UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

(Name of Registrant as Specified In Its Charter)

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): | ||

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Parker-Hannifin Corporation is a Fortune 250 global leader in motion and control technologies. For more than a century, the Company has engineered the success of its customers in a wide range of diversified industrial and aerospace markets.

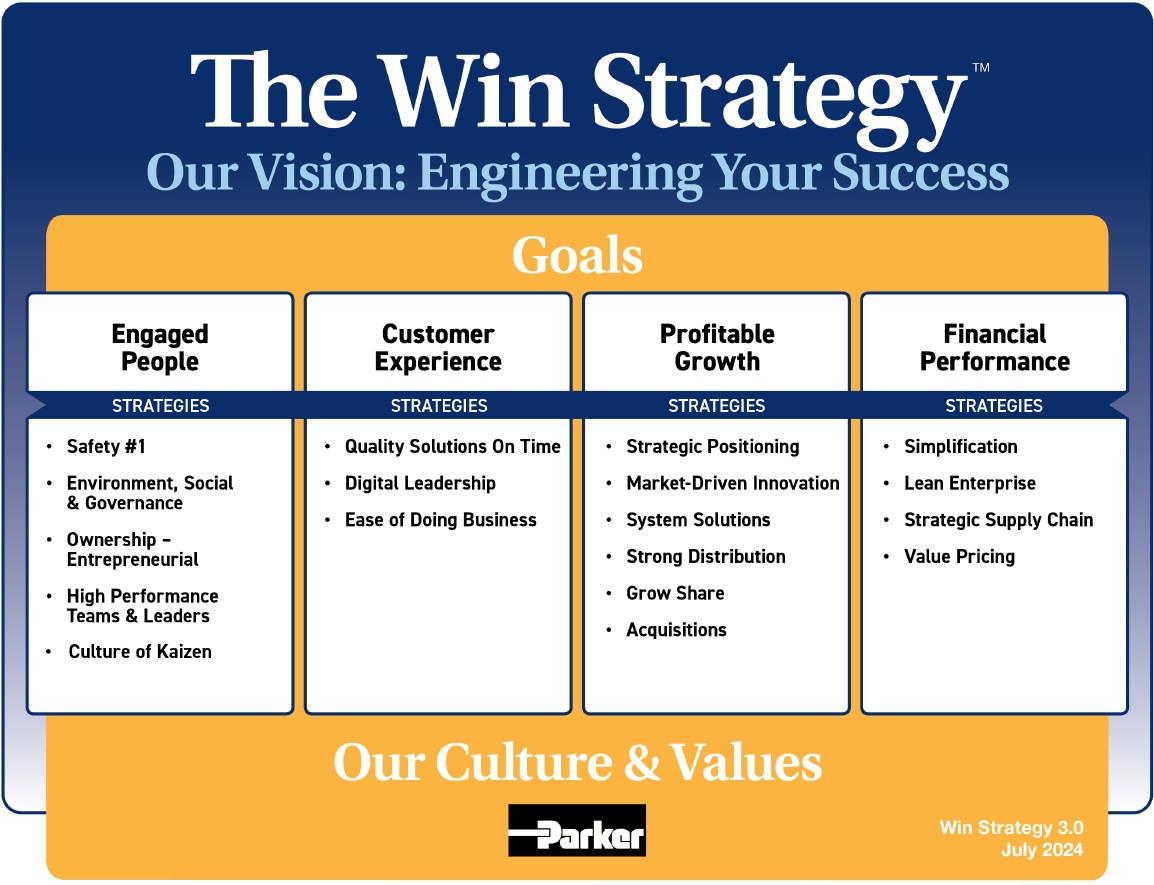

| The Win Strategy™ - | The Win Strategy is Parker’s business system that defines the goals and initiatives that drive growth, transformation and success. |

| Our Values - | Our values shape our culture and our interactions with stakeholders and the communities in which we operate and live. |

| Our Purpose - | Our purpose provides inspiration and direction for our team members and highlights how we can have a positive impact on the world. |

ENABLING ENGINEERING BREAKTHROUGHS THAT LEAD TO A BETTER TOMORROW.

Parker-Hannifin Corporation

6035 Parkland Boulevard, Cleveland, Ohio 44124-4141

| Notice of Annual Meeting of Shareholders |

|

DATE AND TIME October 23, 2024 (Wednesday) 9:00 a.m. EDT |

|

ADDRESS Parker-Hannifin Corporation 6035 Parkland Boulevard Cleveland, Ohio 44124 |

|

RECORD DATE September 6, 2024 |

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Parker-Hannifin Corporation. The meeting will be held at our headquarters located at 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, on Wednesday, October 23, 2024 at 9:00 a.m., Eastern Time, for the following purposes:

| Voting Items | |||||

| 1 | Election of Directors |

|

FOR each director nominee | ||

| 2 | Approval of the Compensation of Our Named Executive Officers on a Non-Binding, Advisory Basis |

|

FOR | ||

| 3 | Ratify the Appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm |

|

FOR | ||

and to transact such other business as may properly come before the meeting.

Shareholders of record at the close of business on September 6, 2024 are entitled to vote at the meeting. On September 6, 2024, 128,670,356 shares were outstanding and entitled to vote at the meeting. Each share is entitled to one vote. This Proxy Statement and the form of proxy are being mailed to shareholders on or about September 20, 2024. Your vote is important, so if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the proxy card. Please refer to the section “General Information About the Annual Meeting” for more information.

Thank you for your support of Parker-Hannifin Corporation.

By Order of the Board of Directors

Joseph R. Leonti

Secretary

September 20, 2024

| How to Vote | ||||||||||

|

VOTE VIA INTERNET www.proxyvote.com |

|

VOTE BY PHONE 800-690-6903 |

|

VOTE BY MAIL Vote Processing c/o Broadridge 51 Mercedes Way, Edgewood NY 11717 |

|

VOTE AT THE MEETING Parker-Hannifin Corporation 6035 Parkland Boulevard Cleveland, Ohio 44124 | |||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on October 23, 2024.

This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2024, is available free of charge on our investor relations website (investors.parker.com). |

| 2024 Proxy Statement | 1 |

| Table of Contents |

| 2 |

|

| Our Company |

Parker-Hannifin Corporation is a Fortune 250 global leader in motion and control technologies. For more than a century, the Company has engineered the success of its customers in a wide range of diversified industrial and aerospace markets. The following sections provide highlights from our fiscal year 2024 across matters of importance to our shareholders, including business and financial performance, executive compensation, our environment, social and governance ("ESG") program and shareholder engagement.

Business and Performance Highlights

Parker Delivered a Record Year in Fiscal 2024

|

|

|

|

| $19.9B TOTAL NET SALES WERE A RECORD AT $19.9 BILLION |

$3.4B CASH FLOW FROM OPERATING ACTIVITIES WAS 17% OF SALES AT A RECORD $3.4 BILLION |

$21.84 EARNINGS PER SHARE (AS REPORTED) WERE A RECORD AT $21.84 |

68th

YEAR INCREASED ANNUAL DIVIDEND PER SHARE FOR THE 68TH YEAR IN A ROW |

Fiscal year 2024 underscored Parker’s transformation. Our people, portfolio and strategy drove record financial performance, including sales, cash flow from operations and earnings per share ("EPS"), all while continuing to reduce debt from our acquisition of Meggitt plc ("Meggitt"). Against a macroeconomic backdrop of continued challenges, including inflation, supply chain constraints, and ongoing international conflict and geopolitical tensions, our unwavering commitment to The Win Strategy drove sustained profitable growth and strong financial performance and showcased the increasing resilience of our businesses across macroeconomic cycles. Safety, engagement, and ownership continued to be the foundations of our culture, and our team members took great pride in living up to our purpose, Enabling Engineering Breakthroughs that Lead to a Better Tomorrow. And with our interconnected technologies that create value for customers across aerospace and defense, in-plant and industrial equipment, transportation, off-highway, energy, and HVAC and refrigeration markets around the world, we believe we are positioned to take Parker from better to best.

