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, and neither a written report was provided to us nor oral advice was provided that D&T concluded was an important factor considered by us in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

On April 17, 2007, the Audit Committee dismissed PwC as our independent registered public accounting firm effective upon completion of its services related to the audit of our consolidated financial statements for the fiscal year ended June 30, 2007. The audit of our consolidated financial statements for the fiscal year ended June 30, 2007 has been completed and we filed our Annual Report on Form 10-K for the fiscal year ended June 30, 2007 on August 29, 2007, which contained PwC’s report on the audit. As a result, our audit relationship with PwC terminated August 29, 2007.

The reports of PwC on our consolidated financial statements for the fiscal years ended June 30, 2007 and June 30, 2006 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended June 30, 2007 and June 30, 2006 and the interim period from July 1, 2006 through August 29, 2007, there were no disagreements (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of the disagreements in connection with its reports on the consolidated financial statements for such years. In addition, during the fiscal years ended June 30, 2007 and June 30, 2006 and the interim period from July 1, 2006 through August 29, 2007, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K). We have provided each of PwC and D&T with a copy of the foregoing disclosures and have given each of them the opportunity to provide a statement to be included in this Proxy Statement if either firm believes the foregoing disclosures are incorrect or incomplete. Neither PwC nor D&T has expressed any disagreement with the foregoing disclosures.

Representatives of D&T and PwC are expected to be present at the Annual Meeting of Shareholders and available to respond to appropriate questions, and will have an opportunity to make a statement if they desire to do so. Ratification of the appointment of D&T as the independent registered public accounting firm for the fiscal year ending June 30, 2008 requires the affirmative vote of the holders of at least a majority of the votes present or represented, and entitled to vote on the proposal, at the Annual Meeting of Shareholders.

Audit Fees. The aggregate fees billed by PwC for the fiscal years ended June 30, 2007 and June 30, 2006 for auditing our annual consolidated financial statements, reviewing our interim financial statements included in our Forms 10-Q filed with the Securities and Exchange Commission and services normally provided in connection with statutory and regulatory filings or engagements were $6.53 million and $7.07 million, respectively.

Audit-Related Fees. The aggregate fees billed by PwC for assurance and related services provided to us for the fiscal years ended June 30, 2007 and June 30, 2006 that are reasonably related to the performance of the audit or review of our financial statements and are not included in “Audit Fees” above were $221,434 and $423,127, respectively. The fees billed related primarily to audit procedures required to respond to or comply with financial, accounting or regulatory reporting matters and internal control reviews and reporting requirements.

12

Tax Fees. The aggregate fees billed by PwC for professional services rendered for tax compliance, tax advice and tax planning services provided to us for the fiscal years ended June 30, 2007 and June 30, 2006 were $2.46 million and $2.39 million, respectively. The fees billed related primarily to federal, state, local and international tax planning, advice and compliance, and tax due diligence related to acquisitions and divestitures.

All Other Fees. PwC did not bill any fees for products and services provided to us that are not included in the above categories for the fiscal years ended June 30, 2007 and June 30, 2006.

Audit Committee Pre-Approval Policies and Procedures. In accordance with the Securities and Exchange Commission’s rules issued pursuant to the Sarbanes Oxley Act of 2002, which require, among other things, that the Audit Committee pre-approve all audit and non-audit services provided by our independent registered public accounting firm, the Audit Committee has adopted a formal policy on Auditor Independence requiring the approval by the Audit Committee of all professional services rendered by our independent registered public accounting firm. The policy specifically pre-approves certain services up to a budgeted amount to be determined annually by the Audit Committee. All other services require Audit Committee approval on a case-by-case basis.

All of the services described in “Audit-Related Fees” and “Tax Fees” were approved by the Audit Committee in accordance with our formal policy on Auditor Independence.

The Board of Directors unanimously recommends a vote FOR the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2008.

