UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PARKER-HANNIFIN CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OCTOBER 26, 2016

TO OUR SHAREHOLDERS:

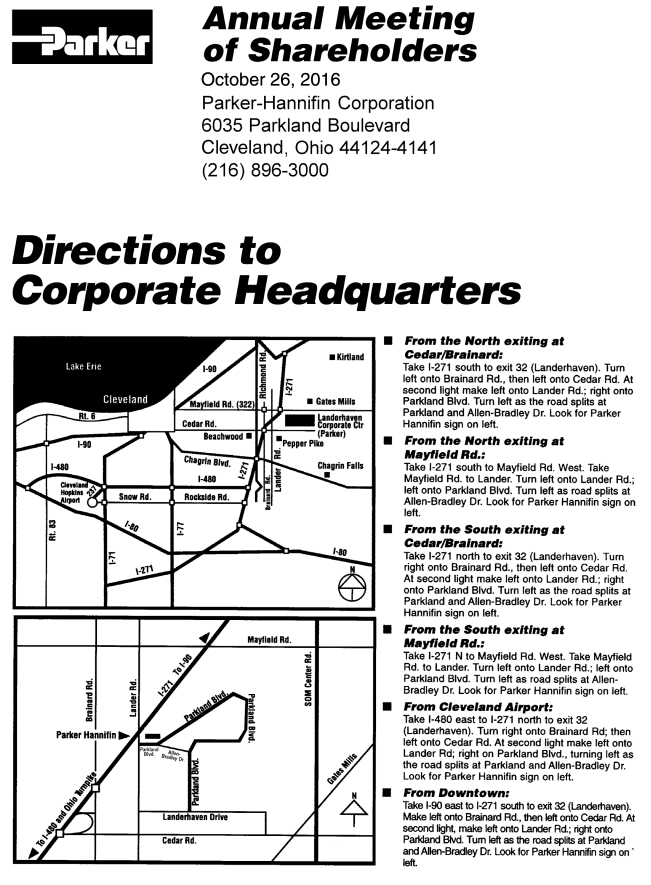

You are cordially invited to attend the Annual Meeting of Shareholders of Parker-Hannifin Corporation. The meeting will be held at our headquarters located at 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, on Wednesday, October 26, 2016, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect Lee C. Banks, Robert G. Bohn, Linda S. Harty, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson, James R. Verrier, James L. Wainscott and Thomas L. Williams as Directors for a term expiring at the Annual Meeting of Shareholders in 2017; |

| 2. | To consider and vote upon a management proposal to adopt an amendment to our Code of Regulations to establish procedures for advance notice of Director nominations and other business at shareholder meetings; |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2017; |

| 4. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| 5. | To approve the Parker-Hannifin Corporation 2016 Omnibus Stock Incentive Plan; and |

| 6. | To transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on August 31, 2016 are entitled to vote at the meeting. Your vote is important, so if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the enclosed proxy card. Please refer to the section “How to Attend the Annual Meeting of Shareholders” and to the back page of this Proxy Statement for directions to attend the annual meeting.

Thank you for your support of Parker-Hannifin Corporation.

| By Order of the Board of Directors |

|

| Joseph R. Leonti |

| Secretary |

September 26, 2016

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be held on October 26, 2016.

This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2016, is available free of charge on our investor relations website (www.phstock.com).

|

Page | ||

| 1 | ||

| 1 | ||

| 3 | ||

| 3 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 22 | ||

| 22 | ||

| Objectives and Philosophies of the Executive Compensation Program |

22 | |

| 22 | ||

| “Pay-for-Performance”— Structure, Key Financial Metrics and Impact on Compensation Payouts |

23 | |

| Highlights and Significant Changes to Executive Compensation Program |

26 | |

| Administration, Oversight and Determination of Executive Compensation |

26 | |

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| General Policies and Practices Relating to Executive Compensation |

30 | |

| 30 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 34 | ||

| 39 | ||

| 43 | ||

| 49 | ||

| 50 | ||

| 51 | ||

| 52 | ||

| 52 | ||

| 54 | ||

| 56 | ||

| 59 |

i

ii

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting of Shareholders scheduled to be held on October 26, 2016, and at all adjournments thereof. Only shareholders of record at the close of business on August 31, 2016 will be entitled to vote at the meeting. On August 31, 2016, 133,772,075 common shares were outstanding and entitled to vote at the meeting. Each share is entitled to one vote. This Proxy Statement and the form of proxy are being mailed to shareholders on or about September 26, 2016.

Our Global Code of Business Conduct, Board of Directors Guidelines on Significant Corporate Governance Issues and Independence Standards for Directors are posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these documents, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000. The information contained on or accessible through our website is not a part of this Proxy Statement.

This summary highlights information relating to items to be voted on at this Annual Meeting of Shareholders and compensation and corporate governance matters. Additional details are found in the discussions contained in this Proxy Statement.

|

General Information for 2016 Annual Meeting of Shareholders

| ||

|

Time and Date |

October 26, 2016 at 9:00 A.M. EDT | |

|

Place |

Parker-Hannifin Corporation 6035 Parkland Boulevard Cleveland, Ohio 44124-4141 | |

|

Record Date |

August 31, 2016 | |

|

Voting Matters and Recommendations

| ||

|

Voting Matter |

Board Recommendations | |

| Election of Directors | FOR ALL NOMINEES | |

| Management proposal to adopt an amendment to our Code of Regulations to establish procedures for advance notice of Director nominations and other business at shareholder meetings | FOR | |

| Ratification of Deloitte & Touche LLP as Independent Registered Public Accounting Firm for fiscal year ending June 30, 2017 | FOR | |

| Approve, on a non-binding, advisory basis, the compensation of our named executive officers | FOR | |

| Approval of the Parker-Hannifin Corporation 2016 Omnibus Stock Incentive Plan | FOR | |

1

We are pleased to provide the following key governance and compensation highlights, which include important changes made during fiscal year 2016. We believe that these measures will better position us to continue to drive profitable growth and financial performance and otherwise compete and win as a leading worldwide diversified manufacturer of motion and control technologies and systems, utilizing key insights drawn from engagement with our shareholders and our shareholders’ votes.

