Parker Hannifin

Corporation Quarterly Earnings Release

3

rd

Quarter FY2012

April 24, 2012

Exhibit 99.2 |

Parker Hannifin

Corporation Quarterly Earnings Release

3

rd

Quarter FY2012

April 24, 2012

Exhibit 99.2 |

| Forward-Looking Statements

Forward-Looking Statements:

Forward-looking

statements

contained

in

this

and

other

written

and

oral

reports

are

made

based

on

known

events

and

circumstances

at

the

time

of

release,

and

as

such,

are

subject

in

the

future

to

unforeseen

uncertainties

and

risks.

All

statements

regarding

future

performance,

earnings

projections,

events

or

developments

are

forward-looking

statements.

It

is

possible

that

the

future

performance

and

earnings

projections

of

the

company,

including

its

individual

segments,

may

differ

materially

from

current

expectations,

depending

on

economic

conditions

within

its

mobile,

industrial

and

aerospace

markets,

and

the

company's

ability

to

maintain

and

achieve

anticipated

benefits

associated

with

announced

realignment

activities,

strategic

initiatives

to

improve

operating

margins,

actions

taken

to

combat

the

effects

of

the

current

economic

environment,

and

growth,

innovation

and

global

diversification

initiatives.

A

change

in

the

economic

conditions

in

individual

markets

may

have

a

particularly

volatile

effect

on

segment

performance.

Among

other

factors

which

may

affect

future

performance

are:

changes

in

business

relationships

with

and

purchases

by

or

from

major

customers,

suppliers

or

distributors,

including

delays

or

cancellations

in

shipments,

disputes

regarding

contract

terms

or

significant

changes

in

financial

condition,

changes

in

contract

cost

and

revenue

estimates

for

new

development

programs

and

changes

in

product

mix;

ability

to

identify

acceptable

strategic

acquisition

targets;

uncertainties

surrounding

timing,

successful

completion

or

integration

of

acquisitions;

ability

to

realize

anticipated

cost

savings

from

business

realignment

activities;

threats

associated

with

and

efforts

to

combat

terrorism; uncertainties surrounding the ultimate resolution of outstanding legal

proceedings, including the outcome

of

any

appeals;

competitive

market

conditions

and

resulting

effects

on

sales

and

pricing;

increases

in

raw

material

costs

that

cannot

be

recovered

in

product

pricing;

the

company’s

ability

to

manage

costs

related

to insurance

and

employee

retirement

and

health

care

benefits;

and

global

economic

factors,

including

manufacturing

activity,

air

travel

trends,

currency

exchange

rates,

difficulties

entering

new

markets

and

general

economic

conditions

such

as

inflation,

deflation,

interest

rates

and

credit

availability.

The

company

makes

these statements

as

of

the

date

of

this

disclosure,

and

undertakes

no

obligation

to

update

them

unless

otherwise required

by

law.

Slide 2 |

| Slide 3

Non-GAAP Financial Measures

This

presentation

reconciles

sales

amounts

reported

in

accordance

with

U.S.

GAAP

to

sales

amounts

adjusted

to

remove

the

effects

of

acquisitions

made

within

the

prior

four

quarters

and

the

effects

of

currency

exchange

rates

on

sales.

The

effects

of

acquisitions

and

currency

exchange

rates

are

removed

to

allow

investors

and

the

company

to

meaningfully

evaluate

changes

in

sales

on

a

comparable

basis

from

period

to

period. |

| Slide 4

Discussion Agenda

CEO 3

rd

Quarter Highlights

Key Performance Measures & Outlook

Questions & Answers

CEO Closing Comments |

Slide 5

Third

Quarter

FY12

Highlights

Record

3

rd

Quarter

Sales:

Q3

Sales

Increased

4.7%

Year-

over-Year

to

$3.4B

due

to

Industrial

North

America

and

Aerospace

End

Market

Demand:

Order

Improvement

of

2%

Year-over-

Year

Against

Tougher

Comparables

driven

by

North

America

and Aerospace

Operating

Margin:

15.1%

as

compared

to

14.8%

in

Q3

FY11

NA Industrial Increased to 17.3% from 16.1% in Q3 FY11; a

Third Quarter Record

Net

Income:

All-time

Quarterly

Record

of

$313

million

Earnings

Per

Share:

All-time

Quarterly

Record

of

$2.01

vs.

