Parker Hannifin

Corporation Quarterly Earnings Release

2

nd

Quarter FY2011

January 20, 2011

****************

****************

****************

****************

****************

****************

Exhibit 99.2 |

Parker Hannifin

Corporation Quarterly Earnings Release

2

nd

Quarter FY2011

January 20, 2011

****************

****************

****************

****************

****************

****************

Exhibit 99.2 |

| Slide 2

Forward-Looking Statements

Forward-Looking Statements:

Forward-looking statements contained in this and other written and oral reports

are made based on

known

events

and

circumstances

at

the

time

of

release,

and

as

such,

are

subject

in

the

future to unforeseen uncertainties and risks. All statements regarding future

performance, earnings projections, events or developments are

forward-looking statements. It is possible that the future performance

and earnings projections of the company, including its individual segments,

may differ materially from current expectations, depending on economic conditions

within its mobile, industrial and aerospace markets, and the company's ability to

maintain and achieve anticipated benefits associated with announced

realignment activities, strategic initiatives to improve operating margins,

actions taken to combat the effects of the current economic

environment,

and

growth,

innovation

and

global

diversification

initiatives.

A

change

in

economic conditions in individual markets may have a particularly volatile effect

on segment performance. Among other factors which may affect future

performance are: changes in business relationships with and purchases by or

from major customers, suppliers or distributors, including delays or

cancellations in shipments, disputes regarding contract terms or significant

changes

in

financial

condition,

and

changes

in

contract

cost

and

revenue

estimates

for

new

development programs; uncertainties surrounding timing, successful completion or

integration of acquisitions; ability to realize anticipated cost savings

from business realignment activities; threats associated with and efforts to

combat terrorism; uncertainties surrounding the ultimate resolution of

outstanding legal proceedings, including the outcome of any appeals; competitive

market conditions and resulting effects on sales and pricing; increases in raw

material costs that cannot be recovered in product pricing; the

company’s ability to manage costs related to insurance and employee

retirement and health care benefits; and global economic factors, including

manufacturing activity, air travel trends, currency exchange rates, difficulties entering

new markets and general economic conditions such as inflation, deflation, interest

rates and credit availability. The company makes these statements as of the

date of this disclosure, and undertakes no obligation to update them unless

otherwise required by law. |

| Slide 3

Non-GAAP Financial Measures

This presentation reconciles sales amounts reported in accordance

with U.S. GAAP to sales amounts adjusted to remove the effects of

acquisitions

made

within

the

prior

four

quarters

and

the

effects

of

currency exchange rates on sales. This presentation also reconciles

cash flow from operating activities as a percent of sales in accordance

with U.S. GAAP to cash flow from operating activities as a percent of

sales without the effect of a discretionary pension plan contribution.

The effects of acquisitions, currency exchange rates and the

discretionary pension plan contribution are removed to allow investors

and the company to meaningfully evaluate changes in sales and cash

flow from operating activities as a percent of sales on a comparable

basis from period to period. |

| Slide 4

Discussion Agenda

CEO 2

nd

Quarter Highlights

Key Performance Measures & Outlook

Questions & Answers

CEO Closing Comments |

Slide 5

Second Quarter FY11 Highlights

End

Market

Improvement:

Orders

Improved

Year-over-Year

and

Sequentially for all Segments

Revenues

Rebounding:

Q2

Revenues

Increased

21.7%

Year-over-

Year

Operating

Margins:

Margins

Improved

Year-over-Year

for

all

Segments

Achieved All-time Record Margins across Q2 for:

–

NA Industrial, Total Industrial and Total Parker Operating Margins

Net

Income:

Q2

Net

Income

More

than

Doubled

Year-over-Year

Continued

Reduction

in

Leverage:

Gross

Debt

to

Total

Capital

Ratio Decreased to 26.5%

Continued

Strong

Cash

Flow:

Q2

FY11

Operating

Cash

Flow/Revenue of 10.0%

Acquisitions:

Completed

Acquisition

of

Gulf

Coast

Seal |

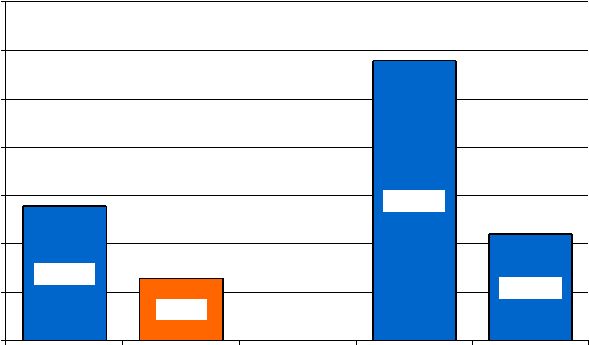

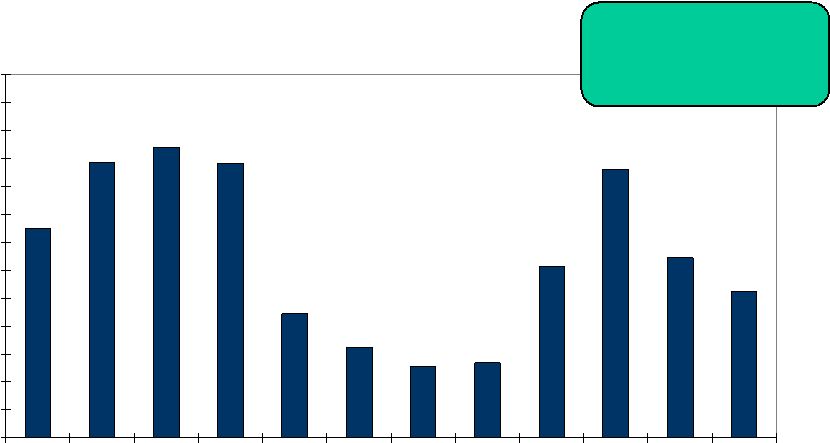

Slide 6

Financial Highlights

Diluted Earnings per Share

2

nd

Quarter

$1.39

$.64

$2.90

$1.10

$.00

$.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

Q2 FY11

Q2 FY10

FY11

FY10 |

Slide 7

Influences on 2

nd

Quarter Earnings

Diluted Earnings Per Share Increase of $.75 Year-

over-Year Primarily Driven By:

Increased Revenues of 21.7%

Improved Operating Income ($.71 EPS Impact)

Margins Improved to 14.0% from 10.4% Year-over-

Year

Lower Other Expense ($.07 EPS Impact)

Offset by:

Increased Corporate G&A Primarily Due To Incentives

($.03 EPS Impact) |

Slide 8

Financial Highlights

Sales –

2

nd

Quarter

Dollars in millions

FY2011

%

Change

FY2010

FY2011

%

Change

FY2010

Sales

As reported

2,867

$

21.7 %

2,355

$

5,696

$

24.0 %

4,592

$

Acquisitions

10

0.4 %

14

0.3 %

Currency

(21)

(0.9)%

(47)

(1.0)%

Adjusted Sales

2,878

$

22.2 %

5,729

$

24.7 %

2nd Quarter

Total Year |

Slide 9

Segment Reporting

Industrial North America

Dollars in millions

FY2011

%

Change

FY2010

FY2011

%

Change

FY2010

Sales

As reported

1,046

$

23.4 %

847

$

2,110

$

29.4 %

1,630

$

Acquisitions

4

0.5 %

4

0.2 %

Currency

5

0.5 %

8

0.5 %

Adjusted Sales

1,037

$

22.4 %

2,098

$

28.7 %

Operating Margin

As reported

159

$

114

$

349

$

191

$

% of Sales

15.2 %

13.5 %

16.5 %

11.7 %

2nd Quarter

Total Year |

Slide 10

Segment Reporting

Industrial International

Dollars in millions

FY2011

%

Change

FY2010

FY2011

%

Change

FY2010

Sales

As reported

1,147

$

23.1 %

932

$

2,240

$

25.7 %

1,782

$

Acquisitions

1

0.1 %

1

0.1 %

Currency

(25)

(2.6)%

(52)