Our Board of Directors is committed to sound corporate governance, promoting the long-term interests of our shareholders and holding itself and management accountable for performance. The following table summarizes some of the key elements of our corporate governance framework.

|

Governance Highlights

| ||||

| ü Annual election of all Directors |

ü Separate Chairman of the Board and Lead Director roles | |||

|

ü Majority voting and resignation policy for uncontested Director elections |

ü Board Committees are 100% comprised of independent Directors | |||

|

ü Two women serve as members of our Board of Directors |

ü Independent Directors meet regularly and frequently (at least four times per year) without management present | |||

|

ü Our Shareholder Protection Rights Agreement, as amended, is due to expire in February 2017 and there is no current plan for renewal |

ü Our focus on Director refreshment recently led to the addition of two new independent Directors | |||

|

ü Published Governance Guidelines |

ü Annual Board and Committee evaluations | |||

|

ü Published Global Code of Business Conduct applicable to our Board of Directors |

ü Annual review of Chief Executive Officer by all independent Directors | |||

|

ü Each Committee of our Board of Directors has a published charter that is reviewed and discussed at least annually |

ü Robust stock ownership guidelines for Directors and executive officers | |||

|

ü None of our Director nominees are “overboarded” – five of our Directors do not sit on any other public company board of directors, seven of our Directors sit on just one other public company board of directors and one Director sits on two other public company boards of directors |

ü 62% of our Director nominees have a tenure of under 10 years.

Director tenure of this year’s Director nominees:

0-5 years: 31% 6-10 years: 31% ³10 years: 38% | |||

|

ü Our Sustainability Report is published annually, addressing our commitment to, and actions and oversight around, sustainability; governance, ethics and compliance; our people; the planet; and product stewardship. | ||||

The table below highlights key aspects of our executive compensation program for fiscal year 2016. The table is not a substitute for, nor does it reflect, all of the information provided in our Compensation Discussion and Analysis and in the Compensation Tables presented later in this Proxy Statement.

|

Compensation Highlights

| ||||

| ü Tax gross-ups have been eliminated from our executive compensation plans and programs on a prospective basis |

ü All future change in control severance agreements provide for double trigger vesting acceleration (a change from the practice of a modified single trigger vesting acceleration) | |||

|

ü Annual advisory vote on executive compensation with consistent high degree of approval |

ü Anti-hedging and anti-pledging policy for Directors and executive officers | |||

|

ü Clawback policy to recover or withhold incentive-based compensation paid to executive officers |

ü Executive compensation program with pay-for-performance structure aligned with The Win StrategyTM | |||

|

ü Chief Executive Officer’s compensation package is a mix of 10% fixed and 90% at risk |

ü Average compensation mix for Named Executive Officers other than our Chief Executive Officer is a mix of 15% fixed and 85% at risk | |||

2

ITEM 1 – ELECTION OF DIRECTORS

Shareholder approval is sought to elect Lee C. Banks, Robert G. Bohn, Linda S. Harty, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson, James R. Verrier, James L. Wainscott and Thomas L. Williams for a term that will expire at the Annual Meeting of Shareholders in 2017. Each candidate for Director is elected only if the votes “for” the candidate exceed the votes “against” the candidate. Abstentions and broker non-votes shall not be counted as votes “for” or “against” a candidate. If the number of candidates exceeds the number of Directors to be elected, then in that election the candidates receiving the greatest number of votes shall be elected.

Our Board of Directors has concluded that the nominees presented in this “Item 1 — Election of Directors” collectively represent a highly-qualified and diverse group of individuals that will effectively serve our Board of Directors, our business, our employees and our shareholders. Our Board of Directors believes that each nominee should serve on our Board of Directors for the coming year based on his or her record of effective past service on our Board of Directors and the specific experiences, qualifications, attributes and skills described in his or her biographical information presented in this “Item 1 — Election of Directors” section.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of another person as our Board of Directors may recommend. However, our Board of Directors has no reason to believe that this circumstance will occur.

NOMINEES FOR ELECTION AS DIRECTORS FOR TERMS EXPIRING IN 2017

|

Director since 2015 |

LEE C. BANKS Age: 53 Committees: None

Mr. Banks has been our President and Chief Operating Officer since February 2015. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015. Mr. Banks is also a Director of Nordson Corporation.

Our Board of Directors believes that Mr. Banks will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President and Chief Operating Officer and Executive Vice President and Operating Officer and in various operational leadership positions during his 24-year career with us;

• intimate,working knowledge of our day-to-day business, plans, strategies and initiatives;

• present service on another public company board;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our employees and our shareholders, and a high level of integrity, honesty, judgment and professionalism. |

3

|

Director since 2010 |

ROBERT G. BOHN Age: 63 Committees: Audit Committee Human Resources and Compensation Committee

Now retired, Mr. Bohn was Chairman of the Board of Oshkosh Corporation (specialty vehicles and vehicle bodies manufacturing) from January 2000 to February 2011 and Chief Executive Officer of Oshkosh from November 1997 to December 2010. Mr. Bohn is also a Director of Carlisle Companies, Inc. and The Manitowoc Company, Inc.

Our Board of Directors believes that Mr. Bohn will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of Oshkosh Corporation, a successful global industrial company of significant size;

• past and present service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2007 |

LINDA S. HARTY Age: 56 Committees: Audit Committee (Chair) Finance Committee

Ms. Harty has been Treasurer of Medtronic plc. (medical technology) since February 2010. Ms. Harty is also a Director of Wabtec Corporation.

Our Board of Directors believes that Ms. Harty will effectively serve our Board of Directors, our business, our employees and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior finance and accounting leadership positions at both Cardinal Health, Inc. and Medtronic, Inc., successful global healthcare and medical technology companies of significant size;

• present service on another public company board;

• qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

4

|

Director since 2002 |

ROBERT J. KOHLHEPP Age: 72 Committees: Corporate Governance and Nominating Committee (Chair and Lead Director) Human Resources and Compensation Committee

Mr. Kohlhepp has been Chairman of the Board of Cintas Corporation (uniform rental) since October 2009 and has been a Director of Cintas since 1979.

Our Board of Directors believes that Mr. Kohlhepp will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer, Chairman, Vice Chairman and a Director of Cintas Corporation, a successful global industrial company of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to effectively serve as our Lead Director and to otherwise work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2013 |

KEVIN A. LOBO Age: 51 Committees: Audit Committee Finance Committee

Mr. Lobo has been Chairman of the Board of Stryker Corporation (medical technology) since July 2014 and has been Chief Executive Officer, President and a Director since October 2012. He was President of Orthopaedics Group of Stryker from June 2011 to October 2012; and President of Neurotechnology and Spine Group of Stryker from April 2011 to June 2011.

Our Board of Directors believes that Mr. Lobo will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior leadership positions at both Stryker Corporation and Johnson & Johnson, successful global medical technology and home and health care products companies of significant size;

• qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

5

|

Director since 1998 |

KLAUS-PETER MÜLLER Age: 71 Committees: Corporate Governance and Nominating Committee Finance Committee

Mr. Müller has been Chairman of the Supervisory Board of Commerzbank AG (international banking) in Frankfurt, Germany since May 2008.