$1.68 in Q3 FY11

Strong

Balance

Sheet:

Cash

Balance

of

$773M

and

Debt/Total Capitalization Metric of 24.3%

Continued

Strong

Cash

Flow:

Q3

FY12

Operating

Cash

Flow/Sales

of

13.1%;

YTD

FY12

of

10.3% |

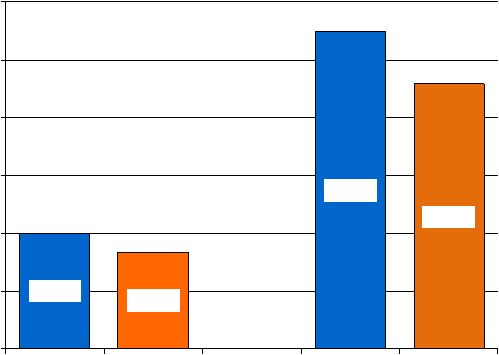

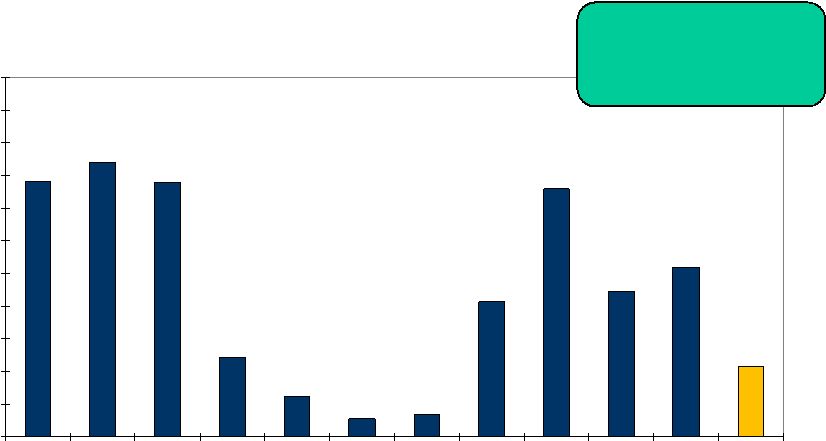

Slide 6

Financial Highlights

Diluted Earnings per Share

3

rd

Quarter and Year-to-Date

$2.01

$1.68

$5.49

$4.58

$.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

Q3 FY12

Q3 FY11

FY12 YTD

FY11 YTD |

| Slide 7

Influences

on

3

rd

Quarter

Earnings

Diluted Earnings Per Share Increase Year-over-Year of $.33 or

20% Primarily Driven By:

Improved Segment Operating Margins to 15.1% from 14.8%

($.13 EPS Impact) driven by Industrial North America and

Climate & Industrial Controls

Lower Tax Rate due to Favorable Resolution of Prior Year Tax

Filings ($.13 EPS Impact)

Lower Shares Outstanding due to Share Repurchase

($.14 EPS Impact)

Offset by:

Increased Expense Below Segment Operating Income Mainly

due to Negative Currency Impact and Prior Year Favorable

Insurance Recoveries ($.08 EPS Impact) |

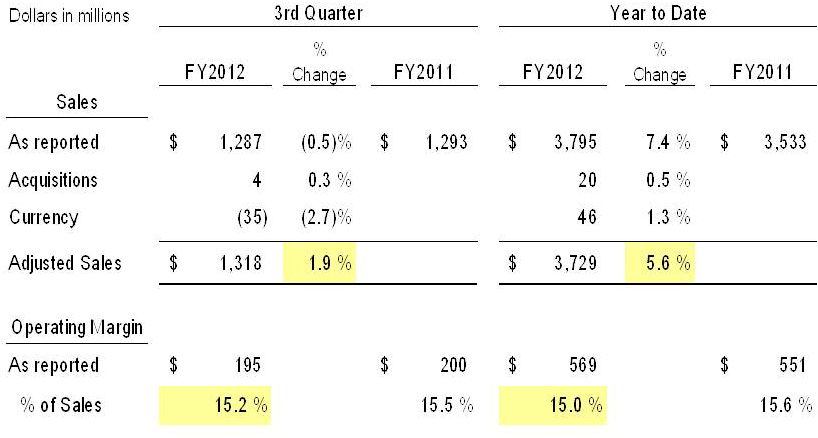

Slide 8

Financial Highlights

Sales

–

3

rd

Quarter |

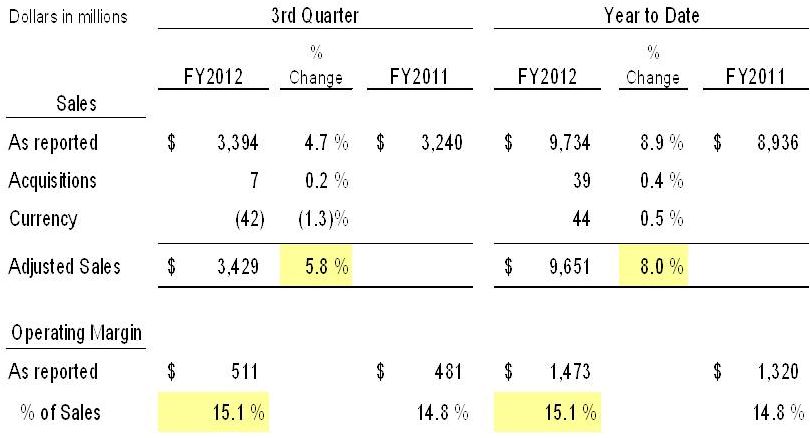

Slide 9

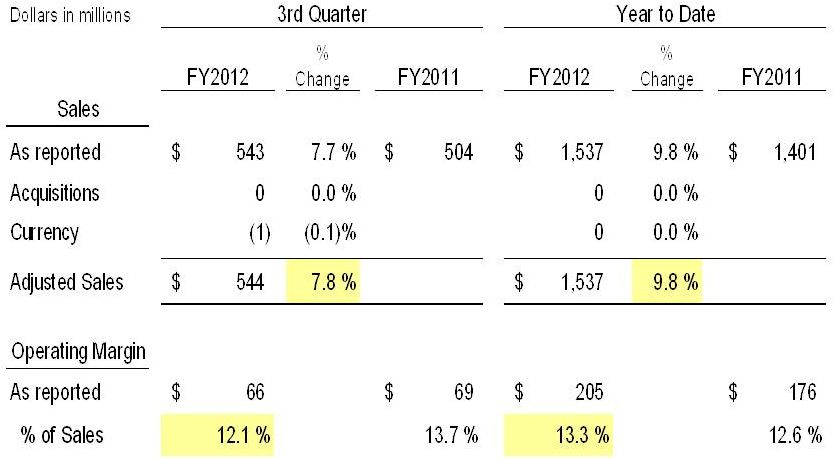

Segment Reporting

Industrial North America |

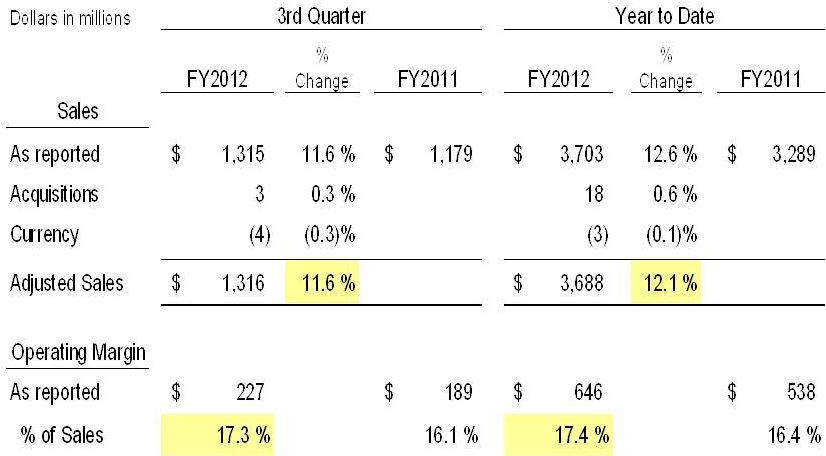

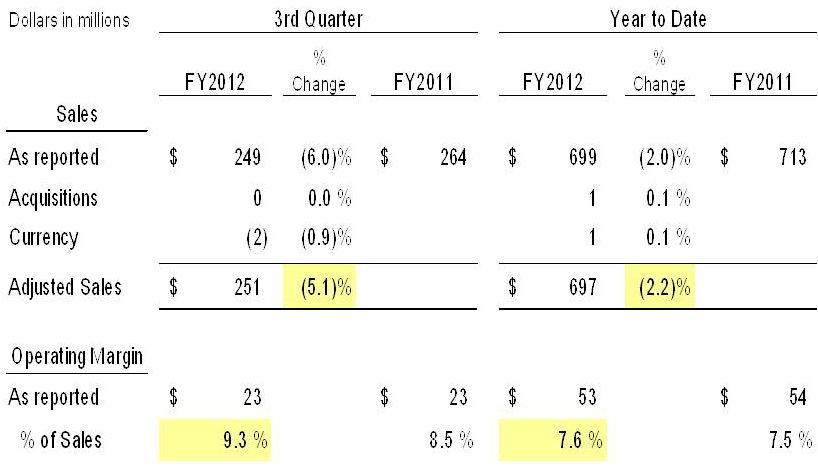

Slide 10

Segment Reporting

Industrial International |

Slide 11

Segment Reporting

Aerospace |

Slide 12

Segment Reporting

Climate & Industrial Controls |

Slide 13

Parker Order Rates

Excludes Acquisitions & Currency

3-month year-over-year comparisons of total dollars, except Aerospace

Aerospace is calculated using a 12-month rolling average

MAR '12

DEC '11

MAR '11

DEC '10

Total Parker

2 %

+

3 %

+

24 %

+

29 %

+

Industrial North America

7 %

+

8 %

+

20 %

+

26 %

+

Industrial International

1 %

-

1 %

+

22 %

+

29 %

+

Aerospace

4 %

+

0 %

+

44 %

+

37 %

+

Climate & Industrial Controls

6 %

-

5 %

-

14 %

