UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PARKER-HANNIFIN CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

In accordance with Rule 14a-6(d) under Regulation 14A of the Securities Exchange Act of 1934, please be advised that Parker-Hannifin Corporation intends to release definitive copies of the proxy statement to security holders on or about September 28, 2015. |

PRELIMINARY COPY

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OCTOBER 28, 2015

TO OUR SHAREHOLDERS:

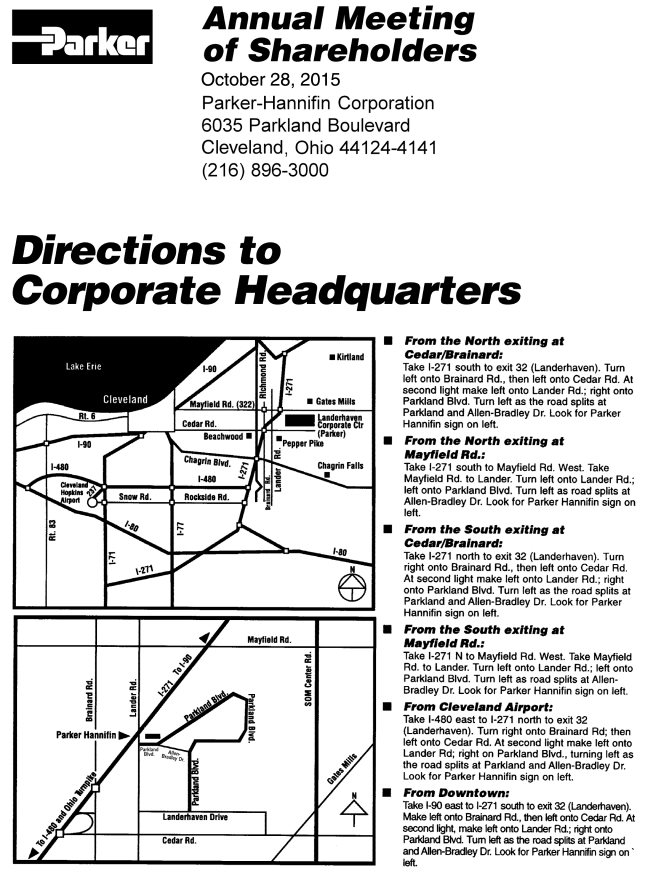

You are cordially invited to attend the Annual Meeting of Shareholders of Parker-Hannifin Corporation. The meeting will be held at our headquarters located at 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, on Wednesday, October 28, 2015, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect Lee C. Banks, Robert G. Bohn, Linda S. Harty, William E. Kassling, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson, James L. Wainscott, Donald E. Washkewicz and Thomas L. Williams as Directors for a term expiring at the Annual Meeting of Shareholders in 2016; |

| 2. | To consider and vote upon a management proposal to amend our Amended Articles of Incorporation to implement a majority voting standard for uncontested Director elections; |

| 3. | To consider and vote upon a management proposal to amend our Amended Articles of Incorporation to eliminate cumulative voting in Director elections; |

| 4. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2016; |

| 5. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| 6. | To approve the Parker-Hannifin Corporation 2015 Performance Bonus Plan; and |

| 7. | To transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on August 31, 2015 are entitled to vote at the meeting. Your vote is important, particularly in light of the supermajority voting requirements of Item 2 and Item 3, as described in this Proxy Statement. So if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the enclosed proxy card. Please refer to the back page of this Proxy Statement for directions to attend the annual meeting.

Thank you for your support of Parker-Hannifin Corporation.

| By Order of the Board of Directors |

|

| Joseph R. Leonti |

| Secretary |

September , 2015

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be held on October 28, 2015.

This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 and our 2015 Annual Report, are available free of charge on our investor relations website (www.phstock.com).

| Page |

||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| Elections |

1 | |||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 23 | ||||

| Objectives and Philosophies of the Executive Compensation Program |

23 | |||

| 24 | ||||

| “Pay-for-Performance”— Structure, Key Financial Metrics and Impact on Compensation Payouts |

24 | |||

| Highlights and Significant Changes to Executive Compensation Program |

28 | |||

| Administration, Oversight and Determination of Executive Compensation |

28 | |||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| General Policies and Practices Relating to Executive Compensation |

31 | |||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 40 | ||||

| 44 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 54 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| Potential Payments Upon Termination or Change of Control at June 30, 2015 |

62 | |||

| 74 | ||||

| 76 | ||||

| Item 4 – Ratification of the Appointment of Independent Registered Public Accounting Firm |

77 | |||

| 78 | ||||

| Page |

||||

| Item 6 – Approval of the Parker-Hannifin Corporation 2015 Performance Bonus Plan |

79 | |||

| 83 | ||||

| 84 | ||||

| 84 | ||||

| 85 | ||||

| 85 | ||||

| A-1 | ||||

| Annex B: Parker-Hannifin Corporation 2015 Performance Bonus Plan |

B-1 | |||

PRELIMINARY COPY

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting of Shareholders scheduled to be held on October 28, 2015, and at all adjournments thereof. Only shareholders of record at the close of business on August 31, 2015 will be entitled to vote at the meeting. On August 31, 2015, common shares were outstanding and entitled to vote at the meeting. Each share is entitled to one vote. This Proxy Statement and the form of proxy are being mailed to shareholders on or about September 28, 2015.

Our Global Code of Business Conduct, Board of Directors Guidelines on Significant Corporate Governance Issues and Independence Standards for Directors are posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these documents, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000. The information contained on or accessible through our website is not a part of this Proxy Statement.

ANNUAL ELECTIONS; CUMULATIVE VOTING.

Our Code of Regulations provides for the annual election of our entire Board of Directors. Accordingly, each Director elected at this Annual Meeting of Shareholders will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected.

Our shareholders have cumulative voting rights in the election of Directors if any shareholder gives notice in writing to our President, any of our Vice Presidents or our Secretary not less than 48 hours before the time fixed for holding the meeting that cumulative voting at such election is desired. The fact that such notice has been given must be announced upon the convening of the meeting by our Chairman of the Board, our Secretary or by or on behalf of the shareholder giving such notice. In such event, each shareholder has the right to cumulate votes and give one nominee the number of votes equal to the number of Directors to be elected multiplied by the number of votes to which the shareholder is entitled, or to distribute votes on the same principle among two or more nominees, as the shareholder determines. If voting at the election held during this Annual Meeting of Shareholders is cumulative, the persons named on the enclosed proxy card will vote common shares represented by valid proxies on a cumulative basis for the election of the nominees set forth in the “Item 1 —Election of Directors” section beginning on page 11 of this Proxy Statement, allocating the votes of such common shares in accordance with their judgment.