13

PRINCIPAL SHAREHOLDERS

The following table sets forth, as of August 31, 2007 except as otherwise indicated, the name and address of each person believed to be a beneficial owner of more than 5% of our Common Shares, the number of shares and the percentage so owned, as well as the beneficial ownership of our Common Shares by the Directors, the Named Executive Officers and all Directors and executive officers as a group:

| Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership (a) |

Percentage Class(b) |

||||

| Wellington Management Company, LLP 75 State Street Boston, MA 02109 |

6,828,463 | (c) | % | |||

| Capital Research and Management Company 333 South Hope Street Los Angeles, CA 90071 |

6,930,400 | (d) | % | |||

| D. E. Collins |

(e) | |||||

| L. S. Harty |

(f) | |||||

| W. E. Kassling |

(g) | |||||

| R. J. Kohlhepp |

(h) | |||||

| P. W. Likins |

(i) | |||||

| G. Mazzalupi |

(j) | |||||

| K. P. Müller |

(k) | |||||

| C. M. Obourn |

(h) | |||||

| J. M. Scaminace |

(l) | |||||

| W. R. Schmitt |

(m) | |||||

| M. I. Tambakeras |

(l) | |||||

| D. E. Washkewicz |

(n) | |||||

| N. W. Vande Steeg |

(o) | |||||

| J. D. Myslenski |

(p) | |||||

| T. K. Pistell |

(q) | |||||

| R. P. Barker |

(r) | |||||

| L. C. Banks |

(s) | |||||

| All Directors and

executive (36 persons) |

(t) | % |

| (a) | Unless otherwise indicated, the beneficial owner has sole voting and investment power. |

| (b) | No Director or executive officer beneficially owned more than 1% of our Common Shares as of August 31, 2007. |

| (c) | Pursuant to a statement filed by Wellington Management Company, LLP with the SEC in accordance with Rule 13d-1(b) of the Securities Exchange Act of 1934, Wellington Management Company, LLP has reported that, as of December 30, 2006, it had shared voting power over 2,314,610 Common Shares and shared investment power over 6,820,663 Common Shares. |

| (d) | Pursuant to a statement filed by Capital Research and Management Company with the SEC in accordance with Rule 13d-1(b) of the Securities Exchange Act of 1934, Capital Research and Management Company has reported that, as of December 30, 2006, it had sole voting power over 840,000 Common Shares and sole investment power over 6,930,400 Common Shares. |

| (e) | This amount includes Common Shares owned solely by Mr. Collins’ spouse and Common Shares subject to options exercisable on or prior to October 30, 2007 granted under our 1993 Stock Incentive Program. |

| (f) | This amount includes . |

| (g) | This amount includes Common Shares owned jointly by Mr. Kassling and his spouse and Common Shares subject to options exercisable on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

14

| (h) | These amounts include Common Shares subject to options exercisable by each of Mr. Kohlhepp and Ms. Obourn on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (i) | This amount includes Common Shares owned jointly by Dr. Likins and his spouse as co-trustees of a revocable family trust and Common Shares subject to options exercisable on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (j) | This amount includes Common Shares subject to options exercisable by Mr. Mazzalupi on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (k) | This amount includes Common Shares subject to options exercisable by Mr. Müller on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (l) | These amounts include Common Shares subject to options exercisable by each of Messrs. Scaminace and Tambakeras on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (m) | This amount includes Common Shares owned by Mr. Schmitt’s son and Common Shares subject to options exercisable on or prior to October 30, 2007 granted under our Non-Employee Directors stock option plans. |

| (n) | This amount includes Common Shares which represents Mr. Washkewicz’s proportionate interest in his mother’s revocable trust, shares owned indirectly by Mr. Washkewicz through the Pamela Washkewicz Revocable Trust, Common Shares as to which Mr. Washkewicz holds voting power pursuant to the Retirement Savings Plan as of June 30, 2007, and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans. Mr. Washkewicz has disclaimed beneficial ownership of shares owned by his children. |

| (o) | This amount includes Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted to Mr. Vande Steeg under our stock option plans. |

| (p) | This amount includes Common Shares as to which Mr. Myslenski holds voting power pursuant to the Retirement Savings Plan as of June 30, 2007 and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans. |

| (q) | This amount includes Common Shares as to which Mr. Pistell holds voting power pursuant to the Retirement Savings Plan as of June 30, 2007 and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans. |