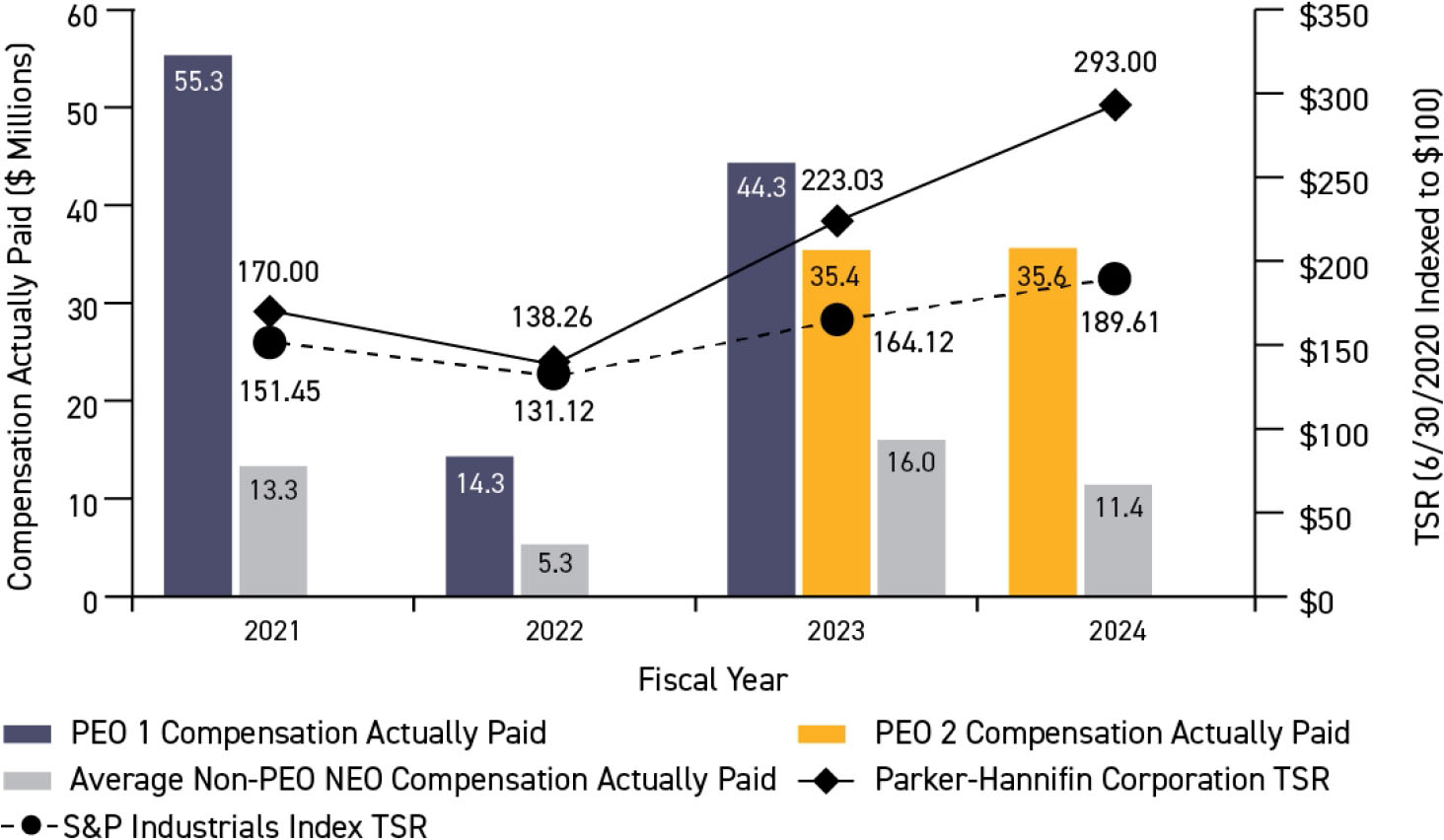

Delivering Superior Total Shareholder Returns

Parker results in fiscal year 2024 built upon a pattern of success established over the past five years that has helped deliver substantial shareholder returns reflected in our 5-year stock performance.

Comparison of 5 Year Cumulative Total Return*

| * | $100 invested on 6/30/19 in stock or index, including reinvestment of dividends. Fiscal year ending June 30. | ||

| Copyright 2024 Standard & Poor's, a division of S&P Global. All rights reserved. |

| 2024 Proxy Statement | 3 |

Our Company

Executive Compensation Highlights

The tables below highlight the performance-based nature of our compensation program and how our program aligns with what we view as executive compensation best practices.

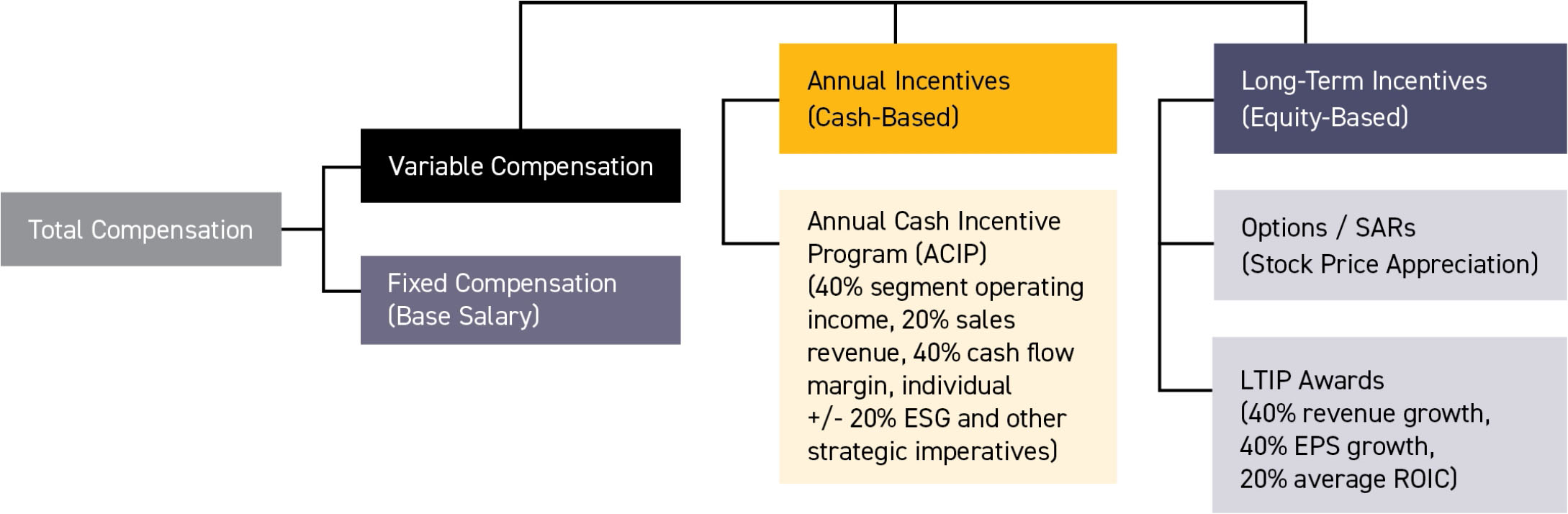

Elements of Executive Compensation

| Elements of Compensation | Purpose | |||||

|

Fixed |

Base Salary |

Attracts, retains and motivates the highly-talented and values-driven individuals we need to advance the goals of The Win Strategy | ||||

|

Annual Cash Incentive |

Officer Annual Cash Incentive Plan ("Officer ACIP") |

Incentivizes executive officers to maximize segment operating income, sales revenue and cash flow margin, metrics we believe align closely with total shareholder return and overall shareholder value, by focusing on key business strategies such as profitable and sustainable sales growth, value pricing, strategic supply chain, market-driven innovation, system solutions, strong distribution channels, lean initiatives, inventory control, strong receivable and payable controls, and ESG-related initiatives | ||||

|

Variable/ At-Risk |

Long-Term Equity Incentive |

Long Term Incentive Performance ("LTIP") Awards |

Incentivizes executive officers to maximize long-term revenue growth, EPS growth, and growth in average return on invested capital ("ROIC") by focusing on key business strategies such as market-driven innovation, on-time delivery of quality products, value-added services and systems, strategic supply chain, lean enterprise, value pricing and profitable growth | |||

|

Stock Incentives/ Stock Appreciation Rights ("SARs") |

Incentivizes executive officers to maximize our stock price by focusing on various key business strategies such as sustained profitable growth and financial and operational performance that contribute to appreciation of our stock price | |||||

Executive Compensation Practices

|

What We Do |

|

What We Don’t Do | |

|

✓Executive compensation program with pay-for-performance structure aligned with The Win Strategy