ELECTIONS.

Upon our Corporate Governance and Nominating Committee’s recommendation and as permitted under our Code of Regulations, as amended, in January 2015 our Board of Directors increased its size to 14 members and elected Thomas L. Williams and Lee C. Banks to serve as Directors for terms expiring at this Annual Meeting of Shareholders.

MEETINGS AND ATTENDANCE; EXECUTIVE SESSIONS.

During fiscal year 2015, there were seven meetings of our Board of Directors. Each Director attended at least 75% of the meetings held by our Board of Directors and the Committees of our Board of Directors on which he or she served.

1

We hold a regularly scheduled meeting of our Board of Directors in conjunction with our Annual Meeting of Shareholders. Directors are expected to attend the Annual Meeting of Shareholders absent an appropriate reason. All of the members of our Board of Directors serving at the time of our 2014 Annual Meeting of Shareholders attended that meeting.

In accordance with the listing standards of the New York Stock Exchange, our non-management Directors are scheduled to meet regularly in executive sessions without management and, if required, our independent Directors will meet at least once annually. Additional meetings of our non-management Directors may be scheduled from time to time when our non-management Directors determine that such meetings are desirable. Our non-management Directors met four times during fiscal year 2015.

NUMBER; CURRENT TERM; RELATIONSHIPS.

Our Board of Directors presently consists of 14 members. The current term of each member of our Board of Directors expires at this Annual Meeting of Shareholders. None of our Directors are related to each other and no arrangements or understandings exist pursuant to which any Director was selected as a Director or Director nominee.

Our Board of Directors Guidelines on Significant Corporate Governance Issues require at least a majority of our Directors to be “independent” as defined in the listing standards established by the New York Stock Exchange. Our Board of Directors has also adopted standards for director independence, which are set forth in our Independence Standards for Directors.

We strongly favor a governance structure that includes an independent Board of Directors. Of the 14 current members of our Board of Directors, 11 are independent based on our Board of Directors’ consideration of the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. In addition, each of the Audit Committee, the Corporate Governance and Nominating Committee, the Finance Committee and the Human Resources and Compensation Committee of our Board of Directors is composed entirely of independent directors. As a result, our independent Directors directly oversee critical matters such as our executive compensation program, our corporate governance guidelines, policies and practices, our corporate finance strategies and initiatives, the integrity of our financial statements and our internal controls over financial reporting.

Our Board of Directors has affirmatively determined that the following 11 individuals who currently serve as Directors are independent: Robert G. Bohn, Linda S. Harty, William E. Kassling, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson and James L. Wainscott.

Among other things, our Board of Directors does not consider a Director to be independent unless it affirmatively determines that the Director has no material relationship with us either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Our Board of Directors annually reviews and determines which of its members are independent based on the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. During the course of such review, our Board of Directors broadly considers all facts and circumstances which it deems relevant, including any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships between us and any of our Directors. In fiscal year 2015, after considering the facts and circumstances applicable to each Director, our Board of Directors determined that the following relationships required further analysis to confirm that the following Directors were independent:

| 1. | Each of Ms. Harty and Messrs. Kohlhepp and Lobo serves as an employee, officer and/or Director of a company that has an existing customer or supplier relationship with us. Our Board of Directors further analyzed these relationships and found that none of these Directors receive any direct or indirect personal benefits as a result of such relationships, and that the amounts paid to or by us under such relationships fell significantly below the thresholds for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. Based on such further analyses, our Board of Directors affirmatively concluded that each of these Directors is independent. |

2

| 2. | Mr. Müller serves as Chairman of the Supervisory Board of Commerzbank AG, with which we have a commercial banking relationship. Our Board of Directors further analyzed this relationship and found that Mr. Müller does not receive any direct or indirect personal benefits as a result of such relationship, and that the amount of our indebtedness to Commerzbank AG is insignificant when compared to the purchase and sale thresholds for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. We also do not have an exclusive banking relationship with Commerzbank AG in Germany or elsewhere. Based on such further analysis, our Board of Directors affirmatively concluded that Mr. Müller is independent. |

Our Board of Directors currently employs a “dual leadership” structure in which our former Chief Executive Officer serves as Chairman of the Board and, pursuant to our Board of Directors Guidelines on Significant Corporate Governance Issues, the Chair of the Corporate Governance and Nominating Committee of our Board of Directors, an independent Director, serves as Lead Director. Our Lead Director is elected solely by the independent members of our Board of Directors and holds a position separate and independent from our Chairman of the Board. The Charter of the Corporate Governance and Nominating Committee and our Board of Directors Guidelines on Significant Corporate Governance Issues provide that the Chair of the Corporate Governance and Nominating Committee is elected or re-elected every five years.

The specific authorities, duties and responsibilities of our Lead Director are described in our Board of Directors Guidelines on Significant Corporate Governance Issues. Among other things, our Lead Director presides over and supervises the conduct of all meetings of our independent Directors, calls meetings of our non-management, independent Directors, and prepares and approves all agendas and schedules for meetings of our Board of Directors.

Our Board of Directors has had a Lead Director since April 2004. Our Board of Directors believes that having a Lead Director who is elected by our independent Directors ensures that our Board of Directors will at all times have an independent Director in a leadership position. At the same time, our Board of Directors believes that it is important to maintain flexibility in its leadership structure to allow for a member of management to serve in a leadership position alongside the Lead Director if our Board of Directors determines that such a leadership structure best meets the then current needs of our Board of Directors, our business, our employees and our shareholders.

Our Board of Directors has determined that this leadership structure is currently more efficient and effective than a structure which employs a single, independent Chairman of the Board. Our Board of Directors views this structure as one that ensures both independence in leadership and a balance of knowledge, power and authority. For example, our leadership structure employs both a Chairman of the Board who possesses an intimate, working knowledge of our day-to-day business, plans, strategies and initiatives, and a Lead Director who has a strong working relationship with our non-management, independent Directors. These two individuals combine and utilize their unique knowledge bases and perspectives to ensure that management and our independent Directors work together as effectively as possible. Among other things, our Chairman of the Board ensures that our Board of Directors addresses strategic issues that management considers critical, while our Lead Director ensures that our Board of Directors addresses strategic issues that our independent Directors consider critical.