Our Board of Directors believes that Mr. Müller will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior leadership positions with Commerzbank AG, a significant financial institution in Europe;

• strong finance background and extensive knowledge of European businesses and related issues and trends;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2002 |

CANDY M. OBOURN Age: 66 Committees: Human Resources and Compensation Committee (Chair) Corporate Governance and Nominating Committee

Ms. Obourn has been Chairman of Isoflux Incorporated (coating technologies) since April 2012. She was previously Chief Executive Officer and President of Isoflux Incorporated from August 2010 to April 2012; and Chief Executive Officer and President of ActivEase Healthcare, Inc. (women’s health care products) from February 2006 to August 2010.

Our Board of Directors believes that Ms. Obourn will effectively serve our Board of Directors, our business, our employees and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• service as Chief Executive Officer and President of a coating technologies company, Chief Executive Officer and President of a health care products company and in senior leadership positions at other global companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

6

|

Director since 2004 |

JOSEPH SCAMINACE Age: 63 Committees: Corporate Governance and Nominating Committee Human Resources and Compensation Committee

Mr. Scaminace was a Director and Chief Executive Officer of OM Group, Inc. (metal-based specialty chemicals) from June 2005 to October 2015; Chairman of the Board of OM Group from August 2005 to October 2015; and President of OM Group from June 2005 to April 2013. Mr. Scaminace is also a Director of The Cleveland Clinic Foundation and Cintas Corporation.

Our Board of Directors believes that Mr. Scaminace will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of OM Group, Inc., and prior leadership positions at other global industrial companies of significant size;

• past and present service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 1992 |

WOLFGANG R. SCHMITT Age: 72 Committees: Audit Committee Corporate Governance and Nominating Committee

Now retired, Mr. Schmitt was the Chief Executive Officer of Trends 2 Innovation (strategic growth consultants) from May 2000 to April 2015.

Our Board of Directors believes that Mr. Schmitt will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer of a strategic growth consulting company and prior leadership positions at other global industrial companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

7

|

Director since 2010 |

ÅKE SVENSSON Age: 64 Committees: Audit Committee Finance Committee

Mr. Svensson has been a member of the Advisory Board for the Swedish Government’s Public Procurement Authority since January 2016; and Chairman of Swedavia AB (transport infrastructure) since April 2016. He was previously Director General of the Association of Swedish Engineering Industries from September 2010 to August 2016; and the Chief Executive Officer and President of Saab AB (aerospace, defense and security industry) from July 2003 to September 2010. Mr. Svensson was formerly a Director of Saab AB.

Our Board of Directors believes that Mr. Svensson will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and President of Saab AB, a successful European aerospace, defense and security company of significant size;

• extensive knowledge of European aerospace, defense and security businesses and related issues and trends;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2016 |

JAMES R. VERRIER Age: 53 Committees: None

Mr. Verrier has been Chief Executive Officer and Director of BorgWarner, Inc. (powertrain solutions) since January 2013; and President of BorgWarner since March 2012. He was previously Chief Operating Officer of BorgWarner from March 2012 to January 2013; and Vice President of BorgWarner and President and General Manager of BorgWarner Morse TEC Inc. from January 2010 to March 2012.

Our Board of Directors believes that Mr. Verrier will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• service as Chief Executive Officer and President of BorgWarner, Inc., a successful global automotive industry components and parts supplier of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• ability to work efficiently and effectively with our other Directors; and

• high level of commitment, integrity, honesty, judgment and professionalism. | |

8

|

Director since 2009 |

JAMES L. WAINSCOTT Age: 59 Committees: Finance Committee (Chair) Human Resources and Compensation Committee

Now retired, Mr. Wainscott was Chairman of the Board of AK Steel Holding Corporation (steel producer) from January 2006 to May 2016; and President, Chief Executive Officer and a Director of AK Steel Holding from October 2003 to January 2016.

Our Board of Directors believes that Mr. Wainscott will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President, Chief Executive Officer and Chairman of the Board of AK Steel Holding Corporation, a successful global industrial company of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director since 2015 |

THOMAS L. WILLIAMS Age: 57 Committees: None

Mr. Williams has been our Chairman of the Board since January 2016; and our Chief Executive Officer since February 2015. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015. Mr. Williams is also a Director of Chart Industries, Inc.

Our Board of Directors believes that Mr. Williams will effectively serve our Board of Directors, our business, our employees and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Executive Vice President and Operating Officer and in various operational leadership positions during his 13-year career with us;

• intimate, working knowledge of our day-to-day business, plans, strategies and initiatives;

• present service on another public company board;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our employees and our shareholders, and a high level of integrity, honesty, judgment and professionalism. | |

9

ANNUAL ELECTIONS; MAJORITY VOTING.

Our Code of Regulations provides for the annual election of our entire Board of Directors. Accordingly, each Director elected at this Annual Meeting of Shareholders will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected.

In 2016, we amended our Articles of Incorporation to implement a majority voting standard in the annual election of our Directors. Initially proposed by a shareholder, we engaged with our shareholders to develop a majority vote standard that dovetailed with our previously-adopted director resignation policy and which allows for a plurality standard in the case of a contested election. Our shareholders voted on the amendment to our Articles of Incorporation to adopt majority voting in October 2015. The amendment, along with a contingent proposal to eliminate cumulative voting, passed with the support of a supermajority of all our outstanding shares. Consequently, at each Annual Meeting of Shareholders, each candidate for Director is elected only if the votes “for” the candidate exceed the votes “against” the candidate, unless the number of candidates exceeds the number of Directors to be elected, and shareholders are not able to cumulate votes in the election of Directors. Abstentions and broker non-votes shall not be counted as votes “for” or “against” a candidate. If the number of candidates exceeds the number of Directors to be elected, then in that election the candidates receiving the greatest number of votes shall be elected.

In December 2015, William E. Kassling retired from our Board of Directors. Immediately prior to his retirement, Mr. Kassling served on both the Human Resources and Compensation Committee and the Audit Committee.

James R. Verrier was identified as a potential Director candidate by a third-party search firm and was evaluated by management and our Corporate Governance and Nominating Committee. Upon our Corporate Governance and Nominating Committee’s recommendation and as permitted under our Code of Regulations, our Board of Directors elected James R. Verrier to our Board of Directors in April 2016 for a term expiring at this Annual Meeting of Shareholders. Mr. Verrier filled the vacancy created by Mr. Kassling’s retirement.