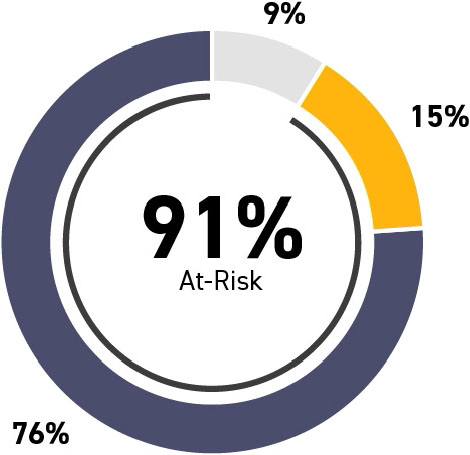

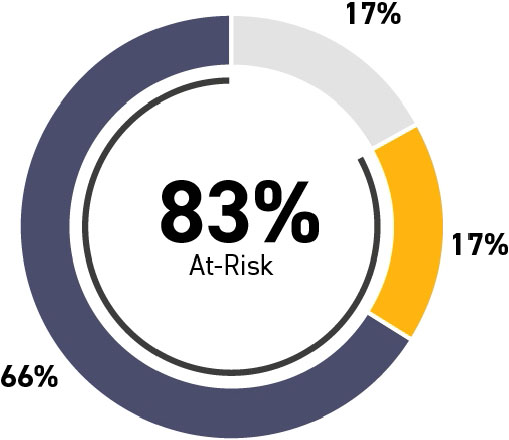

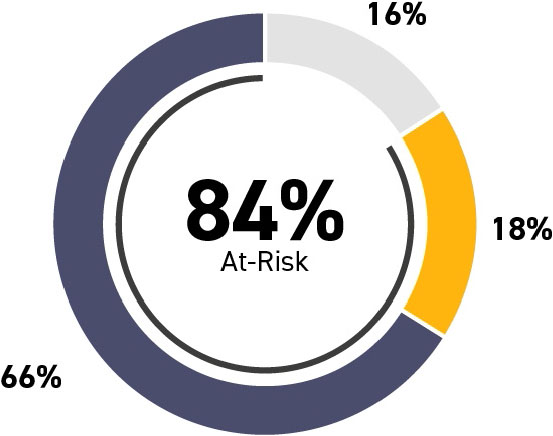

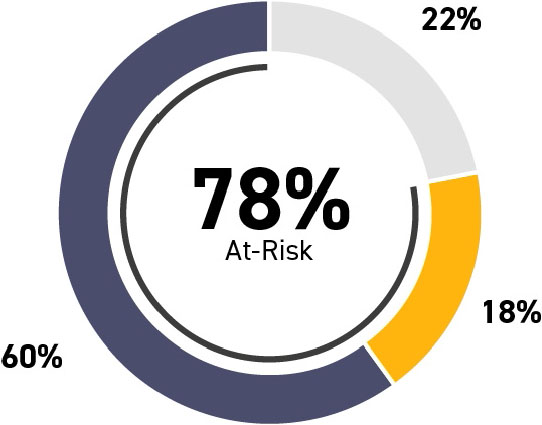

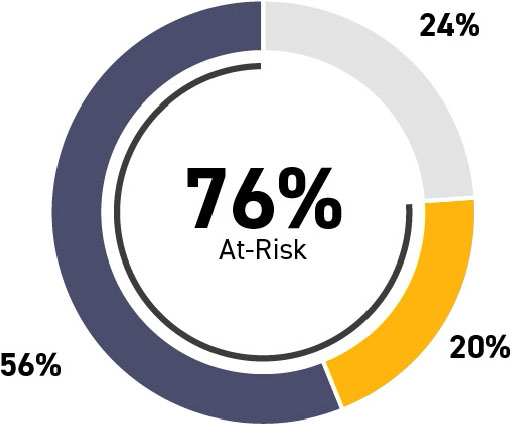

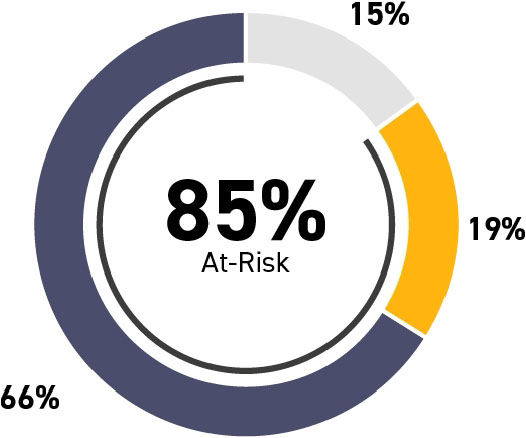

✓The target total direct compensation package for our Chief Executive Officer is a mix of 9% fixed and 91% at-risk, and for our other Named Executive Officers is an average mix of 19% fixed and 81% at-risk

✓Annual advisory vote on executive compensation with consistent high degree of approval

✓One-year minimum vesting or performance period requirements for equity incentives under our 2023 Omnibus Stock Incentive Plan

✓Clawback policies and provisions to recover or withhold incentive-based compensation to executive officers in certain circumstances

✓Anti-hedging and anti-pledging policy for Directors and executive officers

✓Robust Stock Ownership Guidelines for Directors and executive officers |

✕Offer employment agreements to our executives

✕Offer above-market earnings on contributions to deferred compensation accounts

✕Grant stock options or SARs with an exercise price less than the fair market value of Parker’s common stock on the date of grant

✕Re-price stock options or SARs

✕Cash out underwater stock options or SARs

✕Include reload provisions in any stock option or SAR grant

✕Permit Directors or employees, or their respective related persons, to engage in short sales of Parker’s stock or to trade in instruments designed to hedge against price declines in Parker’s stock

✕Permit Directors or executive officers to hold Parker securities in margin accounts or to pledge Parker securities as collateral for loans or other obligations | |||

| 4 |

|

Our Company

Environment, Social and Governance Highlights

Our ESG program includes a range of initiatives around corporate social responsibility and sustainability, taking into account the interests of our key stakeholders, including our shareholders, team members, customers and communities. Issues that we focus on include, among others, workplace health and safety, climate risk, water conservation, human capital management, diversity, equity and inclusion, cybersecurity, and business ethics and compliance. For information on Board and Committee ESG oversight responsibilities, see "Board's Role in Risk Oversight" on page 28 of this Proxy Statement.

We publish our Sustainability Report in line with Sustainability Accounting Standards Board ("SASB") and expect future reporting to be aligned with Task Force on Climate-Related Financial Disclosures ("TCFD") standards, addressing the many ways in which we apply our core technologies to make a positive impact on the world, including through our team members, social responsibility, environmental initiatives, product stewardship, and governance, ethics and compliance. Selected aspects of our most recent Sustainability Report are highlighted below.

We are proud of our corporate social responsibility and sustainability accomplishments but recognize that best practices in ESG integration and reporting frameworks continue to evolve. While there is more work to be done, we are confident that our ESG program will continue to drive meaningful progress and results for our stakeholders.

Environment

| Carbon Neutrality |

We are committed to driving sustainable, long-term growth and doing so in a way that makes the world a better place.

●We have committed to achieve carbon neutral operations by 2040. To ensure continued progress in minimizing our carbon footprint, we established a series of emissions targets, which include:

●Reducing absolute emissions directly from our operations by 50% by 2030; and

●Reducing indirect absolute emissions related to materials sourcing, logistics and services by 15% by 2030, and by 25% by 2040.

●We have reported energy and emissions data to the Carbon Disclosure Project since 2008. | |

| Water Conservation |

●Recognizing the growing scarcity of water in many regions, Parker maintains a water conservation initiative that targets high risk and high volume facilities.

●Our goal is to implement water management best practices at 100% of sites in water-scarce locations (as defined by the World Resources Institute). | |

| Waste and Materials Management |

●We are committed to managing materials and waste responsibly, adhering to all applicable laws in the communities where we operate.

●We take a dual approach to reducing waste in our operations: proactive and continuous improvement. Our Simple by Design innovation methods enable us to proactively remove potential waste during product development. Additionally, we leverage kaizen process improvements to reduce waste in all aspects of our manufacturing process. |

| 2024 Proxy Statement | 5 |

Our Company

| Supplier Partnerships |

●We have implemented several supply chain initiatives to reduce our environmental footprint. This includes leveraging sustainable transport methods to reduce emissions associated with air freight, as well as transitioning to electronic documentation to reduce paper waste. Through kaizen initiatives, our team members continue to develop innovations to help achieve our environmental stewardship goals.

●Since 2012, we have been a member of the U.S. Environmental Protection Agency SmartWay® Transport Partnership aimed at identifying technologies and strategies to reduce carbon emissions and set goals and track progress towards reducing fuel consumption and improving the efficiency of freight transport.

●Our global supply chain team employs dual sourcing and other risk management strategies to ensure the availability of materials needed for production. We also require our suppliers to comply with all applicable laws and regulations related to human rights, resource conservation and the environment. | |

| Technologies Enabling a Better Tomorrow |

●Our interconnected portfolio of technologies features a broad range of highly efficient solutions engineered to improve performance and efficiency and to help end users reduce resource consumption and greenhouse gas emissions.

●We deliver components and systems that enable the adoption of cleaner and more efficient energy, electrification, light weighting and other innovations to provide a more positive, global environmental impact to companies across the industrial, mobile and aerospace markets, including:

●A comprehensive suite of engineered materials such as thermal management, coatings, adhesives and vibration control that enable more electric applications;

●A broad range of motion and control technologies to support the use of various clean energy sources such as batteries, fuel cells, hydrogen, sustainable fuels and renewable energy;

●A strong motion technology offering with electro-hydraulic, electromechanical, and pneumatic actuators, valves, pumps, motors, controllers, software and conveyance for more electric aerospace, mobile and industrial applications; and

●A broad platform of filtration technologies to accelerate a cleaner and more sustainable world. |

| 6 |

|

Our Company

Social

| Safety |

Safety is a core value shared by all team members, and we aspire to achieve a zero-incident workplace. To track our safety progress, we have established key safety milestones. Over the past five years, we have successfully reduced our Recordable Incident Rate by 45%. | |

| Diversity, Equity and Inclusion |

An inclusive environment is a core tenet of our values and one of our key measures of success within The Win Strategy. We have an ongoing commitment to an inclusive and welcoming workplace where everyone feels valued and adds value.

One important component of Parker’s inclusive workplace is the development and deployment of Business Resource Groups ("BRGs"), each of which is open to all team members. In addition to our BRGs, we have processes in place to attract and retain team members with diverse backgrounds and experiences, helping to support them with career plans and experienced mentors. Our goal is to promote a strong, inclusive work environment that will provide us the best talent to further strengthen our organization for success. | |

| Social Responsibility |

Our social responsibility strategy, with the support of the Parker-Hannifin Foundation, empowers team members to make a difference in the communities we call home. We align our collective efforts with the Foundation's three areas of focus:

●STEM EDUCATION: Supporting schools, universities and community agencies to promote access to science, technology, engineering and mathematics education, and the resources and support needed to thrive in the classroom.

●COMMUNITY NEEDS: Supporting our team members, families and neighbors by contributing to the advancement and well-being of our communities.

●SUSTAINABILITY: Supporting long-term efforts to build sustainable communities, address key societal issues and create a better tomorrow.