| (r) | This amount includes Common Shares owned jointly by Mr. Barker and his spouse as co-trustees of a family trust, Common Shares as to which Mr. Barker holds voting power pursuant to the Retirement Savings Plan as of June 30, 2007 and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans. |

| (s) | This amount includes Common Shares as to which Mr. Banks holds voting power pursuant to the Retirement Savings Plan as of June 30, 2007 and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans. |

| (t) | This amount includes Common Shares for which voting and investment power are shared, Common Shares as to which all executive officers as a group hold voting power pursuant to the Retirement Savings Plan as of June 30, 2007, and Common Shares subject to options or options with tandem stock appreciation rights exercisable on or prior to October 30, 2007 granted under our stock option plans held by all Directors and executive officers as a group. |

SHAREHOLDERS’ PROPOSALS

We must receive at our principal executive offices by May 27, 2008 any proposal of a shareholder intended to be presented at our 2008 Annual Meeting of Shareholders (the “2008 Meeting”) and to be included in our proxy, notice of meeting and proxy statement related to the 2008 Meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934. Such proposals should be submitted to us by certified mail, return receipt requested. Proposals of shareholders submitted outside the processes of Rule 14a-8 under the Securities Exchange Act of 1934 (“Non-Rule 14a-8 Proposals”) in connection with the 2008 Meeting must be received by us by August 10, 2008 or such proposals will be considered untimely under Rule 14a-4(c) of the Securities

15

Exchange Act of 1934. Our proxy related to the 2008 Meeting will give discretionary authority to the proxy holders to vote with respect to all Non-Rule 14a-8 Proposals received by us after August 10, 2008. Our proxy related to the 2007 Annual Meeting of Shareholders gives discretionary authority to the proxy holders to vote with respect to all Non-Rule 14a-8 Proposals received by us after August 11, 2007.

Procedures for Submission and Consideration of Director Candidates. The Corporate Governance and Nominating Committee will consider shareholder recommendations for nominees for election to our Board of Directors if such recommendations are in writing and set forth the information listed below. Such recommendations must be submitted to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, and must be received at our executive offices on or before June 30 of each year in anticipation of the following year’s Annual Meeting of Shareholders. All shareholder recommendations for Director nominees must set forth the following information:

| 1. | The name and address of the shareholder recommending the candidate for consideration as such information appears on our records, the telephone number where such shareholder can be reached during normal business hours, the number of Common Shares owned by such shareholder and the length of time such shares have been owned by the shareholder; if such person is not a shareholder of record or if such shares are owned by an entity, reasonable evidence of such person’s beneficial ownership of such shares or such person’s authority to act on behalf of such entity; |

| 2. | Complete information as to the identity and qualifications of the proposed nominee, including the full legal name, age, business and residence addresses and telephone numbers and other contact information, and the principal occupation and employment of the candidate recommended for consideration, including his or her occupation for at least the past five years, with a reasonably detailed description of the background, education, professional affiliations and business and other relevant experience (including directorships, employment and civic activities) and qualifications of the candidate; |

| 3. | The reasons why, in the opinion of the recommending shareholder, the proposed nominee is qualified and suited to be a Director; |

| 4. | The disclosure of any relationship of the candidate being recommended with us or any of our subsidiaries or affiliates, whether direct or indirect; |

| 5. | A description of all relationships, arrangements and understandings between the proposing shareholder and the candidate and any other person(s) (naming such person(s)) pursuant to which the candidate is being proposed or would serve as a Director, if elected; and |

| 6. | A written acknowledgement by the candidate being recommended that he or she has consented to being considered as a candidate, has consented to our undertaking of an investigation into that individual’s background, education, experience and other qualifications in the event that the Corporate Governance and Nominating Committee desires to do so, has consented to be named in our proxy statement and has consented to serve as a Director, if elected. |

There are no specific qualifications or specific qualities or skills that are necessary for our Directors to possess. In evaluating Director nominees, the Corporate Governance and Nominating Committee (or a successor committee) will consider such factors as it deems appropriate, and other factors identified from time to time by the Board of Directors. The Corporate Governance and Nominating Committee will consider the entirety of each proposed Director nominee’s credentials. As a general matter, the Committee will consider factors such as judgment, skill, integrity, independence, possible conflicts of interest, experience with businesses and other organizations of comparable size or character, the interplay of the candidate’s experience and approach to addressing business issues with the experience and approach of incumbent members of the Board of Directors and other new Director candidates. The Corporate Governance and Nominating Committee’s goal in selecting Directors for nomination to the Board of Directors is generally to seek a well-balanced membership that combines a variety of experience, skill and intellect in order to enable us to pursue our strategic objectives.