+

26 %

+

Three Month Rolling at Period End |

| Slide 14

Balance Sheet Summary

Cash

Working capital

-

Accounts receivable

-

Inventory

-

Accounts payable |

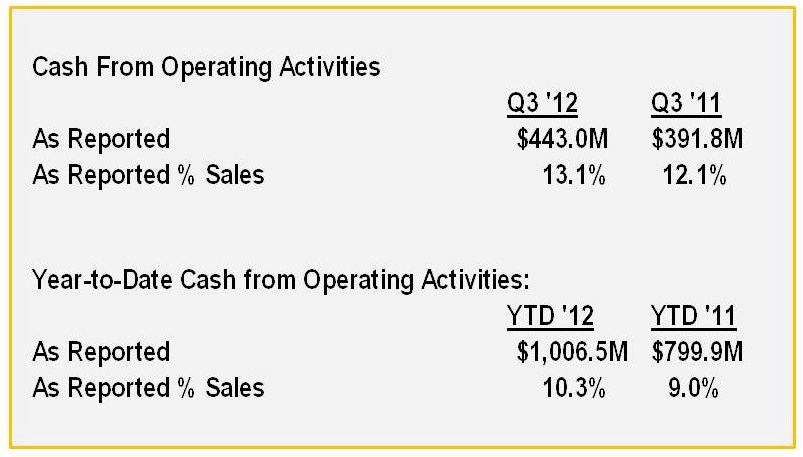

Slide 15

Strong Cash Flow

Cash from Operating Activities

3

rd

Quarter and Year-To-

Date |

Slide 16

Financial Leverage

20.0%

22.0%

24.0%

26.0%

28.0%

30.0%

32.0%

34.0%

36.0%

38.0%

40.0%

42.0%

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

YTD

Debt to Debt Equity

24.3%

Debt to Debt Equity

(15.4% net Debt)

24.3% |

Slide 17

FY 2012 Earnings Outlook Assumptions

Segment Sales & Operating Margins

FY 2012 Sales change versus FY 2011

Industrial North America

11.0 %

--

11.5 %

Industrial International

3.3 %

--

4.1 %

Aerospace

8.0 %

--

9.0 %

Climate & Industrial Controls

(3.9)%

--

(2.8)%

FY 2012 Operating margin percentages

Industrial North America

17.3 %

--

17.5 %

Industrial International

14.9 %

--

15.1 %

Aerospace

13.2 %

--

13.4 %

Climate & Industrial Controls

8.0 %

--

8.2 % |

Slide 18

FY 2012 Earnings Outlook Assumptions

below Operating Margin (+/-.7%)