For 70 years, the Foundation has extended the goodwill of our team members with donations that benefit the communities where we operate. Through our Foundation programs, we have donated over $100 million since 2010, including $10 million in fiscal year 2024. |

| 2024 Proxy Statement | 7 |

Our Company

Governance

| Board Diversity and Composition |

Our Board of Directors is committed to sound corporate governance practices, promoting the long-term interests of our shareholders and holding itself and management accountable for performance.

The metrics included in the graphic below reflect the Board structure and composition of our twelve current Directors. Each Director brings his or her own unique background and range of expertise, knowledge and experience, which we believe provides an optimal and diverse mix of skills and qualifications necessary for our Board to effectively fulfill its oversight responsibilities. | |||||

|

Board Tenure

8.6 years

AVERAGE TENURE

|

Independence

92%

INDEPENDENT

| |||||

|

Age

61 years

AVERAGE AGE

|

Diversity

75%

GENDER/RACIALLY/

ETHNICALLY DIVERSE*  * One of our directors is both gender diverse and racially diverse. Another one of our directors is both racially and ethnically diverse. Ethnicity is defined as country of birth or citizenship other than the United States.

| |||||

|

Director Experience | ||||||

|

Public Company Leadership

|

Manufacturing

| |||||

|

Corporate Strategy & Culture

|

Technology & Innovation

| |||||

|

Risk Management

|

Finance & Accounting

| |||||

|

International

|

Sales & Marketing

| |||||

|

Industrial/Aerospace Industries

|

||||||

| 8 |

|

Our Company

| Board and Committee Practices |

●Our Corporate Governance Guidelines and the charters of our Audit, Corporate Governance and Nominating and Human Resources and Compensation Committees expressly identify the specific areas of ESG oversight responsibility of the full Board and each Committee.

●Director retirement is mandatory (with no exceptions or conditions) after reaching age 72.

●Robust stock ownership guidelines for our Directors and executive officers (all of whom are compliant with such guidelines)

●Annual Board, Committee and individual Director evaluations

●Annual review of our Chief Executive Officer by all independent Directors

●Thoughtful management of our Directors' outside commitments – three do not sit on any other public company boards, six sit on one other public company board, and three sit on two other public company boards

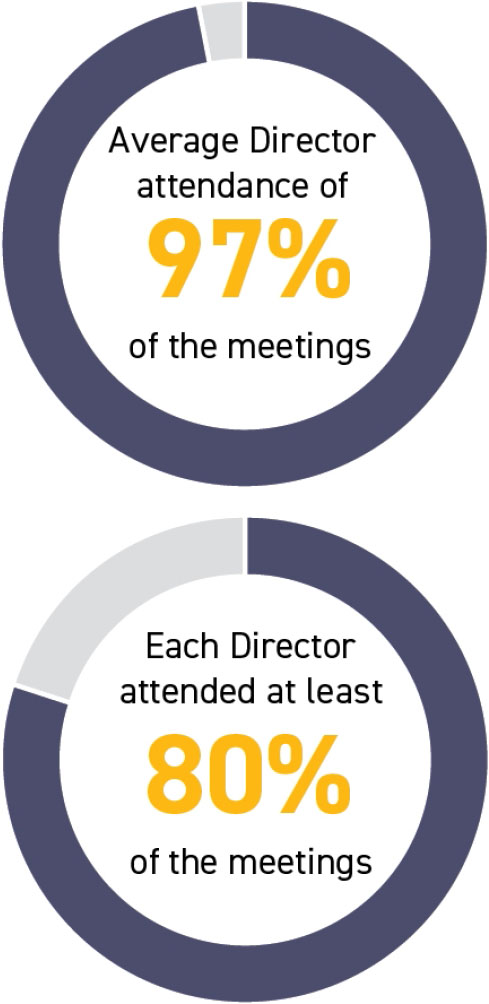

●Average Director attendance at all of our Board of Directors and Committee meetings was 97% and each of our Directors attended at least 80% of his or her meetings of our Board of Directors and his or her Committee meetings during fiscal year 2024.

●Each Committee of our Board of Directors has a published charter that is reviewed and evaluated at least annually. | |

| Shareholder Rights |

●Annual election of all Directors

●Majority voting and resignation policy for uncontested Director elections

●Proxy access permitted for eligible shareholders | |

| Board Independence |

●Board Committees are 100% comprised of independent Directors

●Independent Directors meet regularly and frequently (at least four times per year) without management | |

| Oversight of Risk |

●Our Chairman of the Board and Lead Director ensure the entire Board of Directors maintains regular oversight of key risk areas, such as corporate strategy, management succession planning, cybersecurity, enterprise risk management, and ESG matters. For more information on the Board's oversight responsibilities, see pages 27-29 of this Proxy Statement. | |

| Guidelines and Codes of Conduct |

●Published Global Code of Business Conduct applicable to our Board of Directors

●Published Corporate Governance Guidelines |

| 2024 Proxy Statement | 9 |

Our Company

Shareholder Engagement Highlights

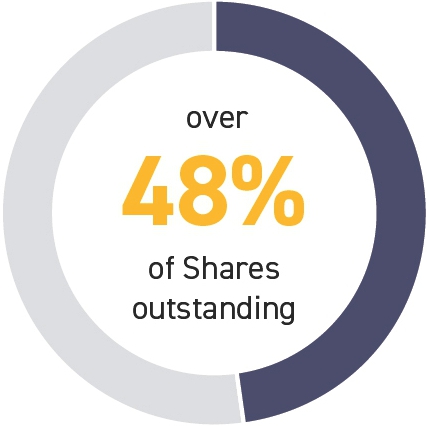

We actively seek and highly value feedback from our shareholders. During fiscal year 2024, in addition to our traditional investor relations outreach efforts, we proactively reached out to shareholders representing over 48% of our outstanding common stock to engage with them on ESG matters. Our outreach was accepted by, and we engaged with, shareholders representing over 18% of our outstanding common stock, covering a wide range of topics.

| We Sought Input from Shareholders Representing |

Company Representatives | Topics Discussed | Feedback/Actions Informed by Feedback | |||

|

●General Counsel and Secretary

●Investor Relations

●Other members of management, including our Environmental, Health and Safety ("EHS") leader |

Governance Topics

●Our commitment to performance-based executive compensation

●Compensation metrics tied to ESG

●Board refreshment and evaluation process

●Board composition & leadership structure and transition

●Board risk oversight including cybersecurity |

●Supportive of business strategy, overall performance, and ESG approach and progress

●Positive feedback on our climate commitments, reporting frameworks, and progress toward goals

●Published our Human Rights and Labor Standards Statement and enhanced our Supplier Code of Conduct with respect to human rights

●TCFD Report in process | |||

|

Environmental and Social Topics

●Environmental / climate goals, strategies, and progress

●Environmental reporting frameworks

●Human capital management matters, including labor market challenges, workplace safety incident reporting, and employee engagement

●Our safety culture |

We also shared the feedback received during these meetings with our Corporate Governance and Nominating Committee and our full Board of Directors. As a result of our shareholder engagement efforts and the feedback we received, we strengthened our disclosures on our website, in this Proxy Statement, and in our Sustainability Report.

| 10 |

|

| Proxy Statement Summary/ Voting Roadmap |

This summary highlights certain information relating to the voting items for our 2024 Annual Meeting of Shareholders. Additional details are found throughout this Proxy Statement.

| Item 1 – Election of Directors | |||||

|

Shareholder approval is sought to elect the following directors for a term that will expire at our Annual Meeting of Shareholders in 2025: |

|||||

|

●Denise Russell Fleming

●Lance M. Fritz |

●Linda A. Harty

●Kevin A. Lobo

●Jennifer A. Parmentier |

●E. Jean Savage

●Joseph Scaminace

●Laura K. Thompson |

●James R. Verrier

●James L. Wainscott |

||

|

The Board of Directors unanimously recommends a vote “FOR” each of the nominees to the Board of Directors.

See page 12 for details |

| Item 2 – Proposal to Approve the Compensation of our Named Executive Officers on a Non-Binding, Advisory Basis | ||

|

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 and the related SEC rules, we are providing our shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of the Named Executive Officers as disclosed in this Proxy Statement. We encourage our shareholders to carefully read this Proxy Statement in its entirety before deciding whether or not to vote for or against this Item. |

|

The Board of Directors unanimously recommends a vote “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this Proxy Statement on a non-binding, advisory basis.

See page 34 for details |

| Item 3 – Ratification of the Appointment of Independent Registered Public Accounting Firm | ||

|

The Audit Committee recommends ratification of its appointment of Deloitte and Touche LLP ("D&T") as the independent registered public accounting firm to audit our financial statements as of and for the fiscal year ending June 30, 2025. D&T served as the independent registered public accounting firm to audit our financial statements as of and for the fiscal year ended June 30, 2024, and has served as our independent auditor since fiscal year 2008. |

|

The Board of Directors unanimously recommends a vote “FOR” the proposal to ratify the appointment of D&T as our independent registered public accounting firm for the fiscal year ending June 30, 2025.

See page 80 for details |

| 2024 Proxy Statement | 11 |

Item 1 – Election of Directors

Shareholder approval is sought to elect Denise Russell Fleming, Lance M. Fritz, Linda A. Harty, Kevin A. Lobo, Jennifer A. Parmentier, E. Jean Savage, Joseph Scaminace, Laura K. Thompson, James R. Verrier, and James L. Wainscott as Directors for a term that will expire at our Annual Meeting of Shareholders in 2025.