Our Board of Directors recognizes, however, that no single leadership model may always be appropriate. Accordingly, our Board of Directors regularly reviews its leadership structure to ensure that it continues to represent the most efficient and effective structure for our Board of Directors, our business, our employees and our shareholders.

SELECTION AND NOMINATION OF DIRECTORS.

The Corporate Governance and Nominating Committee of our Board of Directors is responsible for identifying, evaluating and recommending potential Director candidates. The Corporate Governance and Nominating Committee utilizes a variety of methods for identifying and evaluating candidates. The Corporate Governance and Nominating Committee regularly reviews whether the size of our Board of Directors is appropriate and

3

whether any vacancies on our Board of Directors are expected due to retirements or otherwise. In the event that any vacancies are anticipated or otherwise arise, the Corporate Governance and Nominating Committee will consider various potential candidates.

In evaluating proposed Director nominees, the Corporate Governance and Nominating Committee will consider a variety of factors such as those described below under the caption “Director Qualifications; Board Diversity.” The Corporate Governance and Nominating Committee will consider the entirety of each proposed candidate’s credentials and will consider all available information that may be relevant to the candidate’s nomination. Following such consideration, the Corporate Governance and Nominating Committee may seek additional information regarding, and may request interviews with, any candidate it wishes to further pursue. Based upon all information reviewed and interviews conducted, the Corporate Governance and Nominating Committee will collectively determine whether to recommend the candidate to our entire Board of Directors.

During fiscal year 2015, the Corporate Governance and Nominating Committee retained a third-party search firm to assist in identifying, evaluating and recommending potential Director candidates. Candidates may also be recommended by other third-party search firms and current members of our Board of Directors. In addition, the Corporate Governance and Nominating Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as Directors, if such recommendations comply with the procedures set forth under the caption “Shareholder Recommendations for Director Nominees” beginning on page 84 of this Proxy Statement. The Corporate Governance and Nominating Committee will consider candidates recommended by shareholders on the same basis as candidates from other sources. The Corporate Governance and Nominating Committee generally will not, however, consider recommendations for Director nominees submitted by individuals who are not affiliated with us.

DIRECTOR QUALIFICATIONS; BOARD DIVERSITY.

We believe that oversight from a highly-qualified and diverse Board of Directors is essential for the short-term and long-term success of our business. The size and scope of our global operations, markets, product offerings and employee base raise a wide range of issues. Consequently, we strive to attract and retain Directors who represent a broad range of backgrounds, educations, experiences, skills and viewpoints that will enable them to individually and collectively address the issues affecting our Board of Directors, our business, our employees and our shareholders.

Our Board of Directors, through its Corporate Governance and Nominating Committee, diligently evaluates each Director and Director nominee and our Board of Directors as a whole to ensure that our Board of Directors has a complementary mix of qualified and diverse individuals designed to optimize the functioning and the decision-making and oversight roles of our Board of Directors and its Committees. Our Board of Directors does not have any formal policies with respect to Director qualifications or diversity. As a general matter, however, the Corporate Governance and Nominating Committee considers a broad range of factors such as judgment, skill, integrity, independence, possible conflicts of interest, experience with businesses and other organizations of comparable size or character, the interplay of the candidate’s experience and approach to addressing business issues with the experience and approach of incumbent members of our Board of Directors and other new Director candidates, and the candidate’s ability to effectively monitor and oversee the risks facing our business. More specifically, our Board of Directors seeks to identify nominees who have one or more of the following attributes:

| • | current or recent service as a Chief Executive Officer or in other senior executive positions; |

| • | current or recent service in senior leadership positions in global industrial companies of significant size; |

| • | significant experience in companies headquartered in and/or serving the key regions in which our business operates; |

| • | significant experience in operations, finance, accounting and other key areas; |

| • | ability to effectively monitor and oversee the most critical current risks facing our business; and/or |

| • | other relevant skills and experiences, including leadership positions in growth-oriented companies or companies involved in certain technologies and industries. |

4

Our Board of Directors Guidelines on Significant Corporate Governance Issues also require each of our Directors to comply with our Global Code of Business Conduct and otherwise act with the commitment, integrity, honesty, judgment and professionalism necessary to serve the long-term interests of our Board of Directors, our business, our employees and our shareholders.

Our Board of Directors has concluded that the nominees presented in the “Item 1 — Election of Directors” section beginning on page 11 of this Proxy Statement collectively represent a highly-qualified and diverse group of individuals that will effectively serve our Board of Directors, our business, our employees and our shareholders. Our Board of Directors believes that each nominee should serve on our Board of Directors for the coming year based on his or her record of effective past service on our Board of Directors and the specific experiences, qualifications, attributes and skills described in his or her biographical information presented in the “Item 1 — Election of Directors” section.

Management, our Board of Directors and its Committees are collectively engaged in identifying, overseeing, evaluating and managing the material risks facing our business and ensuring that our strategies and objectives work to minimize such risks. Our Board of Directors has the ultimate responsibility to monitor the risks facing our business.

Various members of our management are responsible for our day-to-day risk management activities, including members of our Human Resources, Internal Audit and Compliance, Legal, Tax, Risk Management, Treasury and Finance departments. Those individuals are charged with identifying, overseeing, evaluating and managing risks in their functional areas and for ensuring that any significant risks are addressed with the appropriate Committee of our Board of Directors. The risk areas for which each Committee is responsible are specifically described in the “Committees of the Board of Directors” section beginning on page 6 of this Proxy Statement. Management and the Chair of the applicable Committee ensure that any significant risks are reported to and addressed with the entire Board of Directors. Our Lead Director and the other Committee Chairs ensure that risk management is a recurring agenda item for meetings of our Board of Directors and its Committees.

Management and our Board of Directors and its Committees also engage outside advisors where appropriate to assist in the identification, oversight, evaluation and management of the risks facing our business. These outside advisors include our independent registered public accounting firm, external legal counsel and insurance providers, and the independent executive compensation consultant retained by the Human Resources and Compensation Committee of our Board of Directors.

Our Board of Directors believes that its current level of independence, leadership structure and qualifications and diversity of its members facilitate the effective identification, oversight, evaluation and management of risk. Our Lead Director meets regularly with our other independent Directors without management to discuss current and potential risks and the means of mitigating those risks, and has the authority to direct and evaluate management’s risk management efforts.