RECOMMENDATION REGARDING PROPOSAL 1:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS.

10

BOARD OF DIRECTORS

MEETINGS AND ATTENDANCE; EXECUTIVE SESSIONS.

During fiscal year 2016, there were seven meetings of our Board of Directors. Each Director attended at least 75% of the meetings held by our Board of Directors and the Committees of our Board of Directors on which he or she served.

We hold a regularly scheduled meeting of our Board of Directors in conjunction with our Annual Meeting of Shareholders. Directors are expected to attend the Annual Meeting of Shareholders absent an appropriate reason. All of the members of our Board of Directors at the time of our 2015 Annual Meeting of Shareholders attended that meeting.

In accordance with the listing standards of the New York Stock Exchange, our non-management Directors are scheduled to meet regularly in executive sessions without management and, if required, our independent Directors will meet at least once annually. Additional meetings of our non-management Directors may be scheduled from time to time when our non-management Directors determine that such meetings are desirable. Our non-management Directors met four times during fiscal year 2016.

NUMBER; CURRENT TERM; RELATIONSHIPS.

Our Board of Directors presently consists of 14 members. The current term of each member of our Board of Directors expires at our 2016 Annual Meeting of Shareholders. Assuming the election of all of the Director Nominees, we expect our Board of Directors to consist of 13 members after the 2016 Annual Meeting of Shareholders. None of our Directors are related to each other and no arrangements or understandings exist pursuant to which any Director was selected as a Director or Director nominee.

Our Board of Directors Guidelines on Significant Corporate Governance Issues require at least a majority of our Directors to be “independent” as defined in the listing standards established by the New York Stock Exchange. Our Board of Directors has also adopted standards for director independence, which are set forth in our Independence Standards for Directors.

We strongly favor a governance structure that includes an independent Board of Directors. Of the 14 current members of our Board of Directors, 11 are independent based on our Board of Directors’ consideration of the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. In addition, each of the Audit Committee, the Corporate Governance and Nominating Committee, the Finance Committee and the Human Resources and Compensation Committee of our Board of Directors is composed entirely of independent directors. As a result, our independent Directors directly oversee critical matters such as our executive compensation program for executive officers, our corporate governance guidelines, policies and practices, our corporate finance strategies and initiatives, the integrity of our financial statements and our internal controls over financial reporting.

Our Board of Directors has affirmatively determined that the following 11 individuals who currently serve as Directors are independent: Robert G. Bohn, Linda S. Harty, Robert J. Kohlhepp, Kevin A. Lobo, Klaus-Peter Müller, Candy M. Obourn, Joseph Scaminace, Wolfgang R. Schmitt, Åke Svensson, James R. Verrier and James L. Wainscott.

Among other things, our Board of Directors does not consider a Director to be independent unless it affirmatively determines that the Director has no material relationship with us either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Our Board of Directors annually reviews and determines which of its members are independent based on the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. During the course of such review, our

11

Board of Directors broadly considers all facts and circumstances which it deems relevant, including any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships between us and any of our Directors. In fiscal year 2016, after considering the facts and circumstances applicable to each Director, our Board of Directors determined that the following relationships required further analysis to confirm that the following Directors were independent:

| 1. | Each of Ms. Harty and Messrs. Kohlhepp, Lobo and Verrier serves as an employee, officer and/or director of a company that has an existing customer or supplier relationship with us. Our Board of Directors further analyzed these relationships and found that none of these Directors receive any direct or indirect personal benefits as a result of these relationships, and that the amounts paid to or by us under such relationships fell significantly below the thresholds for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. Based on such further analyses, our Board of Directors affirmatively concluded that each of these Directors is independent. |

| 2. | Mr. Müller serves as Chairman of the Supervisory Board of Commerzbank AG, with which we have a commercial banking relationship. Our Board of Directors further analyzed this relationship and found that Mr. Müller does not receive any direct or indirect personal benefits as a result of such relationship, and that the amount of our indebtedness to Commerzbank AG is insignificant when compared to the purchase and sale thresholds for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. We also do not have an exclusive banking relationship with Commerzbank AG in Germany or elsewhere. Based on such further analysis, our Board of Directors affirmatively concluded that Mr. Müller is independent. |

Our Board of Directors currently employs a “dual leadership” structure in which our Chief Executive Officer serves as Chairman of the Board and, pursuant to our Board of Directors Guidelines on Significant Corporate Governance Issues, the Chair of the Corporate Governance and Nominating Committee of our Board of Directors, an independent Director, serves as Lead Director. Our Lead Director is elected solely by the independent members of our Board of Directors and holds a position separate and independent from our Chairman of the Board. The Charter of the Corporate Governance and Nominating Committee and our Board of Directors Guidelines on Significant Corporate Governance Issues provide that the Chair of the Corporate Governance and Nominating Committee is elected or re-elected every five years.

The specific authorities, duties and responsibilities of our Lead Director are described in our Board of Directors Guidelines on Significant Corporate Governance Issues. Among other things, our Lead Director presides over and supervises the conduct of all meetings of our independent Directors, calls meetings of our non-management, independent Directors, and prepares and approves all agendas and schedules for meetings of our Board of Directors.

Our Board of Directors has had a Lead Director since April 2004. Our Board of Directors believes that having a Lead Director who is elected by our independent Directors ensures that our Board of Directors will at all times have an independent Director in a leadership position. At the same time, our Board of Directors believes that it is important to maintain flexibility in its leadership structure to allow for a member of management to serve in a leadership position alongside the Lead Director if our Board of Directors determines that such a leadership structure best meets the then current needs of our Board of Directors, our business, our employees and our shareholders.

Our Board of Directors has determined that this leadership structure is currently more efficient and effective than a structure which employs a single, independent Chairman of the Board. Our Board of Directors views this structure as one that ensures both independence in leadership and a balance of knowledge, power and authority. For example, our leadership structure employs both a Chairman of the Board who possesses an intimate, working

12

knowledge of our day-to-day business, plans, strategies and initiatives, and a Lead Director who has a strong working relationship with our non-management, independent Directors. These two individuals combine and utilize their unique knowledge bases and perspectives to ensure that management and our independent Directors work together as effectively as possible. Among other things, our Chairman of the Board ensures that our Board of Directors addresses strategic issues that management considers critical, while our Lead Director ensures that our Board of Directors addresses strategic issues that our independent Directors consider critical.

Our Board of Directors recognizes, however, that no single leadership model may always be appropriate. Accordingly, our Board of Directors regularly reviews its leadership structure to ensure that it continues to represent the most efficient and effective structure for our Board of Directors, our business, our employees and our shareholders.