Expenses Below Segment Operating Margin*

$429M at Midpoint

Tax Rate = 26.5%

*Corporate Admin, Interest and Other Expense (Income)

|

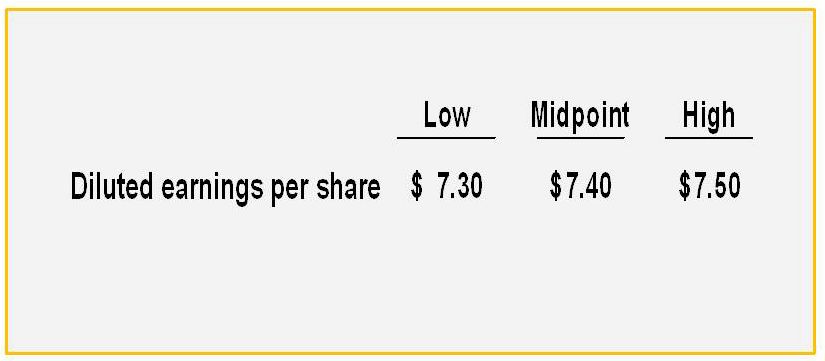

Slide 19

Earnings Outlook –

FY12 |

| Slide 20

Questions & Answers...

*

*

*

* |

| Appendix

Income Statement

3

rd

Quarter FY2012

3

rd

Quarter YTD FY2012

******************

*

*

*

* |

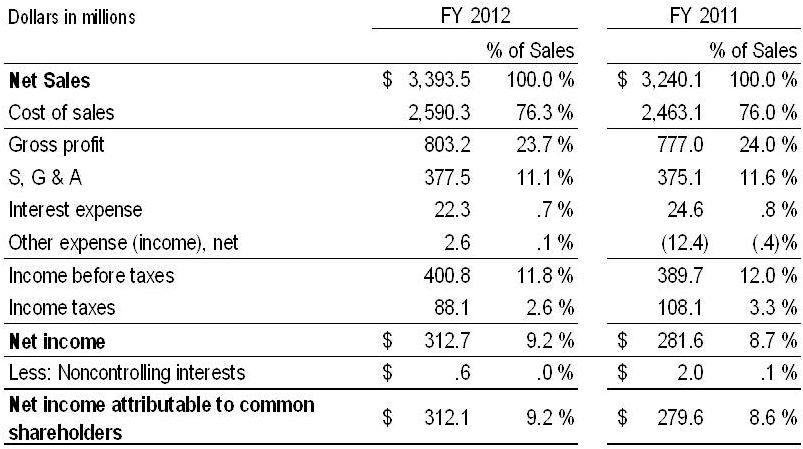

Slide 22

Income Statement –

3

rd

Quarter |

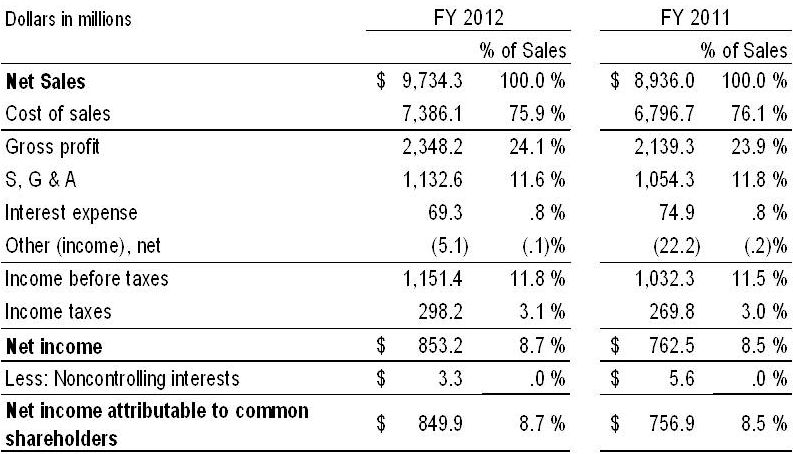

Slide 23

Income Statement –

3

rd

Quarter YTD |