Management and our Board of Directors and its Committees view the risk management role of our Board of Directors and its Committees, and their relationship with management in the identification, oversight, evaluation and management of risk, as paramount to the short-term and long-term viability of our business. The ability to effectively monitor and oversee the most critical current risks facing our business is a key consideration for our Board of Directors and its Committees in identifying potential Board nominees and evaluating current Directors and Committee assignments.

5

COMMITTEES OF THE BOARD OF DIRECTORS

BOARD COMMITTEES; COMMITTEE CHARTERS.

Our Board of Directors has established, and has delegated certain authorities and responsibilities to, its Human Resources and Compensation Committee, Finance Committee, Corporate Governance and Nominating Committee and Audit Committee. Our Board of Directors has also adopted a written charter for each of these Committees, which is posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these charters, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000.

THE HUMAN RESOURCES AND COMPENSATION COMMITTEE.

The Human Resources and Compensation Committee of our Board of Directors is our standing compensation committee. The Human Resources and Compensation Committee met four times during fiscal year 2015. The Human Resources and Compensation Committee consists of six Directors, each of whom is independent as defined in our Independence Standards for Directors and in the listing standards of the New York Stock Exchange.

As described beginning on page 28 of this Proxy Statement, the Human Resources and Compensation Committee has various duties and responsibilities with respect to our processes, plans and programs for executive compensation, employee benefit and incentive compensation plans, and succession planning and talent management. In addition, the Human Resources and Compensation Committee works with its independent executive compensation consultant and our Human Resources, Legal and other management personnel to oversee and evaluate risks arising from:

| • | our compensation policies and practices for all employees; |

| • | our succession planning and talent development strategies and initiatives; and |

| • | other human resources issues facing our business. |

In particular, the Human Resources and Compensation Committee monitors any significant existing or potential risks arising from our compensation policies and practices for all employees through its oversight of an annual compensation risk review conducted by management and its independent executive compensation consultant. The results of this review are evaluated and discussed among management, the Human Resources and Compensation Committee and its independent executive compensation consultant and, if any significant risks are identified, the full Board of Directors. Based on the review conducted during fiscal year 2015, we do not believe that any risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect on our business.

The annual compensation risk review begins with a global assessment of any plans or programs that could potentially encourage excessive risk-taking or otherwise present significant risks to our business. The review also surveys our individual business units to determine whether any of them carries a significant portion of our risk profile, structures compensation significantly different than others or is significantly more profitable than others. The review then evaluates whether the applicable plans and programs are likely to encourage excessive risk-taking or detrimental behavior, vary significantly from our risk-reward structure, or otherwise present significant risks to our business.

During our fiscal year 2015 compensation risk review, we also identified and evaluated various mechanisms that we currently have in place that may serve to mitigate any existing or potential risks arising from our compensation policies and practices, including the following:

| • | our executive officers and other management-level employees are compensated with a mix of annual and long-term incentives, fixed and at-risk compensation, cash and equity compensation, and multiple forms of equity compensation; |

| • | compensation packages gradually become more focused on long-term, at-risk and equity compensation as our employees ascend to and through management-level positions; |

6

| • | our global compensation plans and programs generally utilize the same or substantially similar performance measures; |

| • | we use multiple performance measures to determine payout levels under certain elements of incentive compensation and different performance measures for our annual incentives as compared to our long-term incentives; |

| • | the performance of our employees is not evaluated or measured based solely on changes in our stock price; |

| • | our incentive compensation programs generally limit payouts to a specified maximum, while those that do not are mitigated by other factors (e.g., stock appreciation rights are mitigated by long-term vesting periods and stock ownership guidelines); |

| • | we do not offer “guaranteed” bonuses and all of our incentive compensation elements carry downside risk for participants; |

| • | our executive officers are subject to specific stock ownership guidelines, a “claw-back” policy and provisions requiring forfeiture of certain elements of incentive compensation upon termination for cause; |

| • | our compensation packages, including severance packages and supplemental pensions, are within market ranges; |

| • | the Human Resources and Compensation Committee has the discretion to assess the quality of our results in our various performance measures and the risks taken to attain those results in approving final incentive payouts; |

| • | our de-centralized organizational structure lessens the impact of any excessive risks taken by individual business units or operating groups; and |

| • | our employees are evaluated, measured and assessed based on their compliance with our Global Code of Business Conduct and other internal policies and controls, and the extent to which they act in the best interests of our business and our shareholders. |

During the annual compensation risk review, we also consider whether any changes to our compensation plans and programs may be necessary to further mitigate risk. The Human Resources and Compensation Committee did not make any such changes based on the results of our fiscal year 2015 review.

The Human Resources and Compensation Committee also provides regular reports of its activities to the full Board of Directors, as the full Board of Directors has the ultimate responsibility for monitoring the risks facing our business. The Human Resources and Compensation Committee may, in its discretion, create subcommittees of its members and delegate to them a portion of its duties and responsibilities.

The Finance Committee of our Board of Directors met twice during fiscal year 2015. The Finance Committee consists of five Directors, each of whom is independent as defined in our Independence Standards for Directors and in the listing standards of the New York Stock Exchange.

The Finance Committee has various duties and responsibilities with respect to our capital structure and financial strategies, including establishing policies and procedures for the financing and funding of our employee benefit and incentive compensation plans, reviewing our tax strategies, and reviewing and approving our debt and equity offerings and share repurchase programs. In addition, the Finance Committee works with our Legal, Tax, Risk Management, Treasury, Finance and other management personnel to oversee and evaluate risks arising from:

| • | balance sheet and other financial statement issues; |

| • | structure and amount of our debt and equity; |

| • | our employee benefit and incentive compensation plans (including funding and investment risks); |

| • | our insurance coverage and costs; |

7

| • | tax, credit and liquidity issues; and |

| • | other strategies for our financial risk management (including any use of hedges and derivative instruments). |

The Finance Committee also provides regular reports of its activities to the full Board of Directors, as the full Board of Directors has the ultimate responsibility for monitoring the risks facing our business.

THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE.

The Corporate Governance and Nominating Committee of our Board of Directors is our standing nominating committee. The Corporate Governance and Nominating Committee met twice during fiscal year 2015. The Corporate Governance and Nominating Committee consists of five Directors, each of whom is independent as defined in our Independence Standards for Directors and in the listing standards of the New York Stock Exchange.