SELECTION AND NOMINATION OF DIRECTORS.

The Corporate Governance and Nominating Committee of our Board of Directors is responsible for identifying, evaluating and recommending potential Director candidates. The Corporate Governance and Nominating Committee utilizes a variety of methods for identifying and evaluating candidates. The Corporate Governance and Nominating Committee regularly reviews whether the size of our Board of Directors is appropriate and whether any vacancies on our Board of Directors are expected due to retirements or otherwise. In the event that any vacancies are anticipated or otherwise arise, the Corporate Governance and Nominating Committee will consider various potential candidates.

In evaluating proposed Director nominees, the Corporate Governance and Nominating Committee will consider a variety of factors such as those described below under the caption “Director Qualifications; Board Diversity.” The Corporate Governance and Nominating Committee will consider the entirety of each proposed candidate’s credentials and will consider all available information that may be relevant to the candidate’s nomination. Following such consideration, the Corporate Governance and Nominating Committee may seek additional information regarding, and may request interviews with, any candidate it wishes to further pursue. Based upon all information reviewed and interviews conducted, the Corporate Governance and Nominating Committee will collectively determine whether to recommend the candidate to our entire Board of Directors.

During fiscal year 2016, the Corporate Governance and Nominating Committee retained a third-party search firm to assist in identifying, evaluating and recommending potential Director candidates. Candidates may also be recommended by other third-party search firms and current members of our Board of Directors. In addition, the Corporate Governance and Nominating Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as Directors, provided that such recommendations comply with the procedures set forth under the caption “Shareholder Recommendations for Director Nominees” on page 92 of this Proxy Statement. The Corporate Governance and Nominating Committee will consider candidates recommended by shareholders on the same basis as candidates from other sources. The Corporate Governance and Nominating Committee generally will not, however, consider recommendations for Director nominees submitted by individuals who are not affiliated with us.

DIRECTOR QUALIFICATIONS; BOARD DIVERSITY.

We believe that oversight from a highly-qualified and diverse Board of Directors is essential for the short-term and long-term success of our business. The size and scope of our global operations, markets, product offerings and employee base raise a wide range of issues. Consequently, we strive to attract and retain Directors who represent a broad range of backgrounds, educations, experiences, skills and viewpoints that will enable them to individually and collectively address the issues affecting our Board of Directors, our business, our employees and our shareholders.

Our Board of Directors, through its Corporate Governance and Nominating Committee, diligently evaluates each Director and Director nominee and our Board of Directors as a whole to ensure that our Board of Directors

13

has a complementary mix of qualified and diverse individuals designed to optimize the functioning and the decision-making and oversight roles of our Board of Directors and its Committees. Our Board of Directors does not have any formal policies with respect to Director qualifications or diversity. As a general matter, however, the Corporate Governance and Nominating Committee considers a broad range of factors such as judgment, skill, integrity, independence, possible conflicts of interest, experience with businesses and other organizations of comparable size or character, the interplay of the candidate’s experience and approach to addressing business issues with the experience and approach of incumbent members of our Board of Directors and other new Director candidates, and the candidate’s ability to effectively monitor and oversee the risks facing our business. More specifically, our Board of Directors seeks to identify nominees who have one or more of the following attributes:

| • | current or recent service as a Chief Executive Officer or in other senior executive positions; |

| • | current or recent service in senior leadership positions in successful global companies of significant size; |

| • | significant experience in operations, finance, accounting, information technologies and other key areas; |

| • | ability to effectively monitor and oversee the most critical current risks facing our business; and/or |

| • | other relevant skills and experiences, including international experience or leadership positions in companies involved in certain technologies and industries. |

Our Board of Directors Guidelines on Significant Corporate Governance Issues also require each of our Directors to comply with our Global Code of Business Conduct and otherwise act with the commitment, integrity, honesty, judgment and professionalism necessary to serve the long-term interests of our Board of Directors, our business, our employees and our shareholders.

Management and our Board of Directors and its Committees are collectively engaged in identifying, overseeing, evaluating and managing the material risks facing our business and ensuring that our strategies and objectives work to minimize such risks. Our Board of Directors has the ultimate responsibility to monitor the risks facing our business.

Various members of our management are responsible for our day-to-day risk management activities, including members of our Human Resources, Internal Audit and Compliance, Legal, Tax, Risk Management, Treasury and Finance departments. Those individuals are charged with identifying, overseeing, evaluating and managing risks in their functional areas and for ensuring that any significant risks are addressed with the appropriate Committee of our Board of Directors. The Committees of our Board of Directors are each responsible for the various areas of risk oversight as described in the “Committees of the Board of Directors” of this Proxy Statement. Management and the Chair of the applicable Committee ensure that any significant risks are reported to and addressed with the entire Board of Directors. Our Lead Director and the other Committee Chairs ensure that risk management is a recurring agenda item for meetings of our Board of Directors and its Committees.

Management and our Board of Directors and its Committees also engage outside advisors where appropriate to assist in the identification, oversight, evaluation and management of the risks facing our business. These outside advisors include our independent registered public accounting firm, external legal counsel and insurance providers, and the independent executive compensation consultant retained by the Human Resources and Compensation Committee of our Board of Directors.

Our Board of Directors believes that its current level of independence, leadership structure and qualifications and diversity of its members facilitate the effective identification, oversight, evaluation and management of risk. Our Lead Director meets regularly with our other independent Directors without management to discuss current and potential risks and the means of mitigating those risks, and has the authority to direct and evaluate our risk management efforts.

14

Management and our Board of Directors and its Committees view the risk management role of our Board of Directors and its Committees, and their relationship with management in the identification, oversight, evaluation and management of risk, as paramount to the short-term and long-term viability of our business. The ability to effectively monitor and oversee the most critical current risks facing our business is a key consideration for our Board of Directors and its Committees in identifying potential Director nominees and evaluating current Directors and Committee assignments.

COMMITTEES OF OUR BOARD OF DIRECTORS

BOARD COMMITTEES; COMMITTEE CHARTERS.

Our Board of Directors has established and delegated certain authorities and responsibilities to its four standing Committees: Human Resources and Compensation Committee, Finance Committee, Corporate Governance and Nominating Committee and Audit Committee. Our Board of Directors has adopted a written charter for each of these Committees, which charters are posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these charters, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000.

All members of each Committee are independent under the listing standards of the New York Stock Exchange as well as our Independence Standards for Directors. Each Committee provides regular reports of its activities to the full Board of Directors, as the full Board of Directors has the ultimate responsibility for monitoring the risks facing our business.