Our Board of Directors has concluded that the nominees presented in this “Item 1—Election of Directors” collectively represent a highly-qualified and diverse group of individuals who will effectively serve the long-term interests of our business, our team members and our shareholders. Our Board of Directors believes that each nominee should serve on our Board for the coming year based on his or her record of effective past service on our Board and the specific experiences, qualifications, attributes and skills described in his or her biographical information presented in this “Item 1—Election of Directors” section.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of another person as our Board of Directors may recommend. However, our Board of Directors has no reason to believe that this circumstance will occur.

Board Nominees

| Committee Membership | ||||||||||

| Name | Principal Employment | Director Since | HRC | CGN | AC | |||||

|

Denise Russell Fleming |

Executive Vice President, Technology & Global Services and Chief Information Officer of Becton, Dickinson & Company |

2023 |

|

| ||||||

|

Lance M. Fritz |

Former Chairman, President and Chief Executive Officer of Union Pacific Corporation |

2021 |

|

|

||||||

|

Linda A. Harty |

Former Treasurer of Medtronic plc |

2007 |

|

| ||||||

|

Kevin A. Lobo |

Chairman, Chief Executive Officer and President of Stryker Corporation |

2013 |

|

| ||||||

|

Jennifer A. Parmentier |

Chairman of the Board and Chief Executive Officer of Parker-Hannifin Corporation |

2023 |

||||||||

|

E. Jean Savage |

President and Chief Executive Officer of Trinity Industries, Inc. |

2024 |

|

| ||||||

|

Joseph Scaminace |

Former Chairman and Chief Executive Officer of OM Group, Inc. |

2004 |

|

|

||||||

|

Laura K. Thompson |

Former Executive Vice President and Chief Financial Officer of The Goodyear Tire & Rubber Company |

2019 |

|

| ||||||

|

James R. Verrier |

Former President and Chief Executive Officer of BorgWarner, Inc. |

2016 |

|

| ||||||

|

James L. Wainscott |

Former Chairman, Chief Executive Officer and President of AK Steel Holding Corporation |

2009 |

|

|

||||||

| AC Audit Committee |

|

Member | |

| HRC Human Resources and Compensation Committee |

|

Chair | |

| CGN Corporate Governance and Nominating Committee |

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS. |

| 12 |

|

Item 1 – Election of Directors

Director Selection and Nomination, Qualifications and Diversity

The Corporate Governance and Nominating Committee of our Board is responsible for identifying, evaluating and recommending potential Director candidates. The Corporate Governance and Nominating Committee ensures that Director recruiting, succession and refreshment are persistent areas of focus and regularly reviews the size, composition and independence of our Board, and any expected vacancies, in determining whether and to what extent to actively recruit new Directors or to replace departing Directors.

The Corporate Governance and Nominating Committee utilizes a variety of methods and processes to identify potential Director candidates, including through reputable third-party search firms, unsolicited recommendations from third-party search firms, and referrals from current or past members of our Board. In addition, the Corporate Governance and Nominating Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as Directors provided that such recommendations comply with the procedures set forth under the caption “Shareholder Recommendations for Director Nominees” and will consider such candidates on the same basis as candidates recommended by other sources. The Corporate Governance and Nominating Committee generally will not, however, consider recommendations for Director nominees submitted by individuals who are not affiliated with us.

The Corporate Governance and Nominating Committee has developed and implemented a robust process to ensure that its formal Director searches are appropriately scoped and designed to produce a slate of potential candidates representing a broad range of backgrounds, educations, experiences, skills and viewpoints that will enable them, individually and collectively, to address the issues affecting our Board, our business, our team members and our shareholders, and optimize the functioning and decision-making and oversight roles of our Board and its Committees. The Corporate Governance and Nominating Committee currently focuses on the following key search and evaluation criteria but considers the entirety of each proposed candidate’s credentials and all available information that may be relevant to each candidate’s nomination.

| Key Criteria | Overall Philosophy and Approach | |

|

Culture and Values |

The Corporate Governance and Nominating Committee places high value on cultural fit. Our Directors must be able to work together to efficiently and effectively oversee the issues and risks facing our business, and have the commitment, integrity, honesty, judgment and professionalism required under our Corporate Governance Guidelines and Global Code of Business Conduct, and to otherwise serve the long-term interests of our Board of Directors, our business, our team members and our shareholders. | |

|

Diversity |

The Corporate Governance and Nominating Committee firmly believes diversity is critical to a well-functioning Board of Directors and is committed to ensuring diversity on our Board. As a result, our Corporate Governance Guidelines include a policy requiring each search for qualified director candidates to include individuals with diverse backgrounds, including gender, ethnicity and race. Currently, 50% of our Board is gender diverse and 75% of our Board is diverse in terms of gender, race, or ethnicity. Since 2019, we have recruited and on-boarded seven new directors, six of whom are diverse in terms of gender and/or race. | |

|

Skills and Qualifications |

The Corporate Governance and Nominating Committee also believes it is essential to have a Board with the range of skills and experience needed to effectively evaluate, monitor and oversee the wide range of considerations presented by the size and scope of our Company, operations, products and markets. As a result, the Corporate Governance and Nominating Committee seeks to identify nominees who are independent and well equipped with a broad set of key skills, including those shown on the table on page 14. |

The Corporate Governance and Nominating Committee, utilizing its robust and thoughtful approach to Director recruiting, succession and refreshment, has built an experienced, diverse and independent Board that provides significant oversight over our plans and strategies for growth, financial performance and shareholder value creation.

|

2019

Laura K. Thompson

|

|

2021*

Jillian C. Evanko

Lance M. Fritz William F. Lacey |

|

2023

Jennifer A. Parmentier

Denise Russell Fleming |

|

2024

E. Jean Savage

|

7 new directors since 2019

6 new diverse directors since 2019

|

| * | Ms. Evanko is not standing for reelection (see "New Elections and Departures" on page 21 of this Proxy Statement). Mr. Lacey resigned in fiscal year 2023 to pursue a new career opportunity. |

| 2024 Proxy Statement | 13 |

Item 1 – Election of Directors

Director Skills/Experience/Diversity

In addition to the metrics included on page 8, the following table presents on an individual basis the skills and experience of our Board Nominees in areas that are of importance to our Company. Our Board refreshment efforts over the last several years have strengthened the culture, skills and diversity of our Board. Each Director nominee brings his or her own unique background and range of expertise, knowledge and experience, which provides a comprehensive and optimal mix of skills and qualifications necessary for our Board to effectively fulfill its oversight responsibilities.

| Director Experience |

|

|

|

|

|

|

|

|

|

| ||

|

Public Company Leadership Experience serving as CEO, COO, CFO, or other senior leadership roles, and/or on the Board of Directors of publicly traded companies of significant size and complexity. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

Corporate Strategy & Culture Experience developing and implementing strategies to drive and enhance culture, values, purpose, engagement, customer experience, profitable growth and financial performance. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

Risk Management Experience identifying, managing and mitigating significant business risks (financial, operational, compliance, reputational, etc.) including those related to ESG, cybersecurity, human capital and supply chain. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

International Experience conducting business inside and outside the U.S., or other meaningful exposures to non-U.S. cultures, markets, economies, etc. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

Industrial/Aerospace Industries Experience in the industrial and aerospace markets in which we operate or in those with similar business requirements, priorities, risks and challenges. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ||

|

Manufacturing Experience managing manufacturing operations, capabilities, capital needs, supply chains, cost and operating efficiencies, etc. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

Technology & Innovation Experience in engineering, research and development, product and/or process innovation, information technology, digitization, e-commerce, data management, etc. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ||

|

Finance & Accounting Experience in financial management, reporting and controls, capital allocation, capital markets, mergers and acquisitions, etc. |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

|

Sales & Marketing Experience growing revenue and market shares through effective sales and marketing, customer relationships and channel management, reputation and brand building, etc. |

● | ● | ● | ● | ● | ● | ● | ● | ● |

| 14 |

|

Item 1 – Election of Directors

| Director Diversity | Gender | Race | Ethnicity (Country of Birth/Citizenship) |

| Denise Russell Fleming | F | Black | United States |

| Lance M. Fritz | M | White | United States |

| Linda A. Harty | F | White | United States |

| Kevin A. Lobo | M | Asian | Country of Birth: India Dual Citizenship: Canada, United States |

| Jennifer A. Parmentier | F | White | United States |

| E. Jean Savage | F | White | United States |

| Joseph Scaminace | M | White | United States |

| Laura K. Thompson | F | White | United States |

| James R. Verrier | M | White | Country of Birth: United Kingdom Dual Citizenship: United Kingdom, United States |

| James L. Wainscott | M | White | United States |

| 2024 Proxy Statement | 15 |

Item 1 – Election of Directors

Director Biographies

Nominees for Election as Directors for Terms Expiring in 2025

|

Denise Russell Fleming

Director Since: 2023

Age: 54

Committees: Audit Corporate Governance and Nominating |

Other Public Company Directorships (current in bold):

●None | ||

|

Ms. Fleming has been Executive Vice President, Technology and Global Services and Chief Information Officer of Becton, Dickinson & Company (medical technology) since July 2022. She was the Vice President, Information Technology at Boeing Defense, Space & Security (aerospace and defense) from December 2016 until June 2022. Prior to Boeing, Ms. Fleming served in several information technology leadership roles at BAE Systems, Inc. (aerospace and defense) from 2010 to 2016 and at Sprint Nextel Corporation (telecommunication technology) from 1997 to 2010.