The Corporate Governance and Nominating Committee has various duties and responsibilities with respect to our corporate governance, including identifying qualified nominees for election as Directors and qualified Directors for Committee membership, establishing evaluation procedures and completing an annual evaluation of the performance of our Board of Directors, and developing our corporate governance principles. In addition, the Corporate Governance and Nominating Committee works with our Legal and other management personnel to oversee and evaluate risks arising from:

| • | Director independence, qualifications and diversity issues; |

| • | Board of Directors and Committee leadership, composition, function and effectiveness; |

| • | alignment of the interests of our shareholders with the performance of our Board of Directors; |

| • | compliance with applicable corporate governance rules and standards; and |

| • | other corporate governance issues and trends. |

The Corporate Governance and Nominating Committee also provides regular reports of its activities to the full Board of Directors, as the full Board of Directors has the ultimate responsibility for monitoring the risks facing our business.

The Audit Committee of our Board of Directors is our standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee met five times during fiscal year 2015. The Audit Committee consists of six Directors, each of whom is independent as defined in our Independence Standards for Directors and in compliance with the listing standards of the New York Stock Exchange and under the federal securities laws.

Our Board of Directors has determined that Linda S. Harty, the Chair of the Audit Committee, is an audit committee financial expert as defined in the federal securities laws.

The Audit Committee has various duties and responsibilities with respect to our audit and compliance matters, including appointing, determining the compensation of and overseeing the work and independence of our independent registered public accounting firm, approving all non-audit engagements with our independent registered public accounting firm and reviewing with our financial management and our independent registered public accounting firm annual and quarterly financial statements, the proposed internal audit plan for each calendar year, the proposed independent audit plan for each fiscal year, the results of the audits and the adequacy of our internal control structure.

In addition, the Audit Committee works with our independent registered public accounting firm and our Internal Audit and Compliance, Legal and other management personnel to oversee and evaluate risks arising from:

| • | internal controls over financial reporting; |

8

| • | Form 10-K, Form 10-Q, earnings releases and other public filings and disclosures; |

| • | compliance with our Global Code of Business Conduct and other policies; and |

| • | litigation and claims. |

In this risk management role, the Audit Committee also oversees the operation of our global compliance and internal audit programs. These programs are designed to identify, oversee, evaluate and manage the primary risks associated with our business and our particular business units and functional areas. Our Vice President—Internal Audit and Compliance supervises these programs and discusses issues related to these programs directly with the Audit Committee. The Audit Committee also meets privately at each of its meetings with representatives from our independent registered public accounting firm and our Vice President—Internal Audit and Compliance.

The Audit Committee also provides regular reports of its activities to the full Board of Directors, as the full Board of Directors has the ultimate responsibility for monitoring the risks facing our business.

REVIEW AND APPROVAL OF TRANSACTIONS WITH RELATED PERSONS.

The Charter of the Corporate Governance and Nominating Committee provides that the Corporate Governance and Nominating Committee is responsible for considering questions of possible conflicts of interest of Directors and management and for making recommendations to prevent, minimize or eliminate such conflicts of interest. Our Global Code of Business Conduct provides that our Directors, officers, employees and their spouses and other close family members must avoid interests or activities that create any actual or potential conflict of interest. These restrictions cover, among other things, interests or activities that result in receipt of improper personal benefits by any person as a result of his or her position as our Director, officer, employee or as a spouse or other close family member of any of our Directors, officers or employees. Our Global Code of Business Conduct also requires our Directors, officers and employees to promptly disclose any potential conflicts of interest to our General Counsel. We also require that each of our executive officers and Directors complete a detailed annual questionnaire that requires, among other things, disclosure of any transactions with a related person meeting the minimum threshold for disclosure under the relevant Securities and Exchange Commission, or SEC, rules. All responses to the annual questionnaires are reviewed and analyzed by our legal counsel and, if necessary or appropriate, presented to the Corporate Governance and Nominating Committee for analysis, consideration and, if appropriate, approval.

The Corporate Governance and Nominating Committee will consider the following in determining if any transaction presented should be approved, ratified or rejected:

| • | the nature of the related person’s interest in the transaction; |

| • | the material terms of the transaction; |

| • | the importance of the transaction to the related person and to us; |

| • | whether the transaction would impair the judgment or the exercise of the fiduciary obligations of any Director or executive officer; |

| • | the possible alternatives to entering into the transaction; |

| • | whether the transaction is on terms comparable to those available to third parties; and |

| • | the potential for an actual or apparent conflict of interest. |

During fiscal year 2015, we reviewed the annual questionnaires and determined that no potential related-party transactions exist. This review included a detailed evaluation of the transactions reviewed and analyzed by our Board of Directors in determining Director independence as described in the “Director Independence” section beginning on page 2. Based on management’s review and analysis, no potential related-party transactions were presented to the Corporate Governance and Nominating Committee for analysis, consideration or approval.

9

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE.

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, Directors and beneficial owners of more than 10% of our Common Shares to file initial stock ownership reports and reports of changes in ownership with the SEC. SEC regulations require that we are furnished with copies of these reports. Based solely on a review of these reports and written representations from our executive officers and Directors, we believe that there was compliance with all such filing requirements for fiscal year 2015, except that Kurt A. Keller, Vice President and President—Asia Pacific Group, inadvertently filed one late Form 4 to report the distribution of common shares from his spouse’s 401(k) plan upon her retirement and Daniel S. Serbin, Executive Vice President—Human Resources and External Affairs, inadvertently filed one late Form 4 to report a gift of common shares, which was made during fiscal year 2014.

10

ITEM 1 – ELECTION OF DIRECTORS

We are seeking shareholder approval to elect Lee C. Banks, Robert G. Bohn, Linda S. Harty, William E. Kassling, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson, James L. Wainscott, Donald E. Washkewicz and Thomas L. Williams as Directors for a term of office that will expire at the Annual Meeting of Shareholders in 2016. A plurality of the common shares voted in person or by proxy is required to elect a Director. Our Board of Directors Guidelines on Significant Corporate Governance Issues, however, require any current Director who receives a greater number of votes “withheld” than votes “for” in an uncontested election to submit a written offer of resignation to the Corporate Governance and Nominating Committee and requires our Corporate Governance and Nominating Committee and our Board of Directors to act on that written offer of resignation.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of another person for Director as our Board of Directors may recommend. However, our Board of Directors has no reason to believe that this circumstance will occur.

NOMINEES FOR ELECTION AS DIRECTORS FOR TERMS EXPIRING IN 2016

|

Director since 2015 |

LEE C. BANKS Age: 52 Committees: None

Mr. Banks has been our President and Chief Operating Officer since February 2015. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015. Mr. Banks is also a Director of Nordson Corporation.