Information about the respective Committee purposes, memberships and number of meetings are reflected in the following chart:

| Standing Committee | Purpose |

Members in

|

Meetings in

| |||

| Human Resources & Compensation Committee |

Oversight of our processes, plans and programs for executive compensation, employee benefit and incentive compensation plans, and succession planning and talent management.

|

C. Obourn* R. Bohn R. Kohlhepp J. Scaminace J. Wainscott

|

5 | |||

| Finance Committee | Oversight of our capital structure and financial strategies. | J. Wainscott* L. Harty K. Lobo K.P. Müller Å. Svensson

|

2 | |||

| Corporate Governance & Nominating Committee |

Oversight of our corporate governance matters, including identifying director candidates and establishing and maintaining corporate governance principles and practices. | R. Kohlhepp* K.P. Müller C. Obourn J. Scaminace W. Schmitt

|

3 | |||

| Audit Committee |

Oversight of our audit and compliance matters, including financial integrity and reporting, accounting practices, legal and regulatory compliance, internal audit functions and processes, and outside auditor independence, qualifications and performance.

|

L. Harty* (ACFE) R. Bohn K. Lobo (ACFE) W. Schmitt Å. Svensson |

6 |

* Committee chair

Prior to his retirement, Mr. Kassling served on both the Human Resources and Compensation Committee and the Audit Committee.

15

Our Board of Directors has determined that each of Linda S. Harty, the Chair of the Audit Committee, and Kevin A. Lobo, a member of the Audit Committee, is an audit committee financial expert (designated in the above chart as ACFE) as defined in the federal securities laws.

Each of our Committees works with the applicable members of our Human Resources, Internal Audit and Compliance, Legal, Tax, Risk Management, Treasury and Finance departments and other management personnel to oversee and evaluate risks of concerns to each committee.

THE HUMAN RESOURCES AND COMPENSATION COMMITTEE.

As described on page 26 of this Proxy Statement, the Human Resources and Compensation Committee has various duties and responsibilities with respect to the administration, oversight and determination of our executive compensation program. In addition, the Human Resources and Compensation Committee works with its independent executive compensation consultant and our Human Resources, Legal and other management personnel to oversee and evaluate risks arising from and relating to; our compensation policies and practices for all employees; our succession planning and talent development strategies and initiatives; and other human resources issues facing our business.

In particular, the Human Resources and Compensation Committee monitors any significant existing or potential risks arising from our compensation policies and practices for all employees through its oversight of an annual compensation risk review conducted by management and the Human Resources and Compensation Committee’s independent executive compensation consultant. The results of this review are evaluated and discussed among management, the Human Resources and Compensation Committee and its independent executive compensation consultant and, if any significant risks are identified, the full Board of Directors. Based on the review conducted during fiscal year 2016, we do not believe that any risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect on our business.

The annual compensation risk review begins with a global assessment of any plans or programs that could potentially encourage excessive risk-taking or otherwise present significant risks to our business. The review also surveys our individual business units to determine whether any of them carries a significant portion of our risk profile, structures compensation significantly different than others or is significantly more profitable than others. The review then evaluates whether the applicable plans and programs are likely to encourage excessive risk-taking or detrimental behavior, vary significantly from our risk-reward structure, or otherwise present significant risks to our business.

During our fiscal year 2016 compensation risk review, we also identified and evaluated various mechanisms that we currently have in place that may serve to mitigate any existing or potential risks arising from our compensation policies and practices, including the following:

| • | our executive officers and other management-level employees are compensated with a mix of annual and long-term incentives, fixed and at-risk compensation, cash and equity compensation, and multiple forms of equity compensation; |

| • | compensation packages gradually become more focused on long-term, at-risk and equity compensation as our employees ascend to and through management-level positions; |

| • | our global compensation plans and programs generally utilize the same or substantially similar performance measures; |

| • | we use multiple performance measures to determine payout levels under certain elements of incentive compensation and different performance measures for our annual incentives as compared to our long-term incentives; |

16

| • | the performance of our employees is not evaluated or measured based solely on changes in our stock price; |

| • | our incentive compensation programs generally limit payouts to a specified maximum, while those that do not are mitigated by other factors (e.g., stock appreciation rights are mitigated by long-term vesting periods and stock ownership guidelines); |

| • | we do not offer “guaranteed” bonuses and all of our incentive compensation elements carry downside risk for participants; |

| • | our executive officers are subject to specific stock ownership guidelines, a “claw-back” policy and provisions requiring forfeiture of certain elements of incentive compensation upon termination for cause; |

| • | our compensation packages, including severance packages and supplemental pensions, are within market ranges; |

| • | the Human Resources and Compensation Committee has the discretion to assess the quality of our results in our various performance measures and the risks taken to attain those results in approving final incentive payouts; |

| • | our de-centralized organizational structure lessens the impact of any excessive risks taken by individual business units or operating groups; and |

| • | our employees are evaluated, measured and assessed based on their compliance with our Global Code of Business Conduct and other internal policies and controls, and the extent to which they act in the best interests of our business and our shareholders. |

During the annual compensation risk review, we also consider whether any changes to our compensation plans and programs may be necessary to further mitigate risk. The Human Resources and Compensation Committee did not make any such changes based on the results of our fiscal year 2016 review.

Among other things, the Finance Committee is responsible for reviewing our capital structure and tax and risk management strategies and for reviewing and approving our debt and equity offerings, share repurchase programs and the financial aspects of our qualified and non-qualified employee benefit plans. In addition, the Finance Committee works with our Legal, Tax, Risk Management, Treasury, Finance and other management personnel to oversee and evaluate risks arising from:

| • | balance sheet and other financial statement issues; |

| • | structure and amount of our debt and equity; |

| • | our retirement and other benefit plans (including funding and investment risks); |

| • | our insurance coverage and costs; |

| • | tax, credit and liquidity issues; and |

| • | other strategies for our financial risk management (including any use of hedges and derivative instruments). |

THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE.

Among other things, the Corporate Governance and Nominating Committee is responsible for evaluating and recommending to our Board of Directors qualified nominees for election as Directors and qualified Directors for Committee membership, establishing evaluation procedures and completing an annual evaluation of the

17

performance of our Board of Directors, developing corporate governance principles, recommending those principles to our Board of Directors and considering other matters pertaining to the size and composition of our Board of Directors. In addition, the Corporate Governance and Nominating Committee works with our Legal and other management personnel to oversee and evaluate risks arising from:

| • | Director independence, qualifications and diversity issues; |

| • | Board of Directors and Committee leadership, composition, function and effectiveness; |

| • | alignment of the interests of our shareholders with the performance of our Board of Directors; |

| • | compliance with applicable corporate governance rules and standards; and |

| • | other corporate governance issues and trends. |

The Audit Committee of our Board of Directors is our standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. Each Director who is a member of our Audit Committee is independent, as defined in our Independence Standards for Directors and in compliance with the independence standard applicable to audit committee members in the listing standards of the New York Stock Exchange and under the federal securities laws.