Ms. Fleming has held the senior leadership positions noted above and various other public company leadership roles in significant global companies, including publicly traded technology, manufacturing and aerospace and defense companies. She has demonstrated significant expertise in leading and/or overseeing information technology systems, cybersecurity, digitization, aerospace markets, team member engagement, industrial manufacturing, ESG initiatives, and process optimization, among other critical areas.

Based on her strong background, experience and performance in senior leadership roles, our Board believes Ms. Fleming will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

|

Lance M. Fritz

Director Since: 2021

Age: 61

Committees: Corporate Governance and Nominating Human Resources and Compensation |

Other Public Company Directorships (current in bold):

●Fiserv Inc. (since 2024)

●Union Pacific Corporation (former) (2015-2023) | ||

|

Mr. Fritz currently serves as Special Advisor to Union Pacific Corporation (rail transport), where he previously served as Chairman of the Board from October 2015 to August 2023 and President and Chief Executive Officer from February 2015 to August 2023. He also served as President and Chief Operating Officer of Union Pacific Railroad Company (the principal operating company of Union Pacific Corporation) from February 2014 to February 2015, and in various labor relations, sales and marketing, and other leadership roles with Union Pacific from July 2000 to February 2014.

Mr. Fritz has served in the public company leadership capacities noted above as well as other significant senior leadership roles. His experience includes leading and/or overseeing corporate strategy and culture, risk management, international trade, operations, compliance, supply chain and logistics, corporate finance, ESG initiatives, cybersecurity, capital allocation, M&A, and other key commercial functions including sales and marketing. Additionally, Mr. Fritz has gained significant experience, perspective and insight from his service on other public company boards.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Fritz will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

| 16 |

|

Item 1 – Election of Directors

|

Linda A. Harty

Director Since: 2007

Age: 64 Committees: Audit Corporate Governance and Nominating |

Other Public Company Directorships (current in bold):

●Westinghouse Air Brake Technologies Corporation (Wabtec) (since 2016)

●Chart Industries, Inc. (since 2021)

●Syneos Health, Inc. (former) (2017-2023) | ||

|

Now retired, Ms. Harty was Treasurer of Medtronic plc (medical technology) from February 2010 to April 2017. Prior to joining Medtronic, Ms. Harty served as Executive Vice President and Treasurer of Cardinal Health, Inc. (healthcare) from May 2008 to December 2009 and from August 2006 to March 2007, Executive Vice President – Finance and Chief Financial Officer of Cardinal Health’s Healthcare Supply Chain Services from March 2007 to May 2008, and Senior Vice President of Cardinal Health from January 2005 to August 2006.

Ms. Harty has served in the public company leadership capacities noted above as well as other significant leadership roles. Her experience includes leading and/or overseeing key commercial functions including corporate finance, financial reporting, risk management, strategic planning and pricing, capital allocation, M&A analysis and financing, supply chain management, and process innovation. Additionally, Ms. Harty has extensive and significant experience, perspective and insight, including management of cybersecurity events, from her service and leadership roles on other public company boards.

Based on her strong background, experience and performance in senior leadership roles and as a director, our Board believes Ms. Harty will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

|

Kevin A. Lobo

Director Since: 2013

Age: 59

Committees: Audit (Chair) Human Resources and Compensation |

Other Public Company Directorships (current in bold):

●Stryker (since 2012) | ||

|

Mr. Lobo has been Chairman of the Board of Stryker Corporation (medical technologies) since July 2014 and has been Chief Executive Officer, President and a Director since October 2012. He previously served as Group President for Stryker's Orthopedics and Neurotechnology and Spine Groups.

Mr. Lobo has held the senior leadership positions noted above and other various public company leadership roles in global companies, including publicly traded medical technology and consumer products companies. His experience includes leading and/or overseeing corporate strategy and culture, profitable growth and financial performance, and key commercial functions including strategic pricing, sales and marketing, high-tech innovation, automation, digitization, capital allocation, cybersecurity, management of ESG initiatives and other significant risks and opportunities. Additionally, Mr. Lobo has gained significant experience, perspective and insight from his service on other public company boards.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Lobo will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

| 2024 Proxy Statement | 17 |

Item 1 – Election of Directors

|

Jennifer A. Parmentier

Director Since: 2023

Age: 57

Committees: None |

Other Public Company Directorships (current in bold):

●Nordson Corporation (since 2020) | ||

|

Ms. Parmentier has been our Chairman of the Board since January 2024 and our Chief Executive Officer since January 2023. From August 2021 to December 2022 she was our Chief Operating Officer. Prior to August 2021, she was Vice President and President of the Motion Systems Group from February 2019 to August 2021 and Vice President and President of the Engineered Materials Group from September 2015 to February 2019.

Ms. Parmentier has served in the public company leadership capacities noted above as well as other significant leadership roles since joining us in 2008. Her experience includes leading and/or overseeing all of our operating groups, regions, and key commercial functions. She has been instrumental in driving and implementing strategies to strengthen our financial performance, culture, values, purpose, team member engagement, customer experience, profitable growth, and management of ESG initiatives, cybersecurity and other significant risks and opportunities. Additionally, Ms. Parmentier has gained significant experience, perspective and insight from her service on other public company boards.

Based on her strong background, experience, performance in senior leadership roles and intimate working knowledge of our business, plans, strategies, and initiatives, our Board believes Ms. Parmentier will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

|

E. Jean Savage

Director Since: 2024

Age: 60

Committees: Audit Corporate Governance and Nominating |

Other Public Company Directorships (current in bold):

●Trinity Industries, Inc. (since 2018)

●WestRock Company (2022-2024) | ||

|

Ms. Savage has been President and Chief Executive Officer of Trinity Industries, Inc. (rail car products and services) since January 2020. She was the Vice President, Surface Mining and Technology at Caterpillar Inc. (construction and mining equipment, engines, industrial gas turbines and diesel-electric locomotives) from August 2017 until January 2020, and prior to that role she held a variety of senior leadership roles within Caterpillar that spanned operations, technology and innovation, and quality and continuous improvement. Prior to those roles, Ms. Savage held a variety of engineering and general manager roles at Parker-Hannifin Corporation from 1988 until 2002. Ms. Savage began her career as an intelligence officer with the U.S. Army Reserves.

Ms. Savage has served in the public company leadership capacities noted above as well as other significant leadership roles. Her experience includes leading and/or overseeing corporate strategy and culture, sales and marketing, financial and operational risk management, cybersecurity, technology, industrial manufacturing, capital allocation, M&A, and corporate finance. Additionally, Ms. Savage has gained significant experience, perspective and insight from her service on other public company boards. Ms. Savage was recommended to the Corporate Governance and Nominating Committee by our third party search firm, Russell Reynolds Associates.

Based on her strong background, experience and performance in senior leadership roles and as a director, our Board believes Ms. Savage will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

| 18 |

|

Item 1 – Election of Directors

|

Joseph Scaminace

Director Since: 2004

Age: 71

Committees: Human Resources and Compensation (Chair) Corporate Governance and Nominating |

Other Public Company Directorships (current in bold):

●Cintas Corporation (since 2010) (Lead Director) | ||

|

Now retired, Mr. Scaminace served as the Chairman and Chief Executive Officer of OM Group, Inc. (metal-based specialty chemicals) from June 2005 to October 2015 and Chairman of the Board of OM Group from August 2005 to October 2015. Prior to joining OM Group, Mr. Scaminace held multiple leadership roles at The Sherwin-Williams Company (paints and coatings), ultimately serving as President and Chief Operating Officer from October 1999 to May 2005.

Mr. Scaminace has served in various senior leadership roles in significant global publicly traded manufacturing companies. He has demonstrated meaningful expertise in the management and oversight of corporate strategy and culture, sales and marketing, risk management, cybersecurity, ESG initiatives, international trade and compliance, M&A, aerospace markets, inventory controls, supply chain, and financial planning, performance and reporting. Additionally, Mr. Scaminace has gained significant experience, perspective and insight from his service and leadership roles on other public company boards.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Scaminace will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

|

Laura K. Thompson

Director Since: 2019

Age: 60

Committees: Audit Corporate Governance and Nominating |

Other Public Company Directorships (current in bold):

●Wesco International (since 2019)

●Titan International, Inc. (since 2021) | ||

|

Now retired, Ms. Thompson served as Executive Vice President of The Goodyear Tire & Rubber Company (tire manufacturing) from December 2013 until her retirement in March 2019, and Chief Financial Officer of Goodyear from December 2013 until October 2018. Prior to those roles, Ms. Thompson held multiple leadership positions at Goodyear, including Vice President of Finance from 2009 to 2013 and Vice President of Business Development from 2005 to 2009.

Ms. Thompson has served in the public company leadership capacities noted above as well as other significant leadership roles. She has meaningful expertise in corporate strategy and culture, business development, financial and operational risk management, cybersecurity, corporate finance, financial reporting, international trade, industrial manufacturing, capital allocation, distribution, supply chain management, sales and marketing, technology and process innovation, and M&A strategy, finance and execution. Additionally, Ms. Thompson has significant experience, perspective and insight from her service on other public company boards.