(2.9)%

Adjusted Sales

1,171

$

25.6 %

2,291

$

28.5 %

Operating Margin

As reported

168

$

83

$

352

$

144

$

% of Sales

14.6 %

8.9 %

15.7 %

8.1 %

2nd Quarter

Total Year |

Slide 11

Segment Reporting

Aerospace

Dollars in millions

FY2011

%

Change

FY2010

FY2011

%

Change

FY2010

Sales

As reported

460

$

14.7 %

401

$

897

$

9.7 %

818

$

Acquisitions

1

0.2 %

3

0.4 %

Currency

(1)

(0.2)%

(2)

(0.2)%

Adjusted Sales

460

$

14.7 %

896

$

9.5 %

Operating Margin

As reported

64

$

41

$

107

$

94

$

% of Sales

13.8 %

10.2 %

12.0 %

11.5 %

2nd Quarter

Total Year |

Slide 12

Segment Reporting

Climate & Industrial Controls

Dollars in millions

FY2011

%

Change

FY2010

FY2011

%

Change

FY2010

Sales

As reported

214

$

22.6 %

175

$

449

$

24.1 %

362

$

Acquisitions

4

2.2 %

6

1.3 %

Currency

0

(0.0)%

(1)

(0.0)%

Adjusted Sales

210

$

20.4 %

444

$

22.8 %

Operating Margin

As reported

10

$

6

$

31

$

17

$

% of Sales

4.4 %

3.5 %

6.9 %

4.6 %

2nd Quarter

Total Year |

Slide 13

Parker Order Rates

Excludes Acquisitions & Currency

3-month year-over-year comparisons of total dollars, except Aerospace

Aerospace is calculated using a 12-month moving average

DEC '10

SEPT '10

DEC '09

SEPT '09

Total Parker

29 %

+

29 %

+

7 %

-

25 %

-

Industrial North America

26 %

+

31 %

+

3 %

-

27 %

-

Industrial International

29 %

+

34 %

+

0 %

+

25 %

-

Aerospace

37 %

+

16 %

+

27 %

-

23 %

-

Climate & Industrial Controls

26 %

+

23 %

+

6 %

+

17 %

-

Three Month Rolling at Period End |

| Slide 14

Balance Sheet Summary

Cash

Working capital

-

Accounts receivable

-

Inventory

-

Accounts payable |

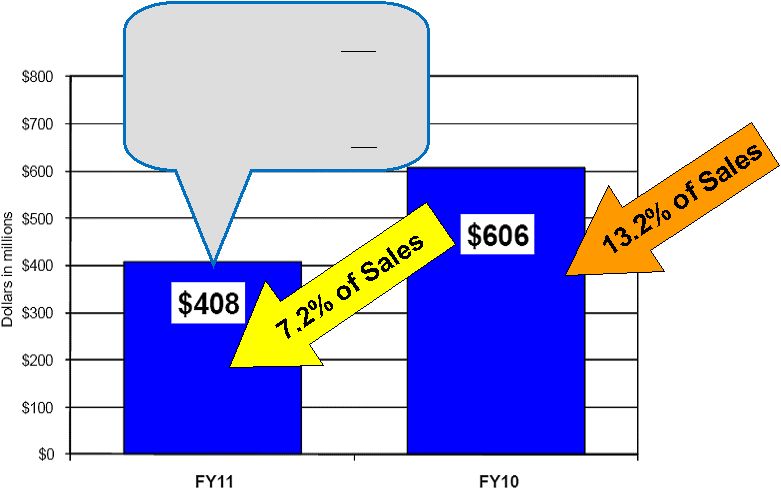

Slide 15

Strong Cash Flow

Cash from Operating Activities

2

nd

Quarter

FY11 Cash from Operating Activities

As

reported

$408

M

Pension

plan

contribution

200

M

Adjusted

$608

M

FY11 Cash from Operating Activities As A % of

Sales

As

reported

7.2%

Pension

plan

contribution

3.5%

Adjusted

10.7% |

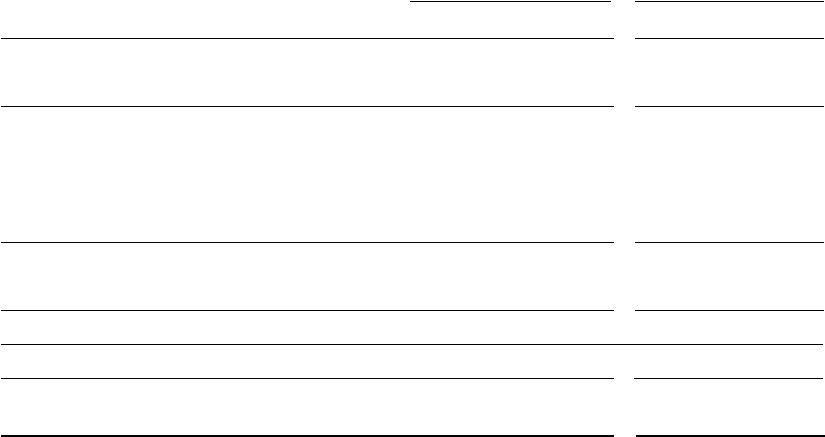

Slide 16

Financial Leverage

26.5%

16.0%

18.0%

20.0%

22.0%

24.0%

26.0%

28.0%

30.0%

32.0%

34.0%

36.0%

38.0%

40.0%

42.0%

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

Debt to Debt Equity

26.5%

Debt to Debt Equity |

Slide 17

FY 2011 Earnings Outlook Assumptions

Segment Sales & Operating Margins