Our Board of Directors believes that Mr. Banks will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• current service as President and Chief Operating Officer and extensive service in various operational leadership positions during his 23-year career with us;

• intimate, working knowledge of our day-to-day business, plans, strategies and initiatives;

• present service on another public company board;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our employees and our shareholders, and a high level of integrity, honesty, judgment and professionalism. |

11

|

Director since 2010 |

ROBERT G. BOHN Age: 62 Committees: Audit Committee Human Resources and Compensation Committee

Now retired, Mr. Bohn was Chairman of the Board of Oshkosh Corporation (specialty vehicles and vehicle bodies manufacturing) from January 2000 to February 2011 and Chief Executive Officer of Oshkosh from November 1997 to December 2010. Mr. Bohn is also a Director of Carlisle Companies, Inc. and The Manitowoc Company, Inc.

Our Board of Directors believes that Mr. Bohn will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of Oshkosh Corporation, a successful global industrial company of significant size;

• past and present service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2007 |

LINDA S. HARTY Age: 55 Committees: Audit Committee (Chair) Finance Committee

Ms. Harty has been Treasurer of Medtronic, Inc. (medical technology) since February 2010.

Our Board of Directors believes that Ms. Harty will effectively serve our Board of Directors, our business, our employees and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior finance and accounting leadership positions at both Cardinal Health, Inc. and Medtronic, Inc., successful global healthcare and medical technology companies of significant size;

• qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

12

|

Director since 2001 |

WILLIAM E. KASSLING Age: 71 Committees: Audit Committee Human Resources and Compensation Committee

Mr. Kassling has been Lead Director of the Board of Directors of Wabtec Corporation (technology-based equipment for the rail industry) since May 2013. He was previously Chairman of the Board of Wabtec from 1990 to May 2013.

Our Board of Directors believes that Mr. Kassling will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of Wabtec Corporation, a successful global industrial company of significant size;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2002 |

ROBERT J. KOHLHEPP Age: 71 Committees: Corporate Governance and Nominating Committee (Chair and Lead Director) Human Resources and Compensation Committee

Mr. Kohlhepp has been Chairman of the Board of Cintas Corporation (uniform rental) since October 2009 and has been a Director of Cintas since 1979.

Our Board of Directors believes that Mr. Kohlhepp will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• current service as Chairman and extensive service as Chief Executive Officer, Vice Chairman and a Director of Cintas Corporation, a successful global product and service provider company of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to effectively serve as our Lead Director and to otherwise work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

13

|

Director since 2013 |

KEVIN A. LOBO Age: 50 Committees: Audit Committee Finance Committee

Mr. Lobo has been Chairman of the Board of Stryker Corporation (medical technology) since July 2014 and has been Chief Executive Officer, President and a Director since October 2012. He was President of Orthopaedics Group of Stryker from June 2011 to October 2012; President of Neurotechnology and Spine Group of Stryker from April 2011 to June 2011; and President of Ethicon Endo-Surgery, a subsidiary of Johnson & Johnson (home and health care products and services), from July 2006 to March 2011.

Our Board of Directors believes that Mr. Lobo will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior leadership positions at both Stryker Corporation and Johnson & Johnson, successful global medical technology and home and health care products companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 1998 |

KLAUS-PETER MÜLLER Age: 70 Committees: Corporate Governance and Nominating Committee Finance Committee

Mr. Müller has been Chairman of the Supervisory Board of Commerzbank AG (international banking) in Frankfurt, Germany since May 2008.

Our Board of Directors believes that Mr. Müller will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior leadership positions with Commerzbank AG, a significant financial institution in Europe;

• strong finance background and extensive knowledge of European businesses and related issues and trends;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

14

|

Director since 2002 |

CANDY M. OBOURN Age: 65 Committees: Human Resources and Compensation Committee (Chair) Corporate Governance and Nominating Committee

Ms. Obourn has been Chairman of Isoflux Incorporated (coating technologies) since April 2012. She was previously Chief Executive Officer and President of Isoflux Incorporated from August 2010 to April 2012; and Chief Executive Officer and President of ActivEase Healthcare, Inc. (women’s health care products) from February 2006 to August 2010. She is also Chairman of the Board of Directors of ESL Federal Credit Union.

Our Board of Directors believes that Ms. Obourn will effectively serve our Board of Directors, our business, our employees and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• service as Chief Executive Officer and President of a coating technologies company, Chief Executive Officer and President of a health care products company and in senior leadership positions at other global companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2004 |

JOSEPH SCAMINACE Age: 62 Committees: Corporate Governance and Nominating Committee Human Resources and Compensation Committee

Mr. Scaminace has been a Director and Chief Executive Officer of OM Group, Inc. (metal-based specialty chemicals) since June 2005 and Chairman of the Board of OM Group since August 2005. He was previously President of OM Group from June 2005 to April 2013. Mr. Scaminace is also a Director of The Cleveland Clinic Foundation and Cintas Corporation.

Our Board of Directors believes that Mr. Scaminace will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of OM Group, Inc., and prior leadership positions at other global industrial companies of significant size;

• past and present service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

15

|

Director since 1992 |

WOLFGANG R. SCHMITT Age: 71 Committees: Audit Committee Corporate Governance and Nominating Committee

Now retired, Mr. Schmitt was the Chief Executive Officer of Trends 2 Innovation (strategic growth consultants) from May 2000 to April 2015.

Our Board of Directors believes that Mr. Schmitt will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer of a strategic growth consulting company and prior leadership positions at other global industrial companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2010 |

ÅKE SVENSSON Age: 63 Committees: Audit Committee Finance Committee

Mr. Svensson has been Director General of the Association of Swedish Engineering Industries since September 2010. He was previously the Chief Executive Officer and President of Saab AB (aerospace, defense and security industry) from July 2003 to September 2010. Mr. Svensson was formerly a Director of the Swedish Export Credit Corporation, Micronic Mydata and Saab AB.

Our Board of Directors believes that Mr. Svensson will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and President of Saab AB, a successful European aerospace, defense and security company of significant size;

• extensive knowledge of European aerospace, defense and security businesses and related issues and trends;

• independence under the applicable independence standards of the New York Stock Exchange, federal securities laws and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

16

|

Director since 2009 |

JAMES L. WAINSCOTT Age: 58 Committees: Finance Committee (Chair) Human Resources and Compensation Committee

Mr. Wainscott has been Chairman of the Board of AK Steel Holding Corporation (steel producer) since January 2006 and President, Chief Executive Officer and a Director of AK Steel Holding since October 2003.