Based on her strong background, experience and performance in senior leadership roles and as a director, our Board believes Ms. Thompson will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

| 2024 Proxy Statement | 19 |

Item 1 – Election of Directors

|

James R. Verrier

Director Since: 2016

Age: 61

Committees: Audit Human Resources and Compensation |

Other Public Company Directorships (current in bold):

●BorgWarner, Inc. (former) (2013-2018) | ||

|

Now retired, Mr. Verrier served as a Board Advisor to BorgWarner, Inc. (powertrain solutions) from August 1, 2018 until his retirement on February 28, 2019. He previously served as Chief Executive Officer and director of BorgWarner, Inc. from January 2013 until July 2018, and President of BorgWarner from March 2012 until July 2018. Prior to those roles, Mr. Verrier held multiple leadership roles with BorgWarner, including Chief Operating Officer and other roles within operations management, quality control and human resources.

Mr. Verrier has served in various senior leadership roles in significant global publicly traded manufacturing companies, primarily at BorgWarner. He has demonstrated meaningful expertise in the management and oversight of corporate strategy and culture, sales and marketing, financial and operational risk management, cybersecurity, ESG initiatives, international trade and compliance, capital allocation, and supply chain management. Additionally, Mr. Verrier has gained significant experience, perspective and insight from his service on other public company boards.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Verrier will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

|

James L. Wainscott

Director Since: 2009 (Lead Director since 2016)

Age: 67

Committees: Corporate Governance and Nominating (Chair) Human Resources and Compensation |

Other Public Company Directorships (current in bold):

●CSX Corporation (since 2020) | ||

|

Now retired, Mr. Wainscott was Chairman of the Board of AK Steel Holding Corporation (steel producer) from January 2006 to May 2016; and President, Chief Executive Officer and a Director of AK Steel Holding Corporation from October 2003 to January 2016. Prior to those roles, Mr. Wainscott held multiple leadership roles with AK Steel, including Chief Financial Officer from 1998 to 2003.

Mr. Wainscott has served in various senior leadership roles in significant global publicly traded manufacturing companies, primarily at AK Steel. He has significant expertise in corporate strategy and culture, manufacturing, financial and operational risk management, cybersecurity, international trade and compliance, supply chain management, inventory control, labor relations, quality and customer relations, cost control, sales and marketing, and financial planning, performance and reporting. Additionally, Mr. Wainscott has gained significant experience, perspective and insight from his service and leadership roles on other public company boards and as our Lead Director since 2016.

Based on his strong background, experience and performance in senior leadership roles and as a director, our Board believes Mr. Wainscott will continue to effectively serve our Board, our business, our team members and our shareholders with a high level of integrity, honesty, judgment and professionalism. | ||||

| 20 |

|

Item 1 – Election of Directors

Director Independence

Our Corporate Governance Guidelines require at least a majority of our Directors to be “independent” as defined in the listing standards established by the New York Stock Exchange. Our Board of Directors has also adopted standards for Director independence, which are set forth in our Independence Standards for Directors.

Of the twelve current members of our Board of Directors, eleven are independent based on our Board of Directors’ consideration of the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. In addition, each of the Audit Committee, the Corporate Governance and Nominating Committee and the Human Resources and Compensation Committee of our Board of Directors is composed entirely of independent Directors. As a result, independent Directors directly oversee critical matters such as our executive compensation program, our Corporate Governance Guidelines, policies and practices, the integrity of our financial statements and our internal controls over financial reporting.

Our Board of Directors has affirmatively determined that the following eleven individuals who currently serve as Directors are independent: Jillian C. Evanko, Denise Russell Fleming, Lance M. Fritz, Linda A. Harty, Kevin A. Lobo, E. Jean Savage, Joseph Scaminace, Åke Svensson, Laura K. Thompson, James R. Verrier and James L. Wainscott.

Among other things, our Board of Directors does not consider a Director to be independent unless it affirmatively determines that the Director has no material relationship with us either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Our Corporate Governance and Nominating Committee and our Board of Directors annually reviews and determines which of its members are independent based on the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. During such review, our Corporate Governance and Nominating Committee and our Board of Directors broadly consider all facts and circumstances that they deem relevant, including any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships between us and any of our Directors.

In fiscal year 2024, after considering the facts and circumstances applicable to each Director, our Board of Directors determined that Mses. Evanko, Fleming and Savage and Messrs. Fritz and Lobo served as executive officers of companies that have existing customer and/ or supplier relationships with us. Our Corporate Governance and Nominating Committee and our Board of Directors further analyzed these relationships and found that each of Mses. Evanko, Fleming and Savage and Messrs. Fritz and Lobo does not receive any direct or indirect personal benefits as a result of these relationships, that the relationships were on ordinary course, competitive terms, and that the amounts paid to or by us under such relationships fell significantly below the threshold for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. Our Board of Directors thus affirmatively concluded that each of Mses. Evanko, Fleming and Savage and Messrs. Fritz and Lobo is independent.

Annual Elections; Majority Voting; No Cumulative Voting

Our Amended and Restated Regulations provide for the annual election of our entire Board of Directors. Accordingly, each Director elected at this Annual Meeting of Shareholders will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected.

Our Amended Articles of Incorporation provide for a majority voting standard in the annual election of our Directors. Accordingly, at each Annual Meeting of Shareholders, each candidate for Director is elected only if the votes “for” the candidate exceed the votes “against” the candidate, unless the number of candidates exceeds the number of Directors to be elected. If the number of candidates exceeds the number of Directors to be elected, then in that election the candidates receiving the greatest number of votes will be elected. Abstentions and broker non-votes will not be counted as votes “for” or “against” a candidate, and shareholders are not able to cumulate votes in the election of Directors.

New Elections and Departures

Effective January 1 , 2024, Jennifer A. Parmentier was elected as Chairman of our Board of Directors. On July 10, 2024, E. Jean Savage was elected to our Board of Directors.

Effective December 31, 2023, Lee C. Banks retired from our Board of Directors. Also effective December 31, 2023, Thomas L. Williams retired from our Board of Directors and from his role as Executive Chairman.

Åke Svensson and Jillian C. Evanko, who are currently serving as Directors, will not stand for reelection at the 2024 Annual Meeting of Shareholders. Mr. Svensson became ineligible for reelection under our mandatory Director retirement policy. Ms. Evanko is not standing for reelection as a result of increased professional commitments.

| 2024 Proxy Statement | 21 |

| Corporate Governance |

Board and Committee Structure

Current Leadership Structure

Our Board of Directors currently employs a dual leadership structure. We have a Lead Director, who is also the Chair of the Corporate Governance and Nominating Committee, and a Chairman of the Board, who is our Chief Executive Officer.

|

Jennifer A. Parmentier Chairman of the Board since 2024 | |

|

James L. Wainscott Lead Independent Director since 2016 |

Our Lead Director is elected solely by the independent members of our Board of Directors and holds a position separate and independent from our Chairman of the Board. Our Corporate Governance Guidelines provide that the Chair of the Corporate Governance and Nominating Committee will serve as our Lead Director and that the Chair of the Corporate Governance and Nominating Committee is elected every five years.

The specific authorities, duties and responsibilities of our Lead Director are described in our Corporate Governance Guidelines. Among other things, our Lead Director presides over and supervises the conduct of all meetings of our independent Directors, calls meetings of our independent Directors, and prepares and approves all agendas and schedules for meetings of our Board.

Our Board believes that having a Lead Director who is elected by our independent Directors ensures that our Board will at all times have an independent Director in a leadership position. At the same time, our Board of Directors believes that it is important to maintain flexibility in its leadership structure to allow for a member of management to serve in a leadership position alongside the Lead Director if our Board of Directors determines that such a leadership structure best meets the needs of our Board, our business, our team members and our shareholders.

Our Board has determined that this leadership structure is currently more efficient and effective than a structure that employs a single, independent Chairman of the Board. Our Board of Directors views this structure as one that ensures both independence in leadership and a balance of knowledge and authority. For example, our leadership structure employs both a Chairman of the Board who possesses an intimate working knowledge of our day-to-day business, plans, strategies and initiatives, and a Lead Director who has a strong working relationship with our non-management, independent Directors. These two individuals combine their unique knowledge and perspectives to ensure that management and our independent Directors work together as effectively as possible. Among other things, our Chairman of the Board ensures that our Board addresses strategic issues that management considers critical, while our Lead Director ensures that our Board addresses strategic issues that our independent Directors consider critical.

Our Board recognizes, however, that no single leadership model may always be appropriate. Accordingly, our Board of Directors regularly reviews its leadership structure to ensure that it continues to represent the most efficient and effective structure for our Board of Directors, our business, our team members and our shareholders.

| 22 |

|

Corporate Governance

Board Committees; Committee Charters

Our Board has established and delegated certain authorities and responsibilities to three committees: the Human Resources and Compensation Committee, the Corporate Governance and Nominating Committee, and the Audit Committee. Each Committee of our Board is governed by a written charter, which is posted and available on the Governance page of our investor relations website at investors.parker.com. Shareholders may request copies of these charters, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000.

All members of each Committee are independent under the listing standards of the New York Stock Exchange as well as our Independence Standards for Directors. Each Committee regularly reports its activities to the full Board of Directors.

Each of our Committees works with members of our Human Resources, Internal Audit, Enterprise Compliance, Legal, and other departments to oversee and evaluate risks relevant to each Committee.

| Human Resources and Compensation Committee | |

| Members: Joseph Scaminace (CHAIR), Jillian C. Evanko, Lance M. Fritz, Kevin A. Lobo, James R. Verrier, James L. Wainscott | Number of meetings in fiscal year 2024: 5 |

|

KEY OVERSIGHT RESPONSIBILITIES

●Administration, structure and determination of our executive compensation program.