Among other things, the Audit Committee is responsible for appointing, determining the compensation of and overseeing the work of our independent registered public accounting firm and evaluating its independence, approving all non-audit engagements with our independent registered public accounting firm and reviewing with our financial management and our independent registered public accounting firm annual and quarterly financial statements, the proposed internal audit plan for each calendar year, the proposed independent audit plan for each fiscal year, the results of the audits and the adequacy of our internal control structure.

In addition, the Audit Committee works with our independent registered public accounting firm and our Internal Audit and Compliance, Legal and other management personnel to oversee and evaluate risks arising from:

| • | internal controls over financial reporting; |

| • | Form 10-K, Form 10-Q, earnings releases and other public filings and disclosures; |

| • | compliance with our Global Code of Business Conduct and other policies; and |

| • | litigation and claims. |

In this risk management role, the Audit Committee also oversees the operation of our global compliance and internal audit programs. These programs are designed to identify, oversee, evaluate and manage the primary risks associated with our business and our particular business units and functional areas. Our Vice President—Internal Audit and Compliance supervises these programs and discusses issues related to these programs directly with the Audit Committee. The Audit Committee also meets privately at each of its meetings with representatives from our independent registered public accounting firm and our Vice President—Internal Audit and Compliance.

18

REVIEW AND APPROVAL OF TRANSACTIONS WITH RELATED PERSONS.

The Charter of the Corporate Governance and Nominating Committee provides that the Corporate Governance and Nominating Committee is responsible for considering questions of possible conflicts of interest of Directors and management and for making recommendations to prevent, minimize or eliminate such conflicts of interest. Our Global Code of Business Conduct provides that our Directors, officers, employees and their spouses and other close family members must avoid interests or activities that create any actual or potential conflict of interest. These restrictions cover, among other things, interests or activities that result in receipt of improper personal benefits by any person as a result of his or her position as our Director, officer, employee or as a spouse or other close family member of any of our Directors, officers or employees. Our Global Code of Business Conduct also requires our Directors, officers and employees to promptly disclose any potential conflicts of interest to our General Counsel. We also require that each of our executive officers and Directors complete a detailed annual questionnaire that requires, among other things, disclosure of any transactions with a related person meeting the minimum threshold for disclosure under the relevant Securities and Exchange Commission, or SEC, rules. All responses to the annual questionnaires are reviewed and analyzed by our legal counsel and, if necessary or appropriate, presented to the Corporate Governance and Nominating Committee for analysis, consideration and, if appropriate, approval.

The Corporate Governance and Nominating Committee will consider the following in determining if any transaction presented should be approved, ratified or rejected:

| • | the nature of the related person’s interest in the transaction; |

| • | the material terms of the transaction; |

| • | the importance of the transaction to the related person and to us; |

| • | whether the transaction would impair the judgment or the exercise of the fiduciary obligations of any Director or executive officer; |

| • | the possible alternatives to entering into the transaction; |

| • | whether the transaction is on terms comparable to those available to third parties; and |

| • | the potential for an actual or apparent conflict of interest. |

During fiscal year 2016, we reviewed the annual questionnaires and determined that no potential related-party transactions exist. This review included a detailed evaluation of the transactions reviewed and analyzed by our Board of Directors in determining Director independence as described in the “Director Independence” section beginning on page 11. Based on management’s review and analysis, no potential related-party transactions were presented to the Corporate Governance and Nominating Committee for analysis, consideration or approval.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE.

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, Directors and beneficial owners of more than 10% of our Common Shares to file initial stock ownership reports and reports of changes in ownership with the SEC. SEC regulations require that we are furnished with copies of these reports. Based solely on a review of these reports and written representations from our executive officers and Directors, we believe that there was compliance with all such filing requirements for fiscal year 2016.

19

COMPANY PROPOSAL RELATING TO CORPORATE GOVERNANCE MATTERS

ITEM 2 — ADOPTION OF AN AMENDMENT TO OUR CODE OF REGULATIONS TO ESTABLISH PROCEDURES FOR ADVANCE NOTICE OF DIRECTOR NOMINATIONS AND OTHER BUSINESS AT SHAREHOLDER MEETINGS

Under this Item 2, we are asking our shareholders to approve an amendment to our Code of Regulations to provide advance notice procedures for Director nominations and other business conducted at meetings of our shareholders. Currently, our Code of Regulations contains no provisions that set forth procedural requirements regarding a shareholder’s ability to propose business at shareholder meetings or nominate candidates for election to our Board of Directors. While SEC rules require a shareholder to notify a public company within a specified period of time prior to a meeting of shareholders if the shareholder seeks to include a proposal in the company’s proxy statement, SEC rules do not prohibit a shareholder from bringing unexpected business before the meeting in person.

Sensible rules of order for the conduct of shareholder meetings are prudent because they promote transparency and protect companies from special interest groups that may seek to leverage surprise tactics to the disadvantage of companies and their shareholders. Our Board of Directors believes that this amendment would provide for an orderly process without diminishing shareholder rights in any meaningful way. Our shareholders would enjoy rights to bring business and nominate Director candidates at our shareholder meetings as long as they simply notify us beforehand. Our Board of Directors further believes that this amendment would secure a reasonable amount of time for us and our shareholders to provide full and thoughtful responses to all proposed business and nominations, and that it would protect us and our shareholders from factions seeking to impose policies, strategies or limitations that they believe would be rejected if given full, fair and open consideration.

The proposed amendment provides that a shareholder that desires to propose business at an annual meeting of shareholders must deliver a notice to the Secretary of the Company not less than 30 days nor more than 60 days prior to the first anniversary of the previous year’s annual meeting of shareholders. If, however, the date of the annual meeting of shareholders is more than 30 days before or more than 60 days after the first anniversary of the previous year’s annual meeting of shareholders, shareholders would instead be required to deliver such notice not later than the later of the 30th day prior to the meeting and the tenth day following the day on which we first publicly disclose the date of the meeting. The proposed amendment would also require the notice to be in a certain form that includes information about the item of business to be brought by the shareholder before the meeting and specific information about the shareholder and its interests, which the shareholder must update as necessary. The proposed amendment would also prohibit shareholders from proposing business, other than, in some cases, the nomination of persons for election as Director, at special meetings of shareholders if they, themselves, did not call the special meeting pursuant to our Code of Regulations.