Our Board of Directors believes that Mr. Wainscott will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President, Chief Executive Officer and Chairman of the Board of AK Steel Holding Corporation, a successful global industrial company of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2000 |

DONALD E. WASHKEWICZ Age: 65 Committees: None

Mr. Washkewicz has been our Chairman of the Board of Directors since October 2004. He was our Chief Executive Officer from July 2001 to February 2015 and our President from January 2007 to February 2015.

Our Board of Directors believes that Mr. Washkewicz will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chairman of the Board, President, and Chief Executive Officer and in various operational leadership positions during his 43-year career with us;

• intimate, working knowledge of our day-to-day business, plans, strategies and initiatives;

• proven ability to work efficiently and effectively with our Lead Director and our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our employees and our shareholders, and a high level of integrity, honesty, judgment and professionalism. | |

17

|

Director since 2015 |

THOMAS L. WILLIAMS Age: 56 Committees: None

Mr. Williams has been our Chief Executive Officer since February 2015. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015. Mr. Williams is also a Director of Chart Industries, Inc.

Our Board of Directors believes that Mr. Williams will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• current service as Chief Executive Officer and extensive service as Executive Vice President and Operating Officer and in various operational leadership positions during his 12-year career with us;

• intimate, working knowledge of our day-to-day business, plans, strategies and initiatives;

• present service on another public company board;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our employees and our shareholders, and a high level of integrity, honesty, judgment and professionalism. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS.

18

COMPANY PROPOSALS RELATING TO CORPORATE GOVERNANCE MATTERS

We are asking our shareholders to approve two corporate governance proposals that our Board of Directors believes are in the best interests of our shareholders and our Company. Before voting on either of these proposals, we urge you to carefully read and consider each proposal as described in detail on the following pages 20-22 of this Proxy Statement.

| • | Item 2 would amend our Amended Articles of Incorporation to implement a majority voting standard for uncontested Director elections, as currently prescribed in our Board of Directors Guidelines on Significant Corporate Governance Issues. This proposed majority voting standard would require that each Director candidate receive more votes “for” than “against” to be elected in an uncontested election. Conversely, a Director candidate who receives more votes “against” than “for” would not be elected in an uncontested election. Our Board of Directors is proposing this majority voting standard in full support of, and to reinforce the Board of Director’s accountability to, the interests of a significant number of our shareholders, as expressed at our 2014 Annual Meeting of Shareholders. |

| • | Item 3 would amend our Amended Articles of Incorporation to eliminate cumulative voting in Director elections. Our Board of Directors is proposing to eliminate cumulative voting because it views cumulative voting as incompatible with the objectives of a majority voting standard, and because it views the elimination of cumulative voting as important to ensuring that a majority voting standard is properly and effectively implemented. |

Our Board of Directors has determined that Items 2 and 3 together represent a carefully balanced and integrated approach designed to further provide shareholders a net positive result by empowering and enhancing the voice of our shareholders in Director elections. These proposals are designed to work together to promote an orderly Director election process that respects and satisfies the will of a majority of our shareholders. Because these amendments are designed to work together, the implementation of each of Item 2 (the proposal to adopt an amendment to our Amended Articles of Incorporation to implement a majority voting standard in uncontested Director elections) and Item 3 (the proposal to adopt an amendment to our Amended Articles of Incorporation to eliminate cumulative voting in Director elections) is conditioned on shareholder approval of both proposals. In other words, if either Item 2 or Item 3 is not approved, then neither proposal will be implemented.

Each of Item 2 and Item 3 require the affirmative vote of the holders of shares entitling them to exercise two-thirds of the voting power of such shares. Consequently, it is important that you vote on these items.

19

ITEM 2 – ADOPTION OF AN AMENDMENT TO OUR AMENDED ARTICLES OF INCORPORATION TO IMPLEMENT A MAJORITY VOTING STANDARD FOR UNCONTESTED DIRECTOR ELECTIONS

Under this Item 2, we are asking our shareholders to adopt an amendment to our Amended Articles of Incorporation to implement a majority voting standard in uncontested Director elections. Following the declassification of our Board of Directors in 2007 and consistent with our history of implementing policies to reinforce the accountability of our Board of Directors to our shareholders, we adopted a policy (in our Board of Directors Guidelines on Significant Corporate Governance Issues) requiring any Director candidate in an uncontested election who receives a greater number of votes “withheld” than “for” his or her election to submit a written offer of resignation to our Corporate Governance and Nominating Committee, and our Corporate Governance and Nominating Committee and our Board of Directors to act on that written offer of resignation.

At the 2014 Annual Meeting of Shareholders, our shareholders showed strong support in favor of our Board of Directors initiating a process to amend our Amended Articles of Incorporation to implement a majority voting standard for uncontested Director elections. Our Board of Directors is proposing this majority voting standard to reflect the desire of those shareholders and reinforce our commitment to accountability and strong corporate governance practices. In August 2015, our Corporate Governance and Nominating Committee recommended, and our Board of Directors unanimously adopted, resolutions approving and recommending to shareholders the adoption of an amendment to our Amended Articles of Incorporation to implement a majority voting standard in uncontested Director elections.

Under the proposed majority voting standard, for a candidate to be elected to our Board of Directors in an “uncontested election,” the number of votes cast “for” the candidate’s election must exceed the number of votes cast “against” his or her election. Abstentions and broker non-votes would not be considered votes “for” or “against” a candidate. An “uncontested election” means an election in which the number of Director candidates does not exceed the number of Directors to be elected. In all other Director elections, which we refer to as contested elections, a plurality voting standard would apply.

Our Board of Directors has concluded that the adoption of the proposed majority voting standard in uncontested elections will give shareholders a greater voice in determining the composition of our Board of Directors by giving effect to shareholder votes “against” a Director candidate, and by requiring a majority of shareholder votes for a candidate to obtain or retain a seat on our Board of Directors. The adoption of this standard in uncontested elections is intended to reinforce the accountability of our Board of Directors to our shareholders voting in uncontested Director elections. If adopted by our shareholders at this Annual Meeting of Shareholders, the majority vote standard would apply to all future uncontested Director elections.

