|

|

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OCTOBER 23, 2019

TO OUR SHAREHOLDERS:

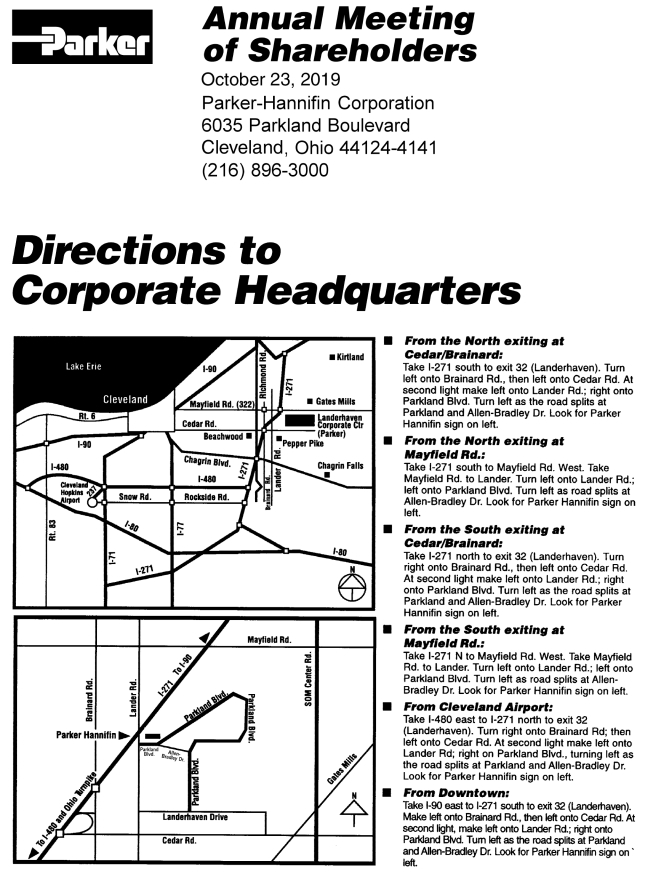

You are cordially invited to attend the Annual Meeting of Shareholders of Parker-Hannifin Corporation. The meeting will be held at our headquarters located at 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, on Wednesday, October 23, 2019, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect Lee C. Banks, Robert G. Bohn, Linda S. Harty, Kevin A. Lobo, Candy M. Obourn, Joseph Scaminace, Åke Svensson, Laura K. Thompson, James R. Verrier, James L. Wainscott and Thomas L. Williams as Directors for a term expiring at the Annual Meeting of Shareholders in 2020; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2020; |

| 3. | To approve, on a non-binding, advisory basis, the compensation of our Named Executive Officers; |

| 4. | To approve the Parker-Hannifin Corporation Amended and Restated 2016 Omnibus Stock Incentive Plan; |

| 5. | To consider and vote upon a shareholder proposal to adopt a policy that requires the Chairman of the Board to be an independent member of the Board of Directors; and |

| 6. | To transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on August 30, 2019 are entitled to vote at the meeting. Your vote is important, so if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the enclosed proxy card. Please refer to the section “How to Attend the Annual Meeting of Shareholders” and to the back page of this Proxy Statement for directions to attend the Annual Meeting.

Thank you for your support of Parker-Hannifin Corporation.

| By Order of the Board of Directors |

|

| Joseph R. Leonti |

| Secretary |

September 23, 2019

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be held on October 23, 2019.

This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2019, is available free of charge on our investor relations website (www.phstock.com).