The Corporate Governance and Nominating Committee will consider all information provided to it that is relevant to a candidate’s nomination as a Director. Following such consideration, the Committee may seek additional information regarding, and may request an interview with, any candidate who it wishes to continue to consider. Based upon all information available to it and any interviews it may have conducted, the Committee will meet to determine whether to recommend the candidate to the Board of Directors. The Committee will consider candidates recommended by shareholders on the same basis as candidates from other sources.

16

The Corporate Governance and Nominating Committee utilizes a variety of methods for identifying and evaluating nominees for Directors. The Committee regularly reviews the appropriate size of the Board of Directors and whether any vacancies on the Board of Directors are expected due to retirement or otherwise. In the event vacancies are anticipated, or otherwise arise, the Committee will consider various potential candidates. Candidates may be recommended by current members of the Board of Directors, third-party search firms or shareholders. During the past fiscal year, the Corporate Governance and Nominating Committee retained Howard & O’Brien Associates, Inc. as a search firm to assist in locating, interviewing, and evaluating potential Board candidates. The Corporate Governance and Nominating Committee generally does not consider recommendations for Director nominees submitted by individuals who are not affiliated with us. In order to preserve its impartiality, the Corporate Governance and Nominating Committee may not consider a recommendation that is not submitted in accordance with the procedures set forth above.

Communications with Directors. Our security holders and other interested parties may communicate with the Board of Directors as a group, with the non-management Directors as a group, or with any individual Director by sending written communications to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary. Complaints regarding accounting, internal accounting controls or auditing matters will be forwarded directly to the Chairman of the Audit Committee. All other communications will be provided to the individual Director(s) or group of Directors to whom they are addressed. Copies of all communications will be provided to all other Directors; provided, however, that any such communications that are considered to be improper for submission to the intended recipients will not be provided to the Directors. Examples of communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate, directly or indirectly, to our business and/or our subsidiaries, or communications that relate to improper or irrelevant topics.

17

GENERAL

The Board of Directors knows of no other matters which will be presented at the meeting. However, if any other matters properly come before the meeting or any adjournment, the person or persons voting the proxies will vote in accordance with their best judgment on such matters.

We will bear the expense of preparing, printing and mailing this Proxy Statement. In addition to solicitation by mail, our officers and employees may solicit the return of proxies. We will request banks, brokers and other custodians, nominees and fiduciaries to send proxy material to beneficial owners of Common Shares. We will, upon request, reimburse them for their expenses in so doing. We have retained Georgeson Inc., 17 State Street, New York, New York, to assist in the solicitation of proxies at an anticipated cost of $14,000, plus disbursements.

You are urged to vote your proxy promptly by internet, telephone or mail by following the instructions on the enclosed proxy card in order to make certain your shares will be voted at the meeting. Common Shares represented by properly voted proxies will be voted in accordance with any specification made thereon and, if no specification is made, will be voted in favor of the election of the three nominees for Directors in the class whose three-year term of office will expire in 2010; in favor of the management proposal to declassify our Board of Directors; and in favor of the ratification of the appointment of Deloitte & Touche LLP as independent registered public accounting firm for the fiscal year ending June 30, 2008. Abstentions and broker non-votes are counted in determining the votes present at a meeting. Consequently, an abstention or a broker non-vote has the same effect as a vote against a proposal which requires the affirmative vote of a certain number of Common Shares, as each abstention or broker non-vote would be one less vote in favor of a proposal. You may revoke your proxy at any time prior to the close of voting at the Annual Meeting of Shareholders by giving us notice in writing, in open meeting, or by internet or telephone as set forth on the proxy card, without affecting any vote previously taken. However, your mere presence at the meeting will not operate to revoke your proxy.