The proposed amendment also provides that shareholder nominations of persons for election as Director may be made only at annual meetings of shareholders or special meetings of shareholders called for the purpose of electing Directors. The proposed amendment further provides that a shareholder that desires to nominate a candidate for election as Director (a) at an annual meeting of shareholders must deliver a notice to the Secretary of the Company within the same time frames as required with respect to other business to be conducted at an annual meeting of shareholders, as described in the paragraph above, and (b) at a special meeting of shareholders must deliver notice to the Secretary of the Company promptly after the date such meeting is publicly disclosed, but in no event later than five business days after the date of such disclosure. The notice delivered to the Company must include specific information about the nominating shareholder, as well as about the proposed nominee, which the nominating shareholder must update as necessary.

The proposed amendment does not affect any rights of shareholders to request inclusion of proposals in our annual proxy statement pursuant to Rule 14a-8 under the Exchange Act.

20

The actual text of the proposed amendment to our Code of Regulations is attached to this Proxy Statement as Annex A. The amendment will become effective upon shareholder approval of Item 2.

Shareholder Approval

The affirmative vote of the holders of shares of our common stock entitling them to exercise a majority of the voting power of such shares is necessary to amend the Company’s Code of Regulations to include the proposed amendment, as described in this Item 2. Abstentions and broker non-votes will have the same effect as votes cast against this Item 2.

RECOMMENDATION REGARDING PROPOSAL 2:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

THE PROPOSAL TO APPROVE AN AMENDMENT TO OUR CODE OF REGULATIONS

TO ESTABLISH PROCEDURES FOR ADVANCE NOTICE OF DIRECTOR NOMINATIONS

AND OTHER BUSINESS AT SHAREHOLDER MEETINGS.

21

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY—FISCAL YEAR 2016.

Objectives and Philosophies of the Executive Compensation Program.

The Win StrategyTM has been the foundation of our business and has represented the unified vision of our employees worldwide since it was first introduced in fiscal year 2001. In September 2015 we introduced a refreshed Win Strategy to our employees and our shareholders. The Win Strategy defines the key goals, operational priorities and metrics used to profitably grow our business. We are confident that a worldwide focus on the Win Strategy will maximize the long-term value of our shareholders’ investments by helping us to realize top-quartile performance among our competitors and peers and steady appreciation of our stock price.

The Win Strategy also provides the means by which we can measure and reward success. In fact, the objective of our executive compensation program is to encourage and reward performance that implements the strategies and advances the goals of the Win Strategy. The program is designed to:

| • | align the financial interests of our executive officers and our shareholders by encouraging and rewarding our executive officers for performance that achieves or exceeds significant financial and operational performance goals and by holding them accountable for results; |

| • | encourage and reward our executive officers for experience, expertise, level of responsibility, continuity of leadership, leadership qualities, advancement, individual accomplishment and other significant contributions to the enhancement of shareholder value and to the success of our business; |

| • | attract, retain and motivate highly-talented and ethical individuals at all levels who are focused on the long-term success of our business and who are equipped, motivated and poised to lead and manage our business presently and in the future; |

| • | offer compensation that keeps us competitive with companies that compete with us for talented employees and shareholder investment; |

| • | promote accountability by providing executive officers an optimal mix of cash and equity compensation, allocating a greater proportion of the compensation for executive officers, as compared to other employees, to elements that are dependent on the performance of our business; and |

| • | maintain a level of flexibility sufficient to adjust for trends and changes in the continuously evolving global business and regulatory environment. |

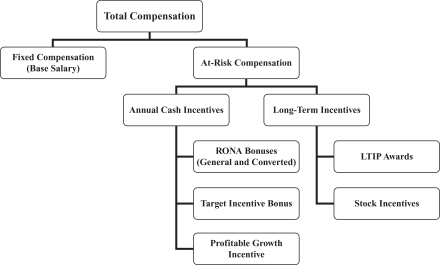

Categories and Elements of Executive Compensation.

Our executive compensation program covers all compensation paid to our executive officers. Our executive officers include, among others, the Chief Executive Officer, Chief Financial Officer and the four other most highly compensated executive officers identified in the Summary Compensation Table for Fiscal Year 2016 on page 52, which we refer to as the Named Executive Officers.

22

Our executive compensation program offers the categories and elements of compensation identified in the following table. Each element of compensation is more specifically defined and described in the “Elements of Executive Compensation” section of this Compensation Discussion and Analysis beginning on the page indicated in the table.

| Category of Compensation

|

Element(s) of Compensation

|

Defined/Described Beginning on:

| ||

|

Base Salaries

|

Base Salaries

|

Page 33

| ||

|

Annual Cash Incentive Compensation |

Target Incentive Bonuses General RONA Bonuses Converted RONA Bonuses PGI Plan

|

Page 35 Page 36 Page 36 Page 39

| ||

|

Long-Term Incentive Compensation |

LTIP Awards Stock Incentives

|

Page 40 Page 42

| ||

|

Employee Benefits

|

Various

|

Page 43

| ||

|

Executive Perquisites

|

Various

|

Page 49

|

“Pay-for-Performance”—Structure, Key Financial Metrics and Impact on Compensation Payouts.

Our executive compensation program is structured to ensure that a significant portion of the compensation for executive officers is dependent upon the performance of our business. This “pay-for-performance” structure drives the program to achieve its objective to encourage and reward performance that implements the strategies and advances the goals of the Win Strategy. Our program is also structured to ensure that the compensation for our executive officers is not overly weighted toward annual cash incentive compensation and does not otherwise have the potential to threaten long-term shareholder value by promoting unnecessary or excessive risk-taking by our executive officers. The “Allocation of Executive Compensation” section beginning on page 30 describes our policies and practices for allocating executive compensation among the various categories and elements.

To illustrate, the chart below shows the mix of fixed and at-risk, annual and long-term and cash and equity compensation represented by base salaries and the elements of annual cash incentive compensation and long-term incentive compensation for the Named Executive Officers. The percentages of total compensation reflected in this chart were calculated using each Named Executive Officer’s fiscal year 2016 base salary, target annual cash incentive compensation and target long-term incentive compensation.

23

Emphasis on Sustained Performance

The “Elements of Executive Compensation” section beginning on page 33 provides detailed discussion and analysis as to how each element of compensation encourages and rewards performance that implements the strategies and advances the goals of the Win Strategy. Our compensation structure includes both fixed and at-risk compensation as noted above, the various cash and equity elements of which may be depicted generally as follows:

24