FY 2011 Sales change versus FY 2010

Industrial North America

19.8 %

--

21.8 %

Industrial International

18.6 %

--

20.6 %

Aerospace

6.7 %

--

8.7 %

Climate & Industrial Controls

14.6 %

--

15.6 %

FY 2011 Operating margin percentages

Industrial North America

16.2 %

--

16.8 %

Industrial International

15.1 %

--

15.7 %

Aerospace

13.6 %

--

13.9 %

Climate & Industrial Controls

8.3 %

--

8.8 % |

Slide 18

FY 2011 Earnings Outlook Assumptions

below Operating Margin (+/-

1.0%)

Corporate Admin

$157M

Interest Expense

$ 98M

Other Expense (Inc.)

$133M

Total

$388M

Tax Rate

27% |

| Slide 19

Earnings Outlook –

FY11

Low

High

Diluted earnings per share

5.80

$

6.20

$ |

| Slide 20

Questions & Answers...

*

*

*

* |

| Appendix

Income Statement

2

nd

Quarter FY2011

1

st

Half FY2011

**************************

**************************

**************************

**************************

**************************

**************************

**************************

**************************

**************************

**************************

*

*

* |

Slide 22

Income Statement –

2

nd

Quarter

Dollars in millions

% of Sales

% of Sales

Net Sales

2,866.6

$

100.0 %

2,354.7

$

100.0 %

Cost of sales

2,195.7

76.6 %

1,869.5

79.4 %

Gross profit

670.9

23.4 %

485.2

20.6 %

S, G & A

345.7

12.1 %

309.8

13.2 %

Interest expense

25.6

.9 %

25.0

1.1 %

Other (income) expense, net

(6.6)

(.3)%

8.1

.3 %

Income before taxes

306.2

10.7 %

142.3

6.0 %

Income taxes

74.4

2.6 %

37.3

1.6 %

Net income

231.8

$

8.1 %

105.0

$

4.4 %

Less:

Noncontrolling

interests

1.6

$

.1 %

.4

$

.0 %

Net income attributable to common

shareholders

230.2

$

8.0 %

104.6

$

4.4 %

FY 2011

FY 2010 |

Slide 23

Income Statement –

1

st

Half

Dollars in millions

% of Sales

% of Sales

Net Sales

5,695.9

$

100.0 %

4,591.9

100.0 %

Cost of sales

4,333.6

76.1 %

3,670.4

79.9 %

Gross profit

1,362.3

23.9 %

921.5

20.1 %

S, G & A

679.2

11.9 %

611.7

13.3 %

Interest expense

50.3

.9 %

50.8

1.1 %

Other (income) expense, net

(9.8)

(.2)%

2.7

.1 %

Income before taxes

642.6

11.3 %

256.3

5.6 %

Income taxes

161.8

2.8 %

77.3

1.7 %

Net income

480.9

$

8.5 %

179.0

$

3.9 %

Less: Noncontrolling

interests

3.5

$

.1 %

.9

$

.0 %

Net income attribituable

to common

shares

477.3

$

8.4 %

178.1

$

3.9 %

FY 2011

FY 2010

$ |