Our Annual Report, including financial statements for the fiscal year ended June 30, 2007, is being mailed to shareholders with this Proxy Statement. If a single copy of the Annual Report and Proxy Statement was delivered to an address that you share with another shareholder, you may request a separate copy by notifying us in writing or by telephone at: Parker-Hannifin Corporation, Corporate Communications, 6035 Parkland Boulevard, Cleveland, Ohio 44124, (216) 896-3000.

You can elect to view future Parker-Hannifin Corporation Annual Reports and Proxy Statements over the internet, instead of receiving paper copies in the mail. Providing these documents over the internet will save us the cost of producing and mailing them. If you give your consent, in the future, when, and if, material is available over the internet, you will receive notification which will contain the internet location where the material is available. There is no cost to you for this service other than any charges you may incur from your internet provider, telephone and/or cable company. To give your consent, follow the prompts when you vote by telephone or over the internet or check the appropriate box located at the bottom of the enclosed proxy card when you vote by mail. Once you give your consent, it will remain in effect until you inform us otherwise. If at any time you would like to receive a paper copy of the Annual Report or Proxy Statement, please contact Corporate Communications at the address or telephone number provided above.

| By Order of the Board of Directors | ||

| ||

| Thomas A. Piraino, Jr. Secretary |

September 24, 2007

18

Appendix A

PROPOSED CHANGES TO ARTICLE II OF

CODE OF REGULATIONS, AS AMENDED

Article II. Board of Directors

Section 1. Number of Directors; Election; Term of Office.

The members of the Board of Directors shall be elected at each annual meeting of shareholders, and each Director shall hold office until the next annual meeting of shareholders and until his or her successor is elected, or until his or her earlier resignation, removal from office or death, provided that each Director elected prior to the Corporation’s 2008 annual meeting of shareholders for a term that is to expire after the 2008 annual meeting of shareholders shall serve the entire term for which he or she was elected and until his or her successor is elected, or until his or her earlier resignation, removal from office or death. The number of Directors, which shall not be less than three, may be fixed or changed (a) at any meeting of shareholders called to elect Directors at which a quorum is present, by the affirmative vote of the holders of a majority of the shares represented at the meeting and entitled to vote on the proposal, or (b) by the Directors at any meeting of the Board of Directors by the vote of a majority of the Directors then in office.

Section 2. Directors Elected by Holders of Serial Preferred Stock.

The provisions of Section 1 shall not apply to any Directors elected by the holders of Serial Preferred Stock of all series voting separately as a class in the event of default in the payment of the equivalent of six quarterly dividends (whether or not consecutive) on any outstanding series of Serial Preferred Stock. Any such Directors shall be elected to serve until the next annual meeting of shareholders and until their respective successors are elected, or until such default is cured, whichever occurs first.

Section 3. Vacancies.

In the event of the occurrence of any vacancy or vacancies in the Board of Directors, however caused, the Directors then in office, though less than a majority of the whole authorized number of Directors, may, by vote of a majority of their number, fill any such vacancy for the unexpired term.

Section 4. Meetings of Directors.

Meetings of Directors may be called by the Chairman of the Board, or the President, or twenty-five percent or more of the Directors then in office. Such meetings may be held at any place within or without the State of Ohio, and may be held through any communications equipment if all persons participating can hear each other. Participation in a meeting of Directors held through communications equipment pursuant to this Section 4 of Article II shall constitute presence at such meeting. Written notice of the time and place of each meeting of Directors shall be given to each Director by personal delivery, or by mail, telegram, or cablegram at least two days before the meeting, which notice need not specify the purposes of the meeting. Notice of adjournment of a meeting of Directors need not be given if the time and place to which it is adjourned are fixed and announced at such meeting.

Section 5. Quorum.

A majority of the Directors in office shall constitute a quorum for any meeting of Directors; provided that a majority of the Directors present at a meeting duly held, whether or not a quorum is present, may adjourn such meeting from time to time. The act of a majority of the Directors present at a meeting at which a quorum is present is the act of the Board of Directors.