Our Board of Directors further believes that a plurality voting standard should still apply in contested Director elections. If the plurality voting standard did not apply in contested elections, it is possible that more candidates could be elected than the number of Director seats up for election because the proposed majority voting standard simply compares the number of “for” votes with the number of “against” votes for each Director candidate without regard to voting for other candidates. Accordingly, the proposed majority voting standard retains plurality voting in contested Director elections to avoid such results.

If this Item 2 is approved by our shareholders and implemented, we expect to retain our Director resignation policy (our current majority voting policy) as set forth in our Board of Directors Guidelines on Significant Corporate Governance Issues, conformed as necessary to reflect the provisions of this Item 2 and Item 3. Under Ohio law and our Code of Regulations, as amended, an incumbent Director who is not re-elected remains in office until his or her successor is elected, continuing as a “holdover” Director. We expect our policy to continue to require an incumbent Director who does not receive more votes “for” than “against” his or her election in an uncontested election to submit a written offer of resignation to our Corporate Governance and Nominating Committee, which will make a recommendation to our Board of Directors as to whether or not it should be accepted. Our Board of Directors will consider the recommendation and decide whether to accept the resignation as described in more detail in our Board of Directors Guidelines on Significant Corporate Governance Issues.

20

Our Amended Articles of Incorporation currently do not address the voting standard that applies to the election of Directors, which means under Ohio law that the plurality voting standard applies unless the Amended Articles of Incorporation are amended. The actual text of the proposed Article SEVENTH to our Amended Articles of Incorporation, marked with underlining to indicate additions, is attached to this Proxy Statement as Annex A. The amendment to the Amended Articles of Incorporation will become effective upon filing with the Secretary of State of Ohio (which is expected to occur promptly following shareholder approval), subject to shareholder approval of Item 3.

Shareholder Approval

The affirmative vote of the holders of shares of our common stock entitling them to exercise two-thirds of the voting power of such shares is necessary to amend the Company’s Amended Articles of Incorporation to include Article SEVENTH, as described in this Item 2. Abstentions and broker non-votes will have the same effect as votes cast against this Item 2. As noted above, if this Item 2 is approved by our shareholders at the Annual Meeting of Shareholders, it will be implemented only if Item 3 is also approved. Accordingly, even if this Item 2 is approved by our shareholders at the Annual Meeting of Shareholders, it will not be implemented unless Item 3 is also approved by our shareholders at the Annual Meeting of Shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE PROPOSAL TO APPROVE AN AMENDMENT TO OUR AMENDED ARTICLES OF INCORPORATION IMPLEMENTING A MAJORITY VOTING STANDARD FOR UNCONTESTED DIRECTOR ELECTIONS.

ITEM 3 – ADOPTION OF AN AMENDMENT TO OUR AMENDED ARTICLES OF INCORPORATION TO ELIMINATE CUMULATIVE VOTING IN DIRECTOR ELECTIONS

Under this Item 3, we are asking our shareholders to approve an amendment to our Amended Articles of Incorporation to eliminate cumulative voting in Director elections. Under Ohio law, because our Amended Articles of Incorporation currently do not address cumulative voting, our shareholders can cumulate votes in Director elections at any meeting held for that purpose, whether or not the election is contested. Cumulative voting enables a shareholder to cumulate his or her voting power by giving one candidate a number of votes equal to the number of Directors to be elected multiplied by the number of shares held by the shareholder, or distributing those votes among two or more candidates as the shareholder sees fit. Thus, with cumulative voting, a shareholder can cast all of his, her or its votes “for” one candidate or a small group of candidates, instead of voting either “for” or “withheld” on each candidate.

Consequently, a candidate may be elected even if he or she was not supported by the holders of a majority of our shares. For example, because 14 Directors are to be elected at the Annual Meeting of Shareholders, a shareholder holding slightly more than 5% of our outstanding common shares, by merely cumulating and casting votes for a single Director candidate, could elect one Director in a contested election, even if the candidate is not supported by nearly 95% of shareholders, based on 138,418,792 common shares outstanding on July 31, 2015 and assuming approximately 80% of the outstanding common shares are voted at the Annual Meeting of Shareholders.

As described under Item 2, we are asking shareholders to implement a majority voting standard in uncontested Director elections in accordance with the desire of a significant number of our shareholders, as expressed at our 2014 Annual Meeting of Shareholders. As discussed in Item 2 above, the objective of a majority voting standard is to reinforce the accountability of the Board of Directors to shareholders voting in uncontested Director elections by ensuring that the Board composition is determined by the holders of a majority of the outstanding shares. Our Board of Directors believes that cumulative voting is incompatible with that objective, as the effect of cumulative voting is potentially to allow a shareholder that holds significantly less than a majority of the outstanding voting power to elect one or more Directors. Our Board of Directors further believes that only a very few companies in the Fortune 500 continue to have cumulative voting in the election of directors. Therefore, our Board of Directors believes that eliminating cumulative voting is a necessary and essential element to effectively implementing a majority voting standard in uncontested Director elections.

21

Our Board of Directors believes that each Director is accountable to and should represent the interests of all of our shareholders, and not just to a minority shareholder that has cumulatively voted its shares and that may have special interests contrary to those of a majority of our shareholders. Among other things, the election of Directors who view themselves as representing a particular minority shareholder could result in partisanship and discord on our Board of Directors, and may impair the ability of the Directors to act in the best interests of all of our shareholders and our Company. Our Board of Directors, therefore, believes that each candidate should be elected only if he or she receives majority support, which cumulative voting could potentially preclude.

In addition, cumulative voting and majority voting are procedurally incompatible, and attempting to combine them in the same election of Directors could create confusion and uncertainty in the Director election process. If, for example, both majority voting and cumulative voting applied in the same election of Directors, it would be very possible that a number of candidates may not receive a majority of votes causing our Board of Directors to have multiple vacancies.

For these reasons, our Board of Directors determined that it is appropriate to eliminate cumulative voting in connection with the adoption of the majority voting standard. Accordingly, in August 2015, on the recommendation of our Corporate Governance and Nominating Committee, our Board of Directors unanimously adopted resolutions approving and recommending to shareholders the adoption of an amendment to our Amended Articles of Incorporation to eliminate cumulative voting in Director elections.

This proposal to eliminate cumulative voting is not in response to any shareholder effort of which we are aware to remove any of our Directors or otherwise gain representation on our Board of Directors, to accumulate shares of our common stock, or to obtain control of our Company or our Board of Directors by means of a solicitation in opposition to management or otherwise.