●ESG strategies, initiatives, policies and risks related to (a) key compensation and benefit plans (including the inclusion and impact of any ESG-based performance measures), (b) executive compensation program, strategy, structure and mix, (c) leadership performance, development and succession, (d) compensation-related ratings and disclosures, and (e) other ESG areas impacting or resulting from the Committee’s duties and responsibilities or as the Board may otherwise delegate.

●Working with its independent executive compensation consultant and our human resources, legal and other management personnel to oversee and evaluate other risks relating to our compensation policies and practices for all team members, our succession planning and talent development strategies and initiatives, and other human resources issues. | |

| Corporate Governance and Nominating Committee | |

| Members: James L. Wainscott (CHAIR), Denise Russell Fleming, Lance M. Fritz, Linda A. Harty, E. Jean Savage, Joseph Scaminace, Åke Svensson, Laura K. Thompson | Number of meetings in fiscal year 2024: 5 |

|

KEY OVERSIGHT RESPONSIBILITIES

●Evaluating and recommending to our Board of Directors qualified nominees for election as Directors and qualified Directors for Committee membership, establishing evaluation procedures for the performance of our Board of Directors and its Committees, developing corporate governance guidelines and independence standards, and considering other matters regarding our corporate governance structure.

●ESG strategies, initiatives, policies and risks related to (a) Board performance, structure, composition and refreshment, (b) corporate governance ratings and disclosures, (c) shareholder engagement processes and feedback, (d) Board and committee oversight responsibilities and meeting cadences on ESG matters, and (e) other ESG areas impacting or resulting from the Committee’s duties and responsibilities or as the Board may otherwise delegate.

●Working with our legal and other management personnel to oversee and evaluate other risks relating to:

●Director independence, qualifications and diversity issues;

●Board of Directors and Committee leadership, composition, function and effectiveness;

●alignment of the interests of our shareholders with the performance of our Board of Directors;

●compliance with applicable corporate governance rules and standards; and

●other corporate governance issues and trends. | |

| 2024 Proxy Statement | 23 |

Corporate Governance

| Audit Committee | |

| Members: Kevin A. Lobo (CHAIR) (ACFE), Jillian C. Evanko (ACFE), Denise Russell Fleming, Linda A. Harty (ACFE), E. Jean Savage (ACFE), Åke Svensson, Laura K. Thompson (ACFE), James R. Verrier | Number of meetings in fiscal year 2024: 5 |

|

The Audit Committee of our Board of Directors is our standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. Each member of our Audit Committee is independent, as defined in our Independence Standards for Directors, and in compliance with the independence standards applicable to audit committee members under the New York Stock Exchange listing standards and under the federal securities laws.

KEY OVERSIGHT RESPONSIBILITIES

●Appointing, compensating, retaining, and overseeing our independent registered public accounting firm and evaluating its independence, approving all audit and non-audit engagements with our independent registered public accounting firm, and reviewing our annual and quarterly financial statements, internal and independent audit plans, the results of such audits and the adequacy of our internal control structure.

●ESG strategies, initiatives, policies and risks related to (a) ethics, integrity, and compliance, (b) audit and financial controls, reporting and disclosures, (c) audit and financial implications of ESG data and processes, (d) governance structures, financial impacts and funding status of employee retirement plans, and (e) other ESG areas impacting or resulting from the Committee’s duties and responsibilities or as the Board may otherwise delegate.

●Working with our internal audit, compliance, legal, and other departments, to oversee and evaluate other significant risks (financial, tax, strategic, operational, legal, regulatory) and management policies, guidelines and processes for assessing and managing such risks.

●Meeting privately at each of its meetings with representatives from our independent registered public accounting firm and our Vice President – Audit, Compliance and Enterprise Risk Management.

Our Board of Directors has determined that each of Jillian C. Evanko, Linda A. Harty, Kevin A. Lobo, E. Jean Savage, and Laura K. Thompson are audit committee financial experts (designated above as ACFE) as defined in the federal securities laws. | |

| 24 |

|

Corporate Governance

Meetings and Attendance; Executive Sessions

|

During fiscal year 2024, there were six meetings of our Board of Directors. Average Director attendance was 97% across all meetings held by our Board of Directors and its Committees and each Director attended at least 80% of all meetings held by our Board of Directors and the Committees on which he or she served.

We hold a regularly scheduled meeting of our Board of Directors in conjunction with our Annual Meeting of Shareholders. Directors are expected to attend the Annual Meeting of Shareholders absent an appropriate reason. We held our Annual Meeting of Shareholders in person in 2023 and all of the members of our Board of Directors attended and were available to answer shareholder questions.

In accordance with the listing standards of the New York Stock Exchange, our non-management Directors are scheduled to meet regularly in executive sessions without management and, if required, our independent Directors will meet at least once annually. Additional meetings of our non-management Directors may be scheduled from time to time when our non-management Directors determine that such meetings are desirable. Our non-management Directors met four times during fiscal year 2024. |

|

Director Education and Orientation Program

Our director orientation program includes extensive meetings with management and other Directors and familiarizes new directors with The Win Strategy and Parker’s businesses, strategies, policies and corporate governance framework; assists them in developing Company and industry knowledge; and educates them with respect to their fiduciary duties and legal responsibilities.

Our Board places high importance on the continuous development and education of our Board members. Directors have ongoing education and development opportunities through participation in Board and Committee meetings, and publications and activities offered by reputable third party organizations. Directors receive specialized presentations on an established cadence from senior-level leaders across our global businesses and functions. When appropriate, our Board also travels to put “feet on the ground” at Company locations to expand their knowledge and oversight of the Company. Most recently, the Board visited our facility in Danville, Kentucky as part of our regularly scheduled Board and Committee meetings in April 2024.

| 2024 Proxy Statement | 25 |

Corporate Governance

Board and Committee Evaluations

Our Board recognizes that a rigorous and constructive evaluation process is an essential component of good corporate governance and Board effectiveness. Under the leadership of our Lead Director, the Corporate Governance & Nominating Committee oversees the annual evaluation process and periodically reviews the format of the process to help ensure it is eliciting actionable feedback with respect to the effectiveness of the Board, Board committees and each individual Director. The annual evaluation process consists of the following components:

|

Continuous Evaluation/

Annual Review ●Through ongoing discussions at Board and Committee Meetings, our Board and Committees are continually seeking ways to strengthen their governance and oversight practices and effectiveness.

●Towards the end of our fiscal year, each director completes a questionnaire assessing the performance of the Board and its committees on which he or she serves.

●Our Lead Director and Chairman also conduct evaluations of each individual Director towards the end of our fiscal year. |

|

Assessment

●The questionnaire results are provided to the Board and to each of the Audit, Human Resources and Compensation and Corporate Governance and Nominating Committees, generally at our regularly scheduled Board and Committee meetings in August.

●The results of the individual Director evaluations are also shared with the Corporate Governance and Nominating Committee in August. |

|

Discussion

●The Board and each such committee discuss the results and identify areas for continuous improvement. The results of the committee sessions are communicated to the full Board. |

|

Feedback

●As a result of the Board’s 2024 self-assessment process, the Board identified opportunities to further strengthen the Board’s practices in areas relating to Board and committee-level oversight of cybersecurity and technology matters (including artificial intelligence), geopolitical business risk, and climate-related risk and reporting. |

| 26 |

|

Corporate Governance

Board Strategic and Risk Oversight

Management and our Board of Directors and its Committees are collectively engaged in identifying, overseeing, evaluating and managing the strategic priorities and material risks facing our business to ensure that our strategies and objectives align with the goals of The Win Strategy and work to minimize such risks. Our Board believes that its current level of independence, leadership structure and qualifications and diversity of its members facilitate the effective identification, oversight, evaluation and management of our business strategy and related risks.

Board’s Role in Strategic Oversight

| ||||

| One of the Board’s primary responsibilities is overseeing management’s development and execution of The Win Strategy. In addition to the ongoing activities detailed in the paragraph to the right, our Board conducts an in-depth annual review of our corporate strategy and annual operating plan, which covers significant strategic topics such as our key markets, operational priorities under The Win Strategy, strategic positioning, financial and operational outlooks, capital allocation, balance sheet strength, debt portfolio and positions, share repurchase activity, and dividend history and strategies. | Led by our CEO, our executive management team develops and implements strategic goals and priorities under The Win Strategy. On a quarterly basis the CEO, our executive leadership team and other business leaders provide detailed business and strategy updates to the Board including progress against business objectives, updates on the competitive landscape facing the Company, economic trends, acquisition and divestiture opportunities and other matters. | |||

|

||||

| 2024 Proxy Statement | 27 |

Corporate Governance

Board’s Role in Risk Oversight

Management and our Board of Directors and its Committees view the risk management role of our Board of Directors and its Committees, and their relationship with management in the identification, oversight, evaluation and management of risk, as paramount to the short-term viability and long-term sustainability of our business.

| BOARD OF DIRECTORS |

OUTSIDE ADVISORS

Management and our Board of Directors and its Committees also engage outside advisors where appropriate to assist in the identification, oversight, evaluation and management of the risks facing our business. These outside advisors include our independent registered public accounting firm, external legal counsel and insurance providers, and the independent compensation consultant retained by the Human Resources and Compensation Committee. | |