A-1

|

c/o National City Bank Shareholder Services Operations Locator 5352 P.O. Box 94509 Cleveland, OH 44193-4509 |

VOTE BY TELEPHONE | ||

|

Have this Proxy Card available when you call the Toll-Free number 1-888-693-8683 using a touch-tone telephone and follow the simple instructions presented to record your vote.

| ||||

| VOTE BY INTERNET | ||||

|

Have this Proxy Card available when you access the website http://www.cesvote.com, and follow the simple instructions presented to record your vote.

| ||||

| VOTE BY MAIL | ||||

|

Please mark, sign and date this Proxy Card and return it in the postage-paid envelope provided or return it to: National City Bank, P.O. Box 535600, Pittsburgh, PA 15253. |

|

Vote by Telephone

Call Toll-Free using a

Touch-Tone phone:

1-888-693-8683

|

Vote by Internet

Access the Website and

cast your vote:

http://www.cesvote.com

|

Vote by Mail

Return this Proxy

in the Postage-paid

envelope provided

|

Vote 24 hours a day, 7 days a week!

Your telephone or Internet vote must be received by 6:00 a.m. Eastern Daylight Time

on October 24, 2007 to be counted in the final tabulation.

If voting by telephone or Internet, please do not mail this proxy card.

|

è

|

Proxy card must be signed and dated below.

ê Please fold and detach card at perforation before mailing. ê

| PARKER-HANNIFIN CORPORATION | PRELIMINARY COPY OF PROXY | |

This proxy is solicited on behalf of the Board of Directors for the Annual Meeting of Shareholders on October 24, 2007.

The undersigned hereby appoints DONALD E. WASHKEWICZ, TIMOTHY K. PISTELL and THOMAS A. PIRAINO, JR., and any of them, as proxies to represent and to vote all shares of stock of Parker-Hannifin Corporation which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Corporation to be held on October 24, 2007, and at any adjournment(s) thereof, on the proposals more fully described in the Proxy Statement for the Meeting in the manner specified herein and on any other business that may properly come before the Meeting.

| Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing on behalf of a corporation or as a fiduciary, attorney, executor, administrator, trustee or guardian, please give full title as such. |

| Signature(s) |

| Signature(s) |

| Date: , 2007 |

ELECTRONIC ACCESS TO FUTURE DOCUMENTS NOW AVAILABLE

You can elect to view future Parker-Hannifin Corporation Annual Reports and Proxy Statements over the Internet, instead of receiving paper copies in the mail. Providing these documents over the Internet can save the Corporation the cost of producing and mailing them. Participation is completely voluntary. If you give your consent, in the future, when, and if, material is available over the Internet, you will receive notification which will contain the Internet location where the material is available. There is no cost to you for this service other than any charges you may incur from your Internet provider, telephone and/or cable company. Once you give your consent, it will remain in effect until you inform us otherwise.

To give your consent, follow the prompts when you vote by telephone or over the Internet or check the appropriate box located at the bottom of the attached proxy card when you vote by mail.

Proxy card must be signed and dated on the reverse side.

ê Please fold and detach card at perforation before mailing. ê

| PARKER-HANNIFIN CORPORATION | PRELIMINARY COPY OF PROXY | |

IF NO DIRECTIONS ARE GIVEN, YOUR PROXY WILL BE VOTED IN ACCORDANCE WITH THE BOARD OF DIRECTORS’ RECOMMENDATIONS. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ITEMS 1, 2 AND 3.

| 1. | Election of Directors in the class whose three-year term of office will expire in 2010. |

| Nominees: | (1) Linda S. Harty | (2) Candy M. Obourn | (3) Donald E. Washkewicz | |||||

| q FOR all nominees listed above (except as otherwise marked above) |

q WITHHOLD AUTHORITY to vote for all nominees listed above | |||||||

| (Instructions: To withhold authority to vote for any individual nominee, strike a line through that nominee’s name.) | ||||||||

| 2. | A management proposal to declassify the Board of Directors. |

| q FOR |

q AGAINST |

q ABSTAIN | ||||||

| 3. | Ratification of the appointment of Deloitte & Touche LLP as independent registered public accounting firm for FY08. |

| q FOR |

q AGAINST |

q ABSTAIN | ||||||

IMPORTANT—THIS PROXY MUST BE SIGNED AND DATED ON THE REVERSE SIDE.

|

q I consent to view future shareholder communications over the Internet as stated above and in the